The spread of the Delta variant of Covid-19 is delaying reopening in Europe, with the UK and Ireland both pausing the next phase of their reopening. German case numbers have increased for a sixth day and UK case numbers have more than doubled over the past two weeks. Cumulatively the increases are a worrying development when numbers should be reducing over the summer. However the reopening and reduction of containment measures combined with the emergence of the more transmissible Delta variant have led to a surge in cases. The use of the AstraZeneca vaccine in the UK has also weakened the countries resistance to the new variant as that vaccine is reported to be less effective against it. Russia is also experiencing a surge in cases from the Delta variant as they are further behind in their vaccine rollout programme. Russian cases have also doubled over the past 3 weeks and there are also questions over the effectiveness of its vaccine against the new variant. Financial Markets are ignoring this dynamic for the time being, with stock markets, in particular the US indices, led by the Nasdaq and the S+P500 making all time fresh highs. So risk markets as a whole are trading well in the face of the spread of the Delta variant, however caution is needed, with 4th wave simmering in the background. A nasty re-pricing of risk is always a threat, with this Delta variant spreading globally now. It has not been all plain sailing for risky assets however and we have seen commodities, like gold (as point out yesterday in our technical analysis piece), and Cryptos are trading lower over the past few weeks. Gold is right on significant support, the weekly close here will be critical and despite putting in a bullish day above $35,400/500 yesterday, Bitcoin has given back most of its gains today. The risk on theme is in danger of a reversal from the virus especially if US begin to increase again.

Before all of this unfolds we have a huge employment figure out of the US to navigate at the end of this week – NFP this Friday could well set the tone for financial markets into July and Aug. The ADP employment report will be released today and after a much stronger than expected 978 k gains last month, the consensus call is for a 550/600k gain today. So the market’s expectations of a strong jobs report on Friday are rising now which has been fuelling further USD strength. All eyes on the release at 1.30pm London time on Friday.

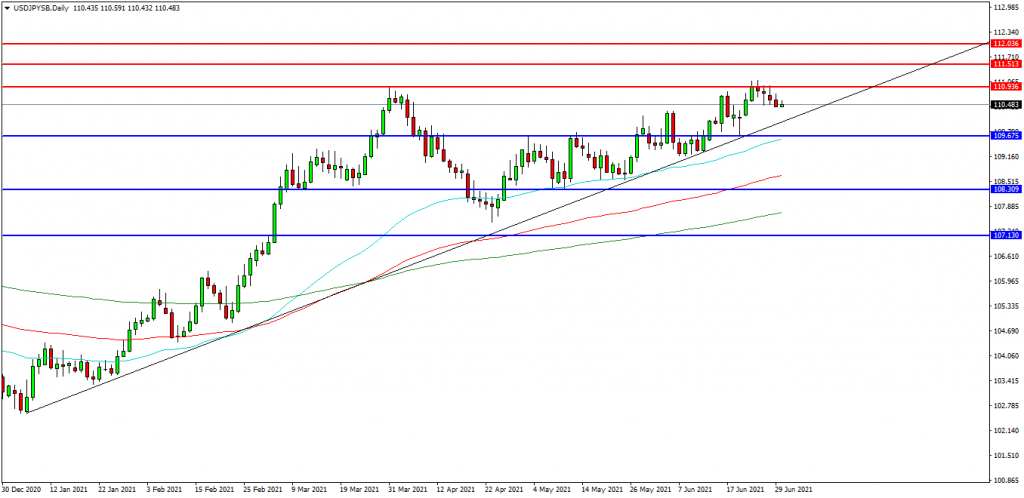

USDJPY

The USDJPY FX pair is trading at 110.500. Price is above its supporting trend line at 110.000. Price tested resistance at the 111.000 level and created a new high at 111.111. The pair is now trading down since then and seeking support. Price is using the 110.940 area as resistance. A confirmed breakout above 111.111 may open the way to resistance at the 111.250 area. The 111.550 area may provide a target along the way to the 112.000 area. Alternatively a move back down under the 110.000 zone may find initial support at 109.675. The 109.400 area may be used as support followed by further supports at 109.200 and 108.300.

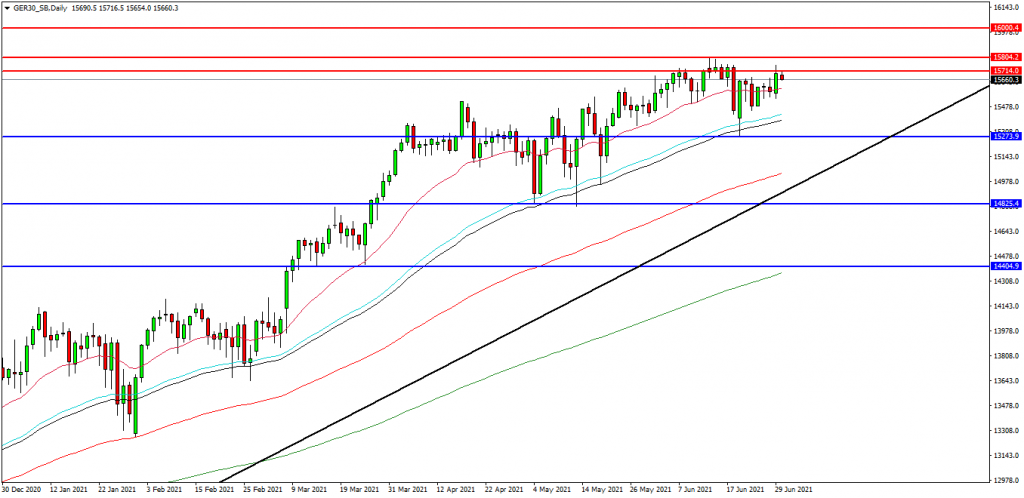

German 30 Index

The German 30 Index created a new high at 15800.00 this month and is now testing the 15700.00 area as resistance. If the market breaks above this level, a test on the high could be possible. The market rallied from support over the last number of days but found resistance ahead of the high at 15750.00 yesterday. Price is attempting to build on support and at present 50EDMA at 15600.00 looks like a potential area followed by the 15500.00 level as support. A move higher from the current level may target resistances at the 15800.00 area and 16000.00. Beyond this level, 16400.00 may offer resistance followed by the 16500.00 level. Alternatively, a move back below 15500.00 may signal a test on the support at 15275.00. Below this level the 15000.00 area may be used as support along with the 14825.00 level. A run below this support may quickly target the 14600.00 followed by 14400.00.

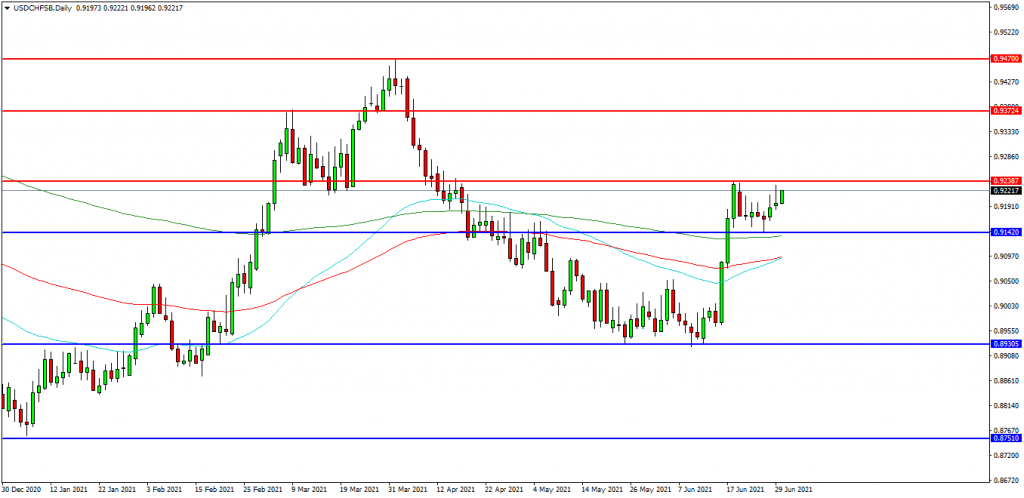

USDCHF

The USDCHF chart is showing how the pair has rallied over recent days and is now trading at 0.9222. The 0.9238 level is expected to act as resistance and the 0.9142 area is the initial support area. The pair may find resistance at the 0.9280 area and the 0.9300 level on a break higher. A continued move higher may find more resistance around the 0.9372 level followed by the 0.9470 area. Alternatively a move back down under the 200 EDMA at 0.9140 may find supports between 0.9100 and 0.9070. A loss of this level may extend the control of sellers and possibly open the way to a test on 0.9000. Below this level the 0.8930 area may play its part as support and the 0.8850 area.