Markets have gained early this week on the back of reports of progress on the UK-EU Trade negotiations and how to implement the issues surrounding the Northern Ireland Protocol. The UK will now withdraw clauses in the Internal Markets Bill which would breach the protocol and have committed to not introducing similar provisions in the Taxation Bill. The breakthrough also produced solutions to the key questions of food imports, state aid, the supply of medicines and the question of the EU’s presence in Northern Ireland. The news has been welcomed in all quarters including the US and it is hoped that the development removed some of the obstacles to agreeing a deal. Markets reacted in a positive manner to the news but acknowledged that the process can still crumble in other areas over the coming days. Last Friday in the US, the Non-Farm Payrolls number showed a weak print, with a fall to 245K against a forecast of 480K and a previous 638K which was revised lower to 610K. The Unemployment Rate fell to 6.7% from 6.9%, which beat the forecast of 6.8%. The Average Hourly Earnings showed an increase to 0.3% from 0.1%. The concern for markets is that job creation is decreasing as optimism wanes with an increase in Covid-19 cases in the US and a worsening economic landscape. Despite the initial positivity of vaccine development and approvals, the rollout is expected to be a long process with question concerning the uptake of the vaccine. With the rise in cases in the US placing more pressure on medical facilities it is likely that states will be forced to introduce harsher restriction to slow the spread of the virus, damaging the economy in the process. As the market is testing all time highs there is concern that a slowing in the economy at this point will sap market confidence and lead to a rotation in sectors once again.

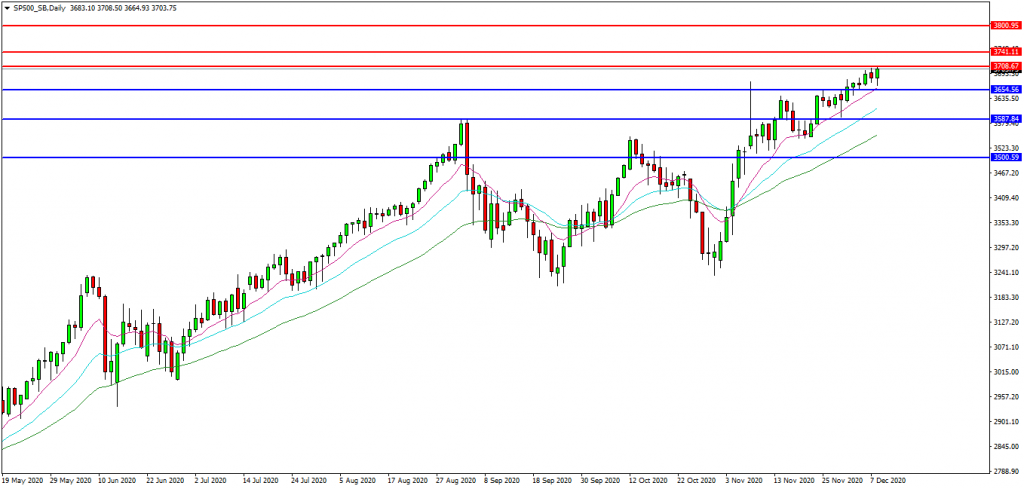

US S&P 500

The US 500 Index is continuing its move higher since the election in early November. Price action is supported by the rising moving averages in particular the 50 EDMA at 3654.00. A break above yesterday’s high of 3705.00 will be seen as encouragement for buyers. Resistance may then be seen at 3708.00 followed by the 3740.00 area. These levels provide the initial upside resistance. A confirmed breakout above 3750.00 would appear bullish and target further resistances at 3775.00 and the 3800.00 area. Alternatively, a move back below 3654.00 may signal a test on support at 3600.00/3587.50 as the September high. The 3500 area may also provide support but even a test on this area still leaves the bears with a lot of work to do.

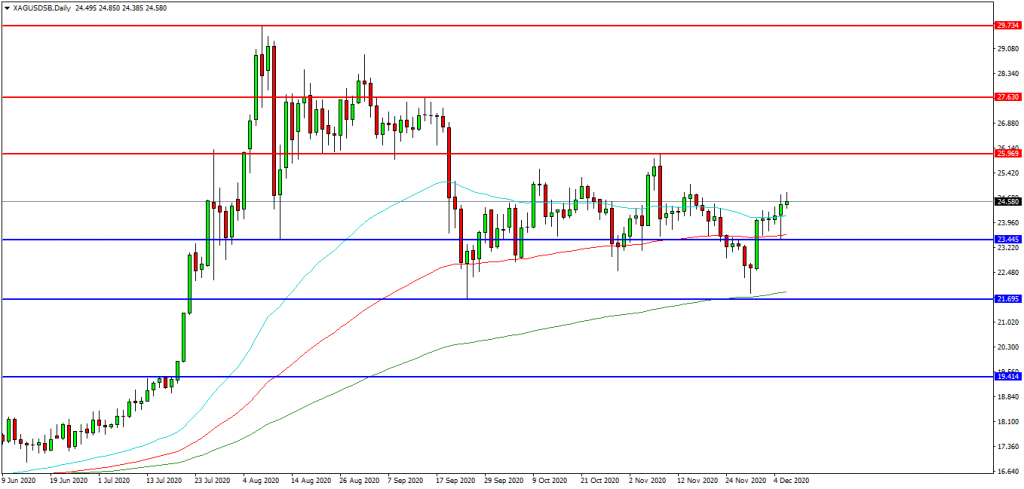

Silver

The Silver chart broke lower over a week ago around 23.50 to find support at 21.80 but has since recovered from the loss and reversed higher to trade 24.58. If the metal closes above that level today there is a possibility that the buyers might remain in control and attempt to extend up to 25.00. The price is attempting to break higher to engage the 25.95/26.00 area. A breakout higher may seek to test the 27.00 area followed by the lower high at 27.63. Beyond this the August at 29.73 comes into view. Alternatively, a loss of 24.00 may result in further selling emerging that would target the mid-August low at 23.45. Below this the 21.70 level might offer support as a key level over the last few months. A breakdown opens the way to 20.00 and 19.41 as the July breakout level.

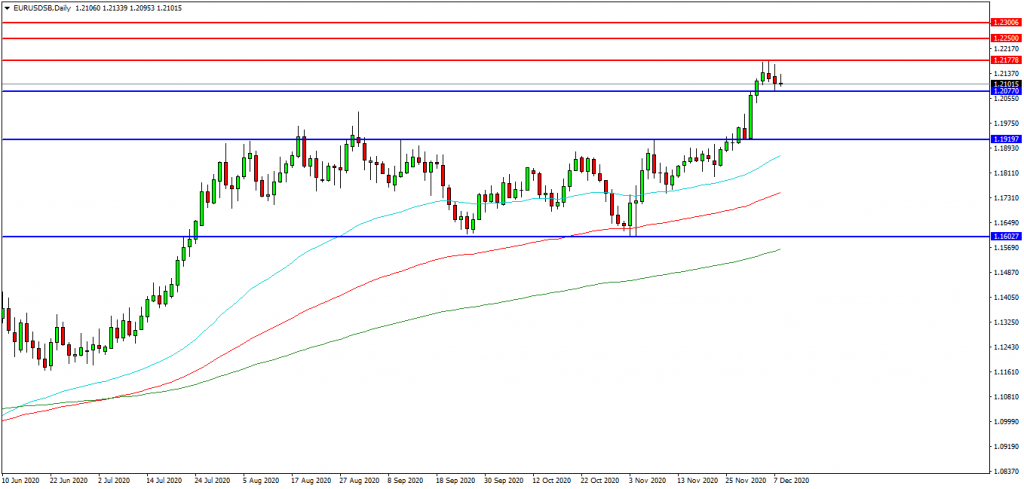

EURUSD

The EURUSD FX pair is currently consolidating after breaking higher last week above the 1.2000 level. The pair has found resistance at 1.2177 and has tested support at 1.2077. A confirmed breakout above this range may open the way to initial resistance at 1.2200 followed by the 1.2250 area. A continued move higher may find a target around the 1.2300 area. Alternatively, a move back down under 1.2070 may find initial support at 1.2010/1.2000. A loss of this level might hand control to sellers and possibly open the way to 1.1920, followed by the 1.1730 level. Below these levels the 1.1600 area may once again play its part as significant resistance. The coming Brexit negotiations and their outcome are expected to have a major impact on the movement of this pair over the coming days and weeks.