The equity markets sold off after the FOMC and added to losses because of Quadruple Witching options expiry on Friday. Most of the selloff has been retraced by now and traders are back in a neutral position and looking for direction. The market to some extent still has to digest the FOMC’s impact on the broader markets and what it means going forward. The FED has stuck to its tone that it believes inflation is transitory but it has opened the door towards tapering if it needs to act to combat inflation from overshooting longer term. It believes the rise in inflation is due to covid-19 related supply issues and that a full reopening will allow prices to fall and supply to catch up to demand. FED speakers are being monitored by market participants for changes in their tone in this regard. At present they are willing to look through the rise in prices but a continued rise in inflation may force their hand. The spread of the Delta variant is causing concern in the UK as well as Australia. The high level of vaccination in the UK is a mitigating factor but the reopening has stalled as cases rise. In Australia the population is drastically under-vaccinated, with only 3.5% having received jabs. There is now a lockdown over the metropolitan Sydney area. Australia’s vaccination rollout is relatively slow, with supply issues and also population hesitancy. AUD may weaken as a result.

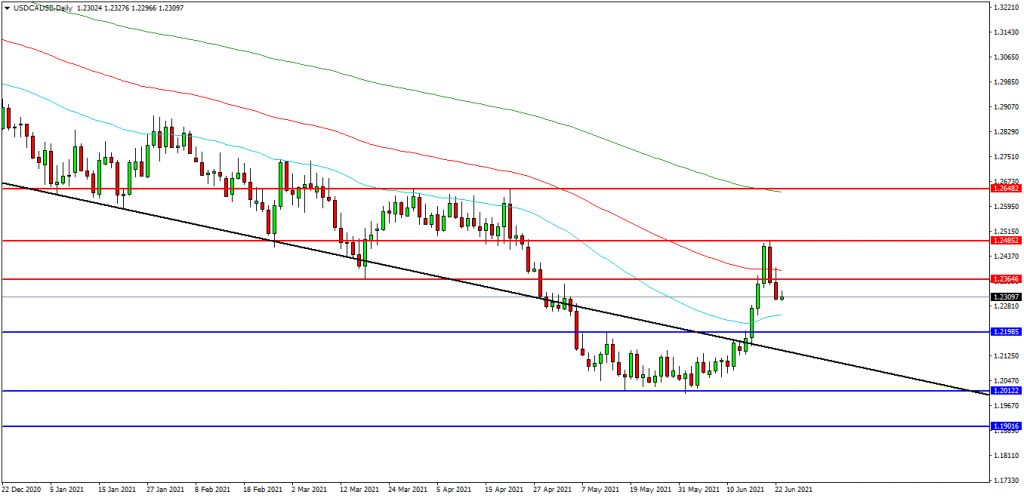

USDCAD

The USDCAD FX pair is trading between its 50 EDMA at 1.2252 and its 100 EDMA at 1.2393. Price tested resistance at the 1.2485 level on Monday. The pair is now trading at 1.2397. Price is using the 1.2400 area as resistance. A confirmed breakout above 1.2485 may open the way to resistance at the 1.2500 area. The 1.2550 area may provide a target along the way to the 1.2660 area. Alternatively a move back down under the 1.2200 zone may find initial support at 1.2125. The 1.2100 area may be used as support followed by further supports at 1.2000 and 1.1900.

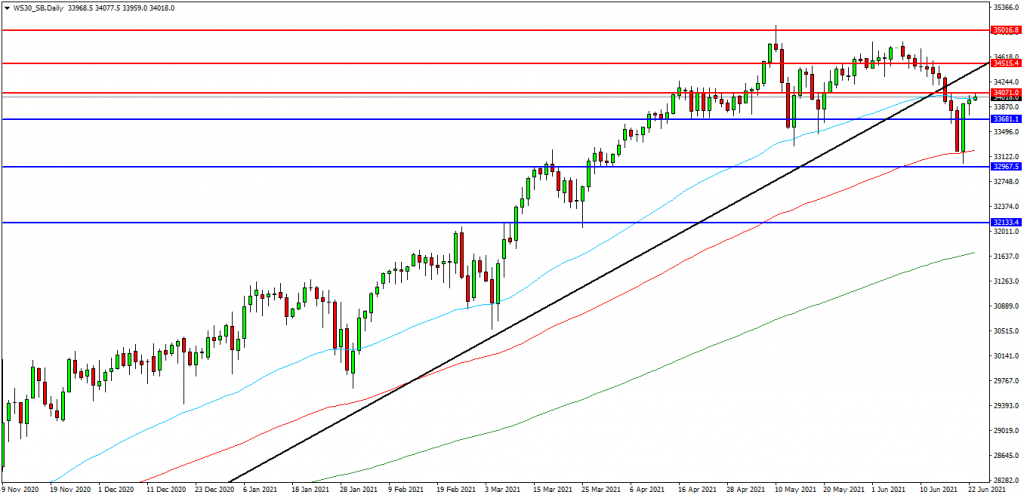

Wall St 30 Index

The Wall St 30 Index created a new high at 35090.00 last month and is now testing the 34070.00 area as resistance. If the market breaks above this level of the 50EDMA around 34020.00, a test on the trend line from the 2020 low could be possible. The market sold off from resistance over the last number of days but found support on the 33000.00 on Monday. Price is attempting to build on support and at present 33680.00 looks like a potential area followed by the 33500.00 level as support. A move higher from the current level may target resistances at the 34500.00 area and 34670.00. Beyond this level, 34800.00 may offer resistance followed by the 35000.00 level. Alternatively, a move back below 33500.00 may signal a test on the support at 33285.00. Below this level the 33000.00 area may be used as support along with the 32900.00 level. A run below this support may quickly target the 32400.00 followed by 32130.00.

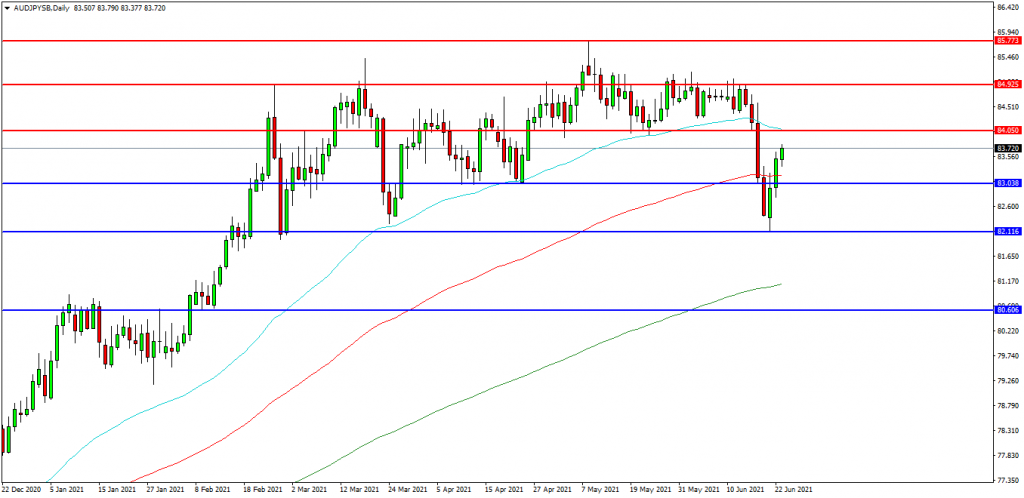

AUDJPY

The AUDJPY chart is showing how the pair has declined over recent days, but has recovered this week and is now trading at 83.720. The 84.000 level is expected to act as resistance and the 83.200 area is the initial support area. The pair may find resistance at the 84.010 area and the 84.500 level on a break higher. A continued move higher may find more resistance around the 84.925 level followed by the 85.440 area. Alternatively a move back down under the 100 EDMA at 83.200 may find supports between 83.000 and 82.450. A loss of this level may extend the control of sellers and possibly open the way to a test on 82.115. Below this level the 82.000 area may play its part as support and the 81.400 area.