The market has continued to consolidate gains but there are hints that the coming days may have an outsized impact on prices. With earnings once again taking place over the January/February window investors and traders are grappling with positions. The FED is expected to leave rates unchanged tonight at <0.25%. The release of the FOMC Statement and the following Press conference will no doubt attract copious amounts of attention. The FED is likely to stress its commitment to low interest rates and combating the economic fallout from the pandemic. The message that the FED will remain accommodative for as long as is necessary has been bolstered by the fall in the labour market, expanding on the idea that the FED has remain active in supporting the market. Murmurs about tapering have emerged in recent days and it is expected that FED Chair Powell will attempt to silence them in the press conference. The rumours focussed the successful rollout of vaccinations and the emergence of even greater fiscal stimulus as reasons that the FED may begin to taper in H2 of 2021. As mentioned earlier in our market up-date tweets there remains an outside chance that Governor Powell acknowledges the improved macro backdrop, as the ECB’s president Lagarde did last week. This could produce an oversized reaction in the markets, particularly the equity markets, given their current levels – this is our key risk element to watch out for at tonight’s presser – albeit an outside chnace. The confirmation of former FED Chair Janet Yellen as Treasury Secretary yesterday is thought to bring looser expansionary fiscal policy also. It is also worth noting the rotation of voting members of the FOMC will result in some new faces in the near future: out go Mester (hawk), Kashkari (dove), Kaplan (neutral) and Harker (neutral). In comes Evans (dovish), Daly (neutral), Bostic (dove), and Barkin (neutral).

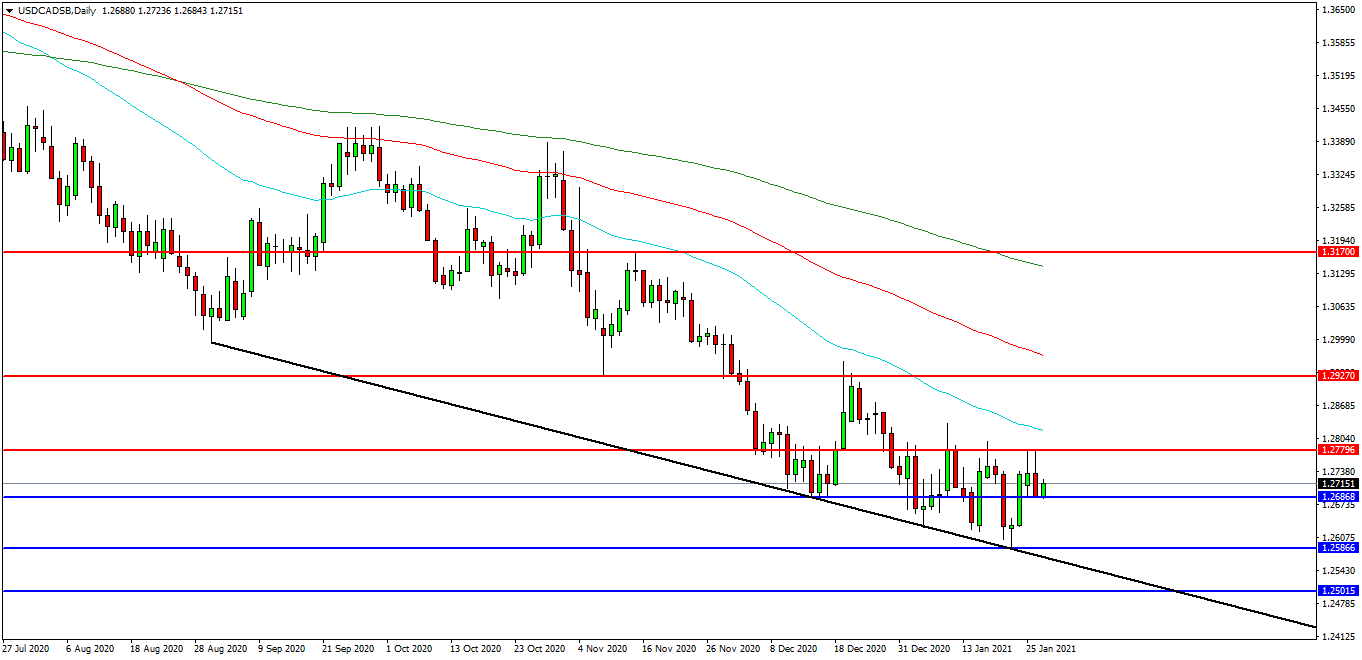

USDCAD

The USDCAD FX pair is consolidating after breaking lower past the important 1.3000 level in November. The pair is testing the 1.2700 level at present and bouncing off the supporting trend line at 1.2600/1.2585 – post comments from the Central Bank Governor. A confirmed breakout above this area has opened the way to initial resistance at 1.2780 followed by the 1.2800 area – where decent supply come into the market first time around. The 50 EDMA comes into play at 1.2818. The 1.2927 level may provide a target along the way to the more ambitious 1.3000 area. Alternatively a move back down under the 1.2687 level may find initial support at 1.2600. The 1.2586 level has been used as support in recent days. The 1.2567 area is of great importance as the trend line level and further supports may be seen at 1.2500 and 1.2450.

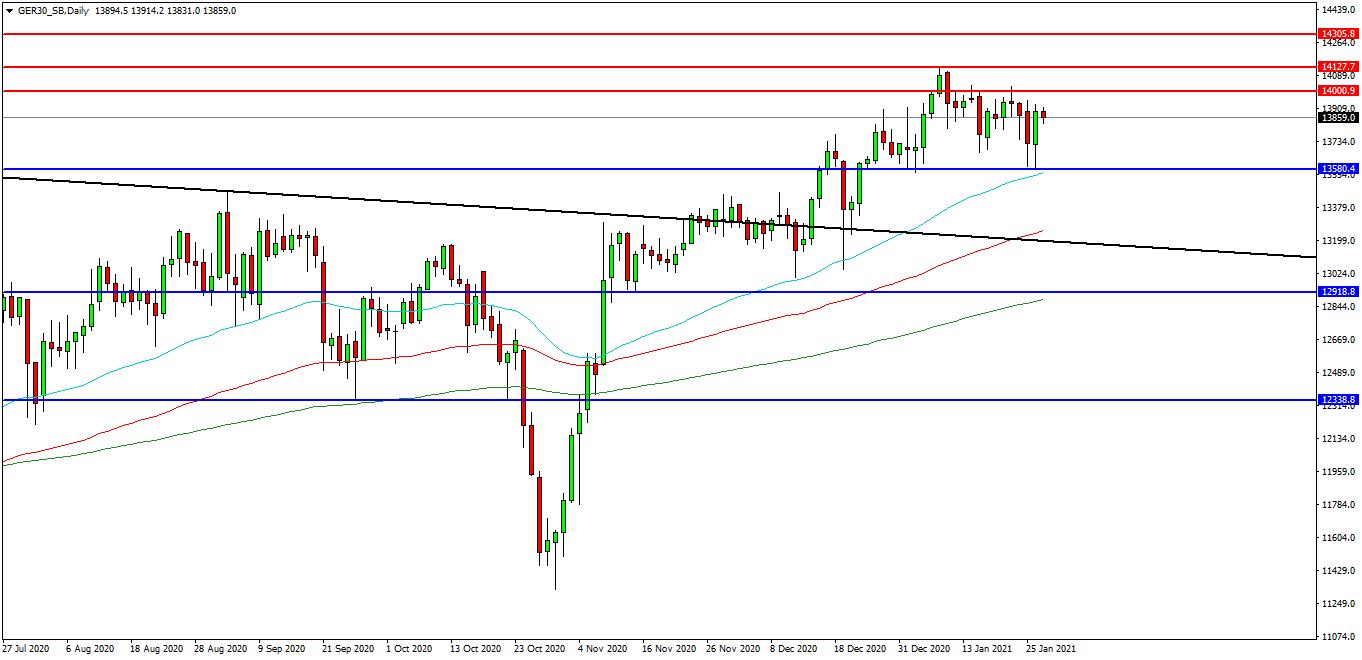

German 30 Index

The German 30 Index is continuing its test of the 14000.00 level. Price has found resistance around the 14127.00 area and turned lower as Covid-19 and economic factors increased risks. But buyers are stepping in and price action would still appear bullish with former resistance being used as support. A move higher from the current level of 13860.00 may target resistances at the 14000.00 area. Beyond this level, 14130.00 may offer resistance followed by 14300.00 and 14500.00. Alternatively, a move back below 13600.00 may signal a test on the 50 EDMA support at 13560.00. Below this level the 13250.00 area may be used as support. A run below this support may quickly target the 13000.00 round number followed by 12915.00.

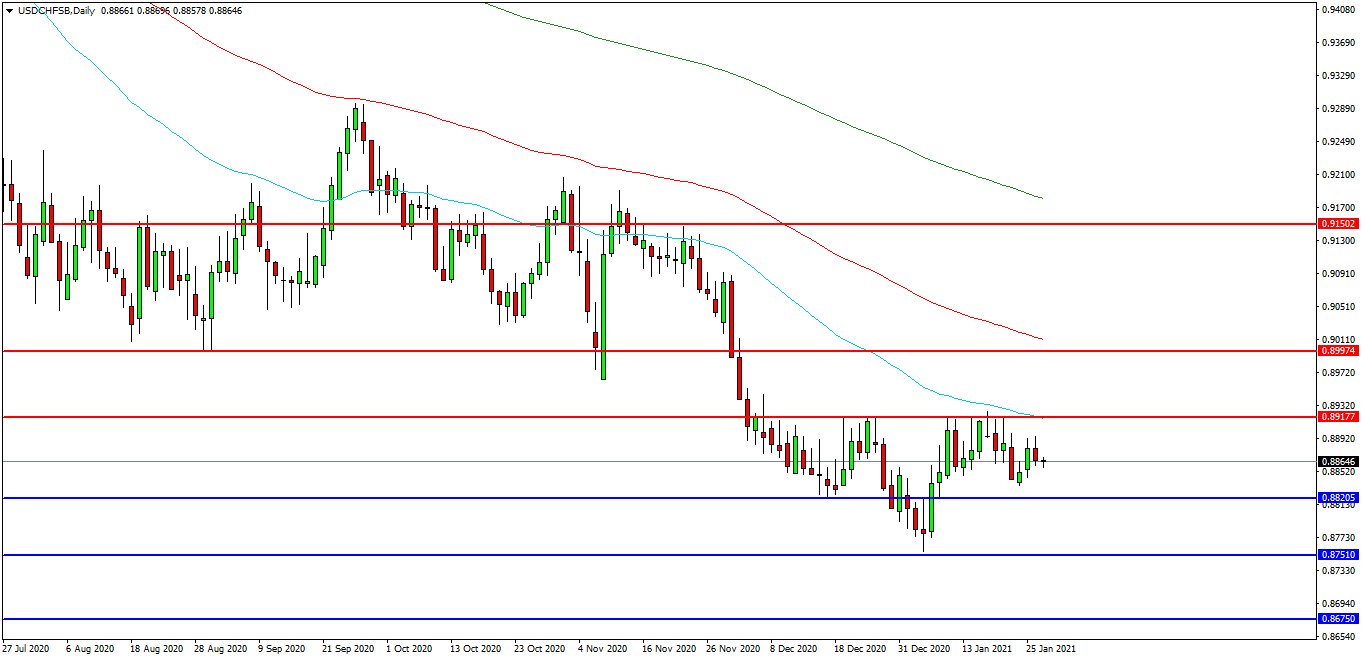

USDCHF

The USDCHF chart is showing how the pair is pushing back higher towards the 0.8895/0.8900 area followed by 0.8917 and the 50 EDMA. The pair found resistance at this level in the first trading days of the year. The pair remains in this range with initial resistance at 0.8915 followed by the 0.8965 area. A continued move higher may find more resistance around the 0.9000 round number followed by the 0.9015 100 EDMA. Alternatively a move back down under 0.8836 may find initial support at 0.8820. A loss of this level might hand control to sellers and possibly open the way to a retest on 0.8750, as the January low. Below this level the 0.8675 area may play its part as support.