The US political and economic landscape is leading sentiment at present in markets as the focus over the last two weeks has been on the yield in US Treasuries moving higher and what is being called the global reflation trade. This has seen commodity prices rally, as pent up demand expectations hit the global markets. The worry in markets is that this is a harbinger of a longer period of higher yields than will force the FED to increase interest rates and result in higher inflation that would unhinge the economic and investing dynamic. This would have huge implications for global asset classes, in particular the equity markets who have enjoyed sustained periods of low interest rates, low inflation and cheap funding. The FED has taken a rather lassiez faire attitude to the increase in yields labelling the move as transitory and in-line with the FED’s 2% inflation target despite the rapidity of the rise. Let’s not forget that this was their exact approach back in 2013 during the ‘’Taper Tantrum’’ which ultimately forced them to move to move uber-dovish The FED speakers yesterday said that they were watching the rise but were largely unconcerned. FED Member Brainard said that inflation was low but inflation expectations have moved closer to 2% and it will take some time to see substantial further progress. “The long-standing presumption that accommodation should be reduced pre-emptively when the unemployment rate nears estimates of the neutral rate in anticipation of high inflation that is unlikely to materialize risks an unwarranted loss of opportunity for many of the most economically vulnerable Americans.” She said when asked when she would be concerned about yields, “I would be concerned if I saw disorderly conditions or persistent rises in yields that threaten our goals” adding that she watches these bond market developments “very carefully”. FED Member Daly said that the recent rise in inflation compensation is “encouraging” and in line with the FED’s goals. He added that runaway inflation risk is not imminent and it will likely be some time before inflation is sustainably back to 2%. He also said that the FED must avoid pre-emptively tightening monetary policy. These all seem reasonable arguments at this junction – however with US 10 Yr Yields above 1.5% – the market maybe disagreeing with the FED members. This is the key driver of markets today and should be watched very closely.

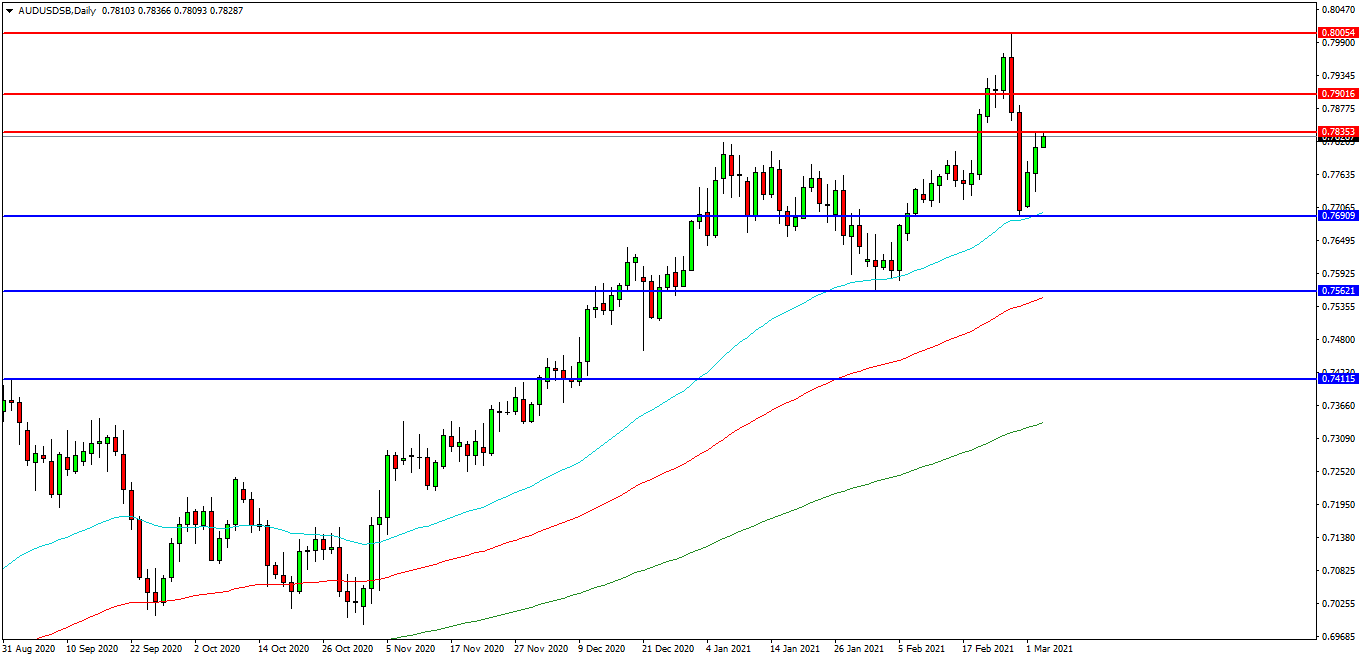

AUDUSD

The AUDUSD FX pair is making extraordinary advances after breaking the 0.7400 level in December. The price has shot up to test 0.8000 as resistance last week. Price has fallen back and found support at 0.7690 and is now trading at 0.7820. A confirmed breakout above this area may open the way to initial resistance at 0.7835 followed by the 0.7850 area. The 0.7900 level may provide a target along the way back to the high at the 0.8000 area. Alternatively a move back down under the 0.7000/0.7699 zone may find initial support at 0.7640. The 0.7600 round number level has been used as support in recent days and may be of importance in the event of a retracement. The 0.7562 area is of great importance as a former higher low. Further supports may be seen at 0.7500 and 0.7410.

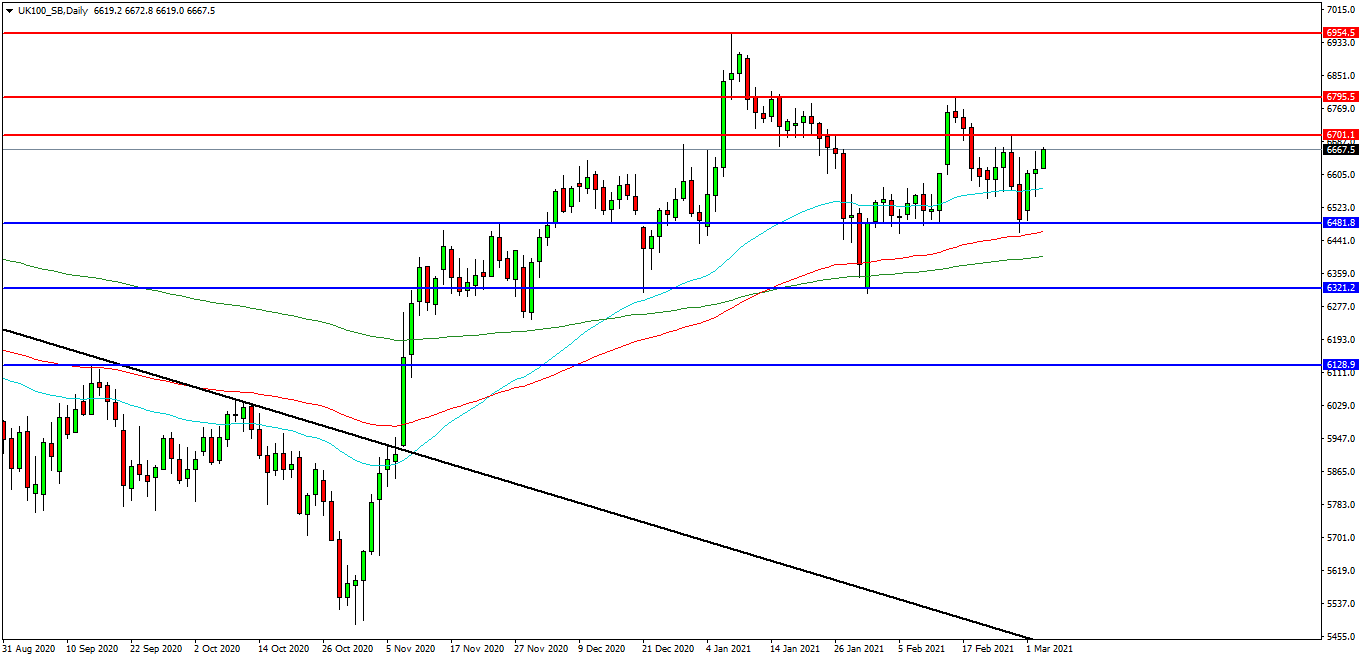

UK 100 Index

The UK 100 Index is consolidating its rally higher after breaking the resistance of the trend line in November. The market is testing the 6670.00 level as resistance. Price is attempting to find resistance and at present 6700.00 looks like a potential area followed by the lower high at 6795.00. A move higher from the current level may target resistances at the January high of the 6955.00 area. Beyond this level, 7000.00 may offer resistance followed by 7250.00 and 7500.00. Alternatively, a move back below 6650.00 may signal a test on the support at 6480.00. Below this level the 6320.00 area may be used as support along with the 6300.00 level. A run below this support may quickly target the 6130.00 followed by 6000.00.

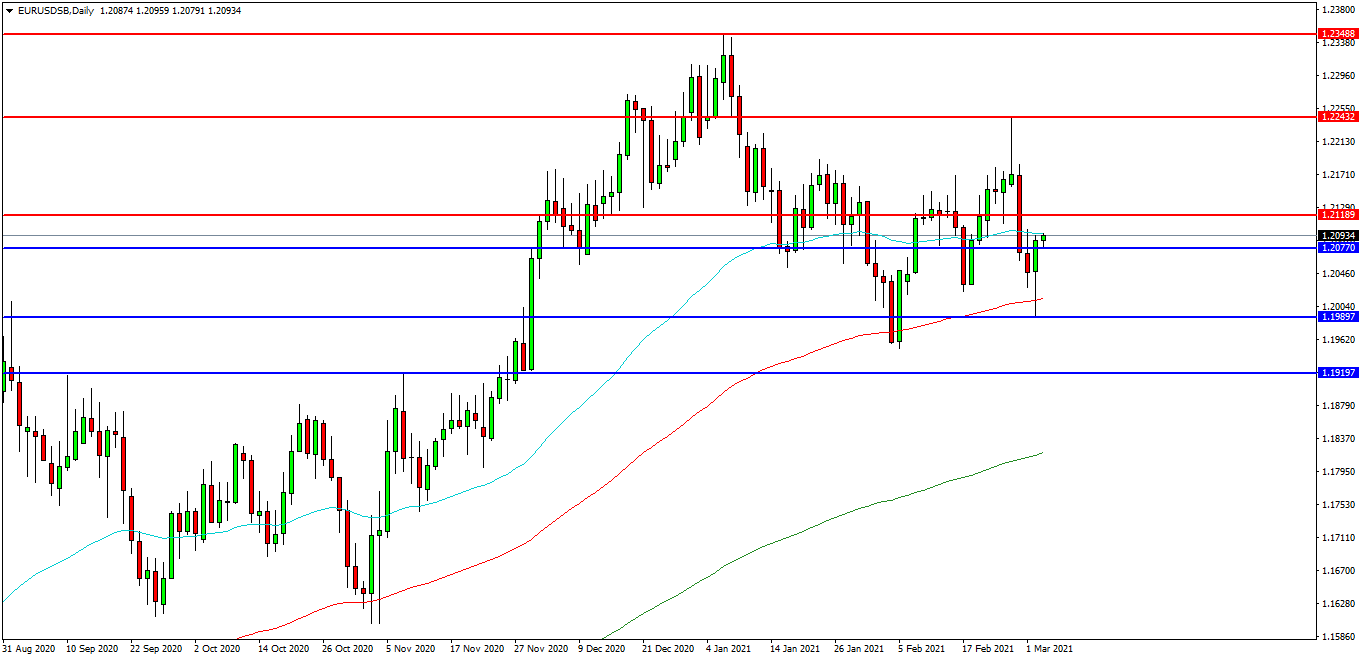

EURUSD

The EURUSD chart is showing how the pair is consolidating with a downward bias towards the 1.2000 and forming a low yesterday’s at 1.1986 area. The pair found support ahead of 1.1950 higher low from last month. The pair has initial resistance at 1.2100 and the 50 EDAM followed by the 1.2119 area. A continued move higher may find more resistance around the 1.2175 level or the 1.2200 round number followed by the 1.2225 level and the lower high at 1.2243. Alternatively a move back down under 1.2050 may find initial supports at 1.200 and 1.1990. A loss of this level might hand control to sellers and possibly open the way to a test on 1.1940. Below this level the 1.1920 area may play its part as support ultimately followed by 1.1820 and the 200 EDMA.