The FOMC minutes were released on Wednesday 07 July with the report showing that various members of the FOMC saw a taper being implemented somewhat earlier than previously anticipated. The majority of participants judged that the risks to their inflation projections were tilted to the upside. They also expected the conditions for beginning to reduce the pace of asset purchases to be met somewhat earlier than they had anticipated at previous meetings in light of economic data and that the Committee would have information in coming months to make a better assessment of the path of the labour market and inflation. Several participants saw benefits to reducing the pace of these purchases more quickly or earlier than Treasury purchases in light of valuation pressures in housing markets. But they also emphasized that the Committee should be patient in assessing progress toward its goals and in announcing changes to its plans for asset purchases. As regards inflation: Participants attributed the upside surprise to more widespread supply constraints in product and labour markets than they had anticipated and to a larger-than-expected surge in consumer demand as the economy reopened. To summarize, the FOMC believes that a taper is now closer due to improved economic conditions and rising inflation. The USD weakened initially on the release of the minutes sending US stocks higher. The rally in stocks lasted into the close of Wednesday’s US session but on reflection risk aversion crept in overnight on Wednesday and stock saw a substantial fall on Thursday. Bonds maintained their trend with the 10-Year yield falling to 1.26% on Thursday before moving higher on Friday. The Bond market is particular has been ground zero for the inflation narrative this week. However, the markets are trying to make sense of the change in tone from the FED at a time of lower liquidity and repositioning which is distorting moves.

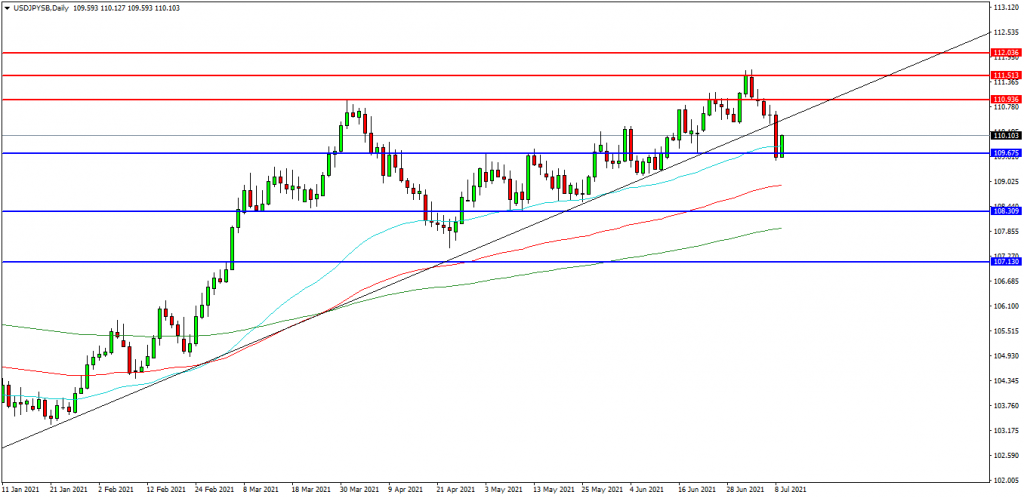

USDJPY

The USDJPY FX pair is trading at 110.100. Price has fallen below its supporting trend line at 110.390 following the FOMC minutes. Price had tested resistance at the 111.000 level and created a new high at 111.650 last week but fell into support at 109.520 yesterday. The pair is now trading back above 110.000 since then and seeking to potentially retest the trend line as resistance. In the wider context price is using the 111.500 area as resistance. A confirmed breakout above 110.400 may open the way to resistance at the 111.250 area. The 111.550 area may provide a target along the way to the 112.000 area. Alternatively, a rejection of the trend line at 111.390 and the 110.000 zone may find sellers retaining control with initial support at 109.675. The 109.400 area may be used as support followed by further supports at 109.200 and 108.300.

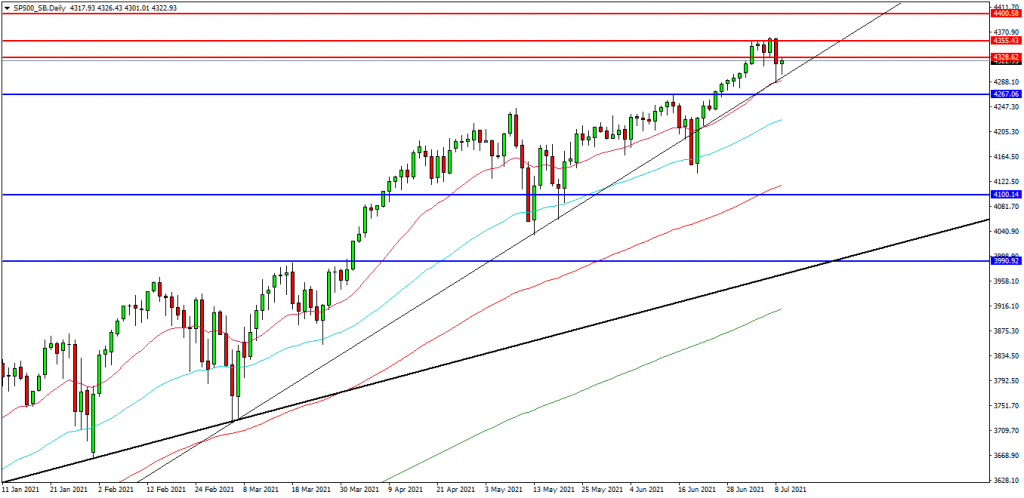

US 500 Index

The US 500 Index created a new high at 4361.00 on Wednesday after the FOMC minutes. The Index is testing the 4328.00 area as resistance. If the market breaks above this level, a test on the highs could be possible. The market rallied from support at 4267.00 over the last number of days but the FOMC has potentially changed the outlook. Price is attempting to build on support at 4287.00 and the rising trend line in conjunction with the 20 Day moving average. A move higher from the current level may target resistances at the 4350.00 area and 4355.00. Beyond this level, 4370.00 may offer resistance followed by the 4400.00 level. Alternatively, a move back below 4287.00 may signal a test on the support at 4267.00. Below this level the 4250.00 area may be used as support along with the 4225.00 level as the 50 Day moving average. A run below this support may quickly target the 4200.00 followed by 4136.00.