The market is waiting anxiously for the Presidential inauguration of Joe Biden as he has said that his first 10 days in office will be set to a background of franticly reversing President Trump’s policies. The new administration has said that they will tackle the Climate crisis, the economic crisis, the Covid-19 crisis and the inequality of American society. The hearings to vet candidates for high offices in the administration have produced a range of headlines. Most significantly for hearing from a market perspective has been that of Treasury Secretary Janet Yellen, the former FED Chair. She said that she believed in market determined exchange rates and she said that she opposed foreign countries manipulating FX for gain. She said that job losses from raising the minimum wage would be “very minimal, if anything”. She said that some investment programs for public sector would have strong returns that argue in favour of borrowing to finance them, but it is crucial keep in mind interest burden on debt in the term of GDP because as debt grows, more tax revenue is needed to pay the interest, and this curtails other spending. The market is expecting President-elect Biden to make a series of rapid executive orders on his first day, including cancelling the Keystone pipeline between the US and Canada. The fact is that the market has to balance what is known and expected against what may emerge over the next few days. It will have to adapt positions quickly and this may lead to a rise in volatility.

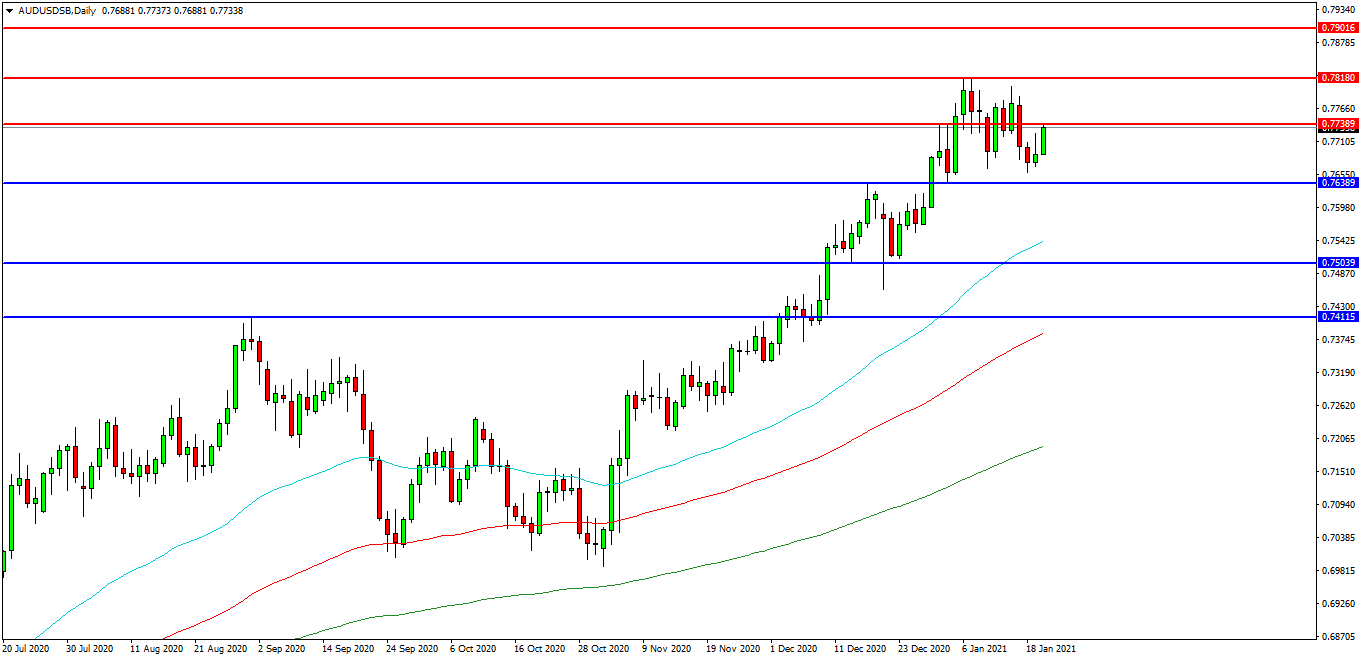

AUDUSD

The AUDUSD FX pair is consolidating after breaking higher past the important 0.7411 level in December. The pair is strengthening through resistance and approaching the 0.7740 level. A confirmed breakout above this area has opened the way to initial resistance at 0.7815 followed by the 0.7850 area. The 0.7900 level may provide a target along the way to the more ambitious 0.8000 area. Alternatively a move back down under 0.7700 may find initial support at 0.7650. The 0.7639 level has been used as support and resistance during recent days. A failure at this level might hand control to sellers and possibly open the way to 0.7600. The 0.7550 area is of great importance as the 50 EDMA is close to the level and further supports may be seen at 0.7500 and 0.7411.

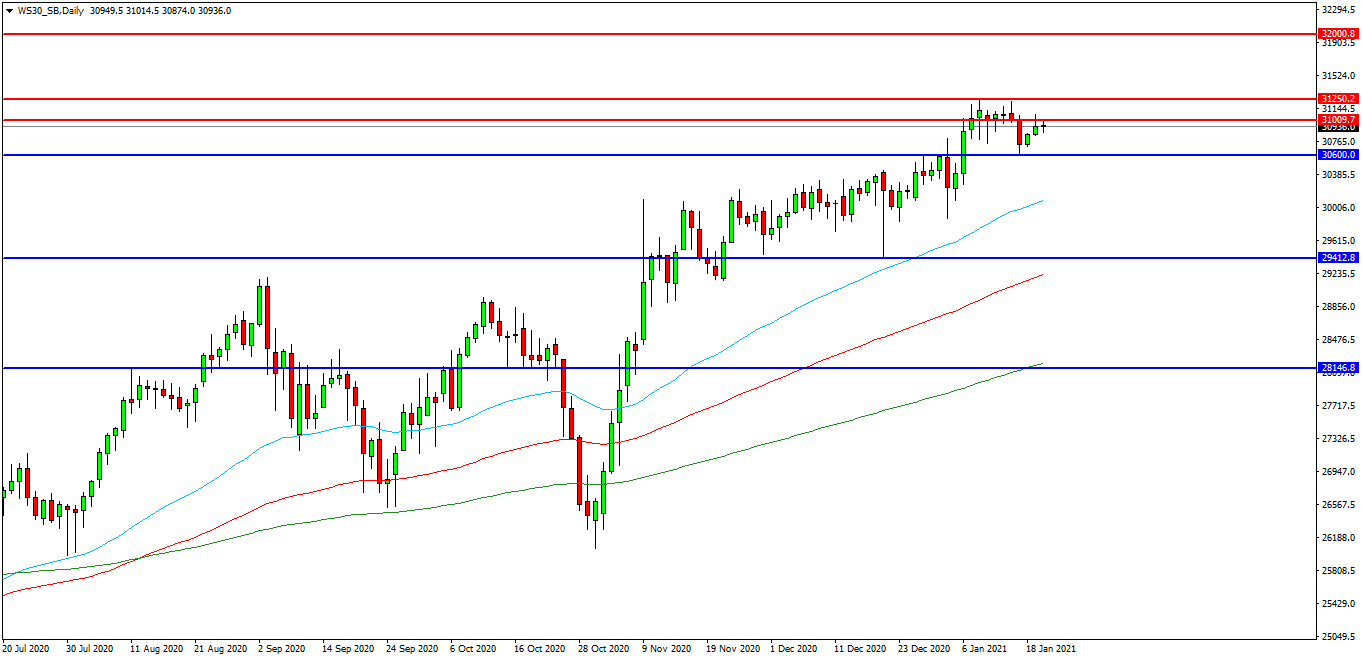

Wall St 30

The Wall St 30 Index is attempting to continue its breakout above the 30000.00 level. Price has found resistance around the 31250.00 area and turned lower as political and economic tension in the US increases. But buyers are stepping in and price action would appear bullish with former resistance being used as support. A move higher from the current level of 30935.00 may target resistances at the 31000.00 area. Beyond this level, 31250.00 may offer resistance followed by 31500.00 and 32000.00. Alternatively, a move back below 30600.00 may signal a test on the round number support at 30000.00. Below this level the 29410.00/29400.00 area may be used as support. A run below this support may quickly target the 29000.00 round number followed by 28145.00.

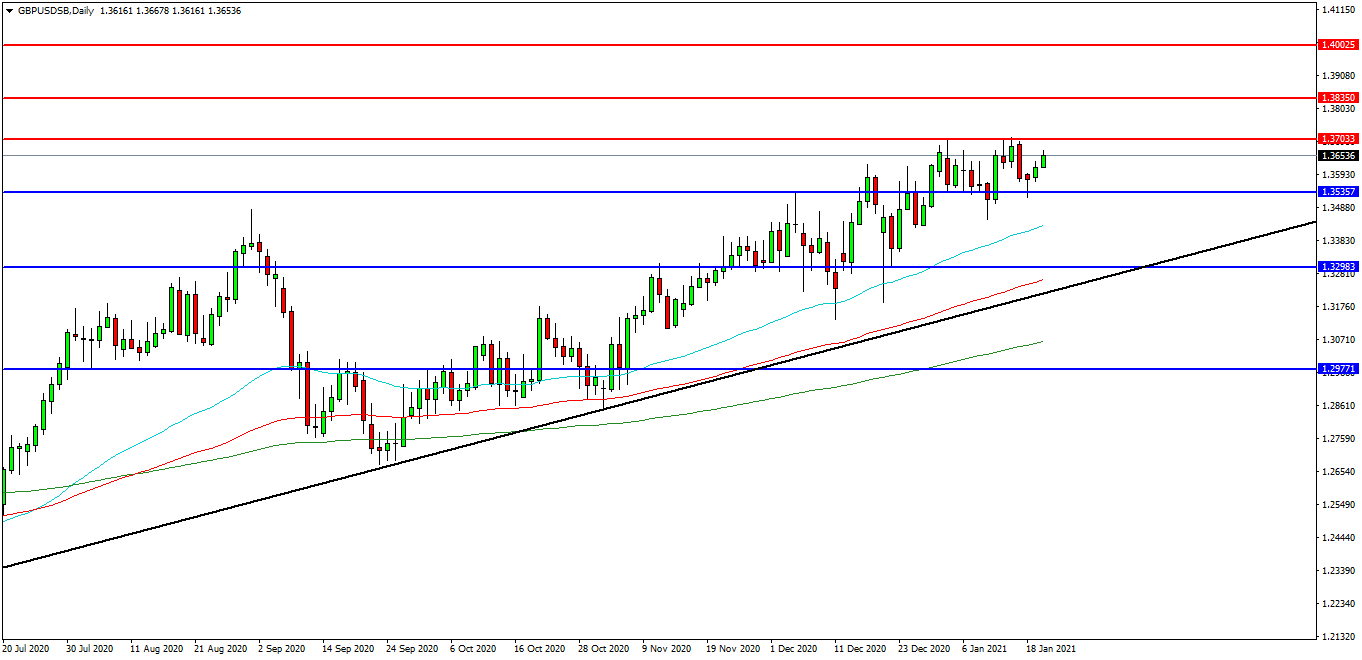

GBPUSD

The GBPUSD chart is showing how the pair is pushing back higher towards the 1.3700 area. The pair found resistance at this level in the first trading days of the year. The pair remains in this range with initial resistance at 1.3700 followed by the 1.3835 area. A continued move higher may find more resistance around the 1.4000 round number followed by the 1.4050 area. Alternatively a move back down under 1.3535 may find initial support at 1.3431 as the 50 EDMA. A loss of this level might hand control to sellers and possibly open the way to 1.3300, followed by the 1.3250 level, the trend line and the 100EDMA. Below these levels the 1.2977 area may once again play its part as support.