Overview of the Macro Financial Trading Report

The markets have consolidated to a large degree over the past week as the familiar ranges play out to the background of the same stories that have dominated headlines already this month. Essentially nothing has changed on the political or economic front. There are still efforts being made to get an agreement between the EU and UK for a trade deal, while on the other side of the Atlantic Democrats and Republicans are trying to thrash out a stimulus agreement. While there has been some progress between the EU and the UK in the form of the UK having accepted a “rebalancing mechanism” on the level playing field issue that would see it face tariffs from the EU if it moves too far away from EU rules. With time running out progress is welcome but a new deal will have to be in place by 1 January to avoid the trading having to take place on WTO terms. In the US Senate Majority Leader Mitch McConnell has said that he will not leave Washington for his holidays until there is an agreement on a new cvoid-19 relief package. There is also the matter of agreeing the next spending bill in the US this week in order to avoid a government shutdown this Friday. This week will also see a focus on the Federal Open Market Committee decision on the US Federal Funds Rate, which is expected to remain at <0.25%. The meeting is expected to be a difficult one for the FED who will have to balance taking action with looking through the short term disruption of higher covid cases and economic disruption, instead focussing on the vaccine rollout and a resurgence of the economy in 2021. The expectation in markets is that the FED will lengthen the maturity of its asset purchases, which would be expected to be USD negative. If the FED does nothing, the baseline case is for USD strength. The Swiss National Bank and the Bank of England are also expected to leave their rates unchanged on Thursday, with the Bank of Japan expected to follow suit on Friday.

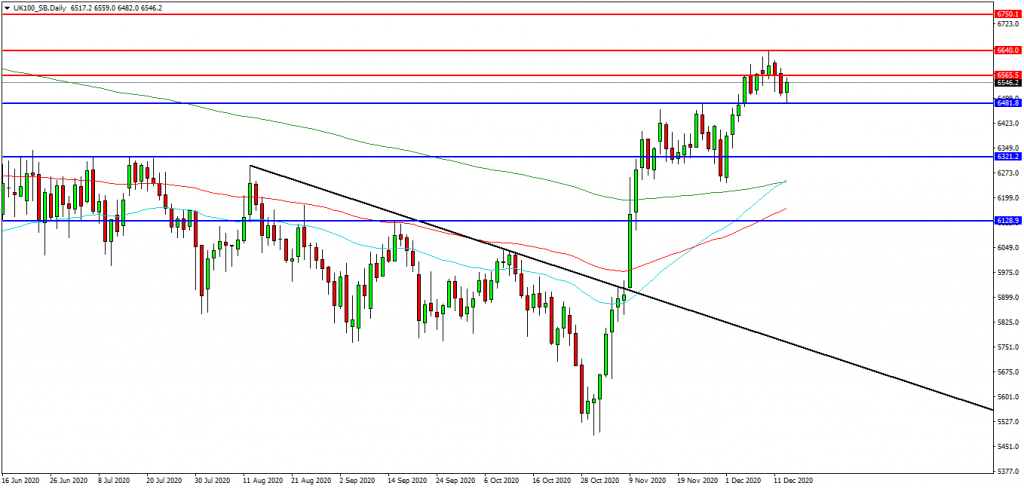

UK 100 Index

The UK 100 Index is continuing its move higher since the election in early November. Price action is supported by the rising moving averages in particular the 50 EDMA and 200EDMA producing a Golden cross at 6250.00. A break above last week’s high of 6640.00 will be seen as encouragement for buyers with a continuation of the move higher. Resistance may be seen at 6565.00 followed by the 6640.00 area. These levels provide the initial upside resistance. A confirmed breakout above 6640.00 would appear bullish and target further resistances at 6700.00 and the 6750.00 area. Alternatively, a move back below 6480.00 may signal a test on support at 6320.00 followed by the September high at 6130.00. The 6000.00 area may also provide support.

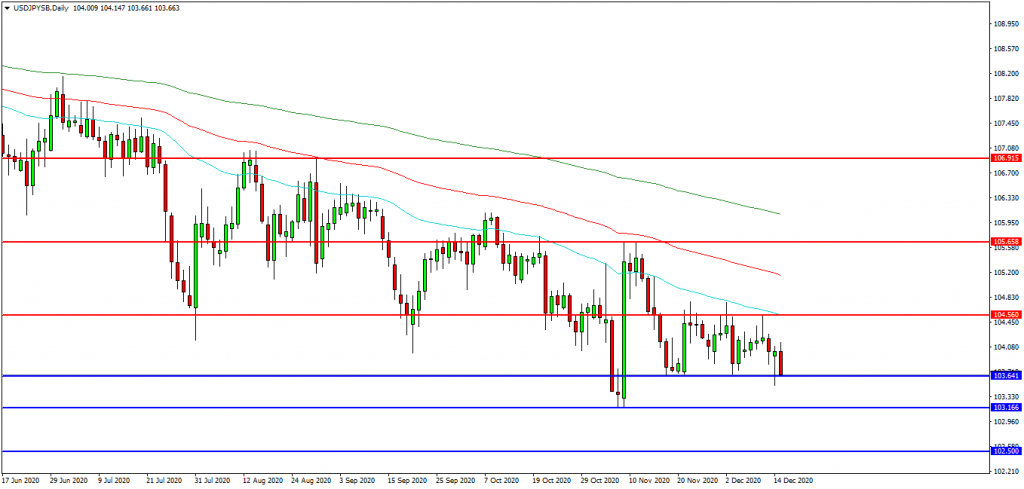

USDJPY

The USDJPY chart is trending lower with a low set at 103.165. Support was found at that level and price is now testing 103.640 as support. Further support may be seen acting on price below 103.000 at 102.500. The price attempted to break higher but found resistance at the 105.660 area. Price may use resistance at 104.560 and the 50 EDMA. A breakout higher may seek to test the 105.000 area followed by the lower high at 105.660. Above these levels the 200 EDMA around the 106.000 area is followed by 106.915.

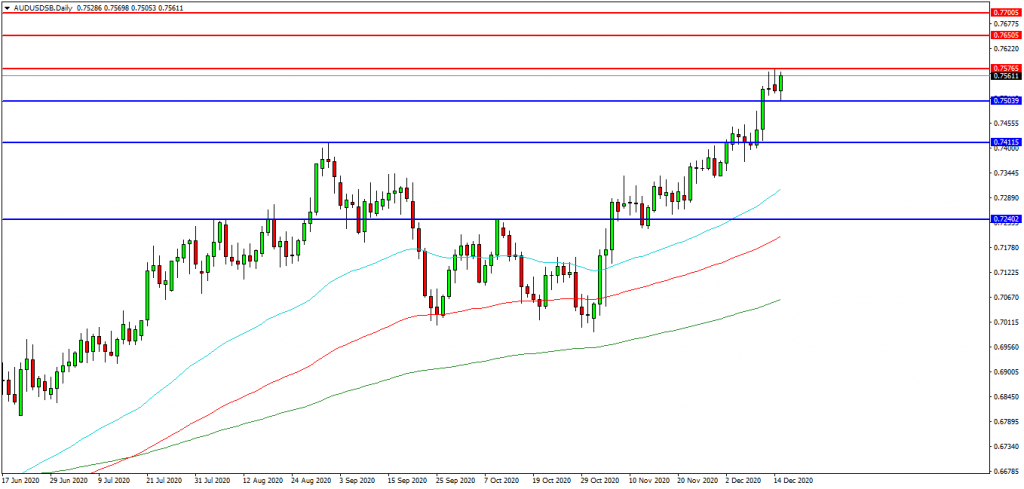

AUDUSD

The AUDUSD FX pair is trending higher after breaking higher last week above the 0.7500 level. The pair has found resistance at 0.7576 and has tested support at 0.7500. A confirmed breakout above this range may open the way to initial resistance at 0.7600 followed by the 0.7650 area. A continued move higher may find more resistance around the 0.7700 area. Alternatively a move back down under 0.7500 may find initial support at 0.7450. A loss of this level might hand control to sellers and possibly open the way to 0.7411, followed by the 0.7400 level. Below these levels the 0.7240 area may once again play its part as support.