3Sigma Markets – Mid Week Macro Report May 5th 2021

US equity indices sold off yesterday as key technical support areas broke and risk off sentiment engulfed the stock markets. The lighter liquidity environment due to the Japanese and Chinese holiday created conditions where sellers pushed prices below technical supports than had held up well over April. There were also catalysts from central bank and government officials – Yellen’s comments regarding the need to raise rates in the US if the economy began to overheat – which ignited further selling in the equity markets, in particular the Nasdaq, which was off nearly 400 points on the day at its intra-day lows. The markets have been consolidating in recent weeks with many institutional traders and analysts calling for a minor correction as equities have become overextended – last week’s stellar results from the tech giants could not see us trade to all time fresh highs. Any dip at present is expected to see buyers set in along the way with the technical outlook in equities still ultimately pointing to higher prices. However a retest on supports should not be ruled out and in the context of the moves over the last 12 months this would be healthy for the market. Bonds were also affected by the risk off move yesterday along with appreciation in the USD versus most of the majors and EM currencies. As mentioned US Treasury Secretary Janet Yellen said yesterday that rates may have to rise to keep the economy from overheating. This was interrupted by the market as a negative and added to further selling pressures in stocks. The comment added to the move higher in the USD. She later back tracked saying that she is not predicting or recommending that the FED raise rates and said that the FED has tools to address higher inflation over the coming months. She said that she expects a rise in labour force participation and that it was important to maintain fiscal space to address a future emergency. FED Member Kaplan also made comments that moved the market when he said that in his opinion it was time to start discussing a taper. He said “I think it will make sense to at least start discussing how we would go about adjusting these purchases and starting having those discussions sooner rather than later” adding that he sees higher inflation which would moderate to around 2.25% by year end. He said that he is watching inflation carefully and worries about excessive risk taking. Its comments like these that will fuel speculation surrounding every up and coming Fed rate decision and should help to push US yields higher into these meetings – next meeting June 16th. Gold held its ground yesterday and has recovered losses overnight, continuing to test the 1800.00 area as resistance.

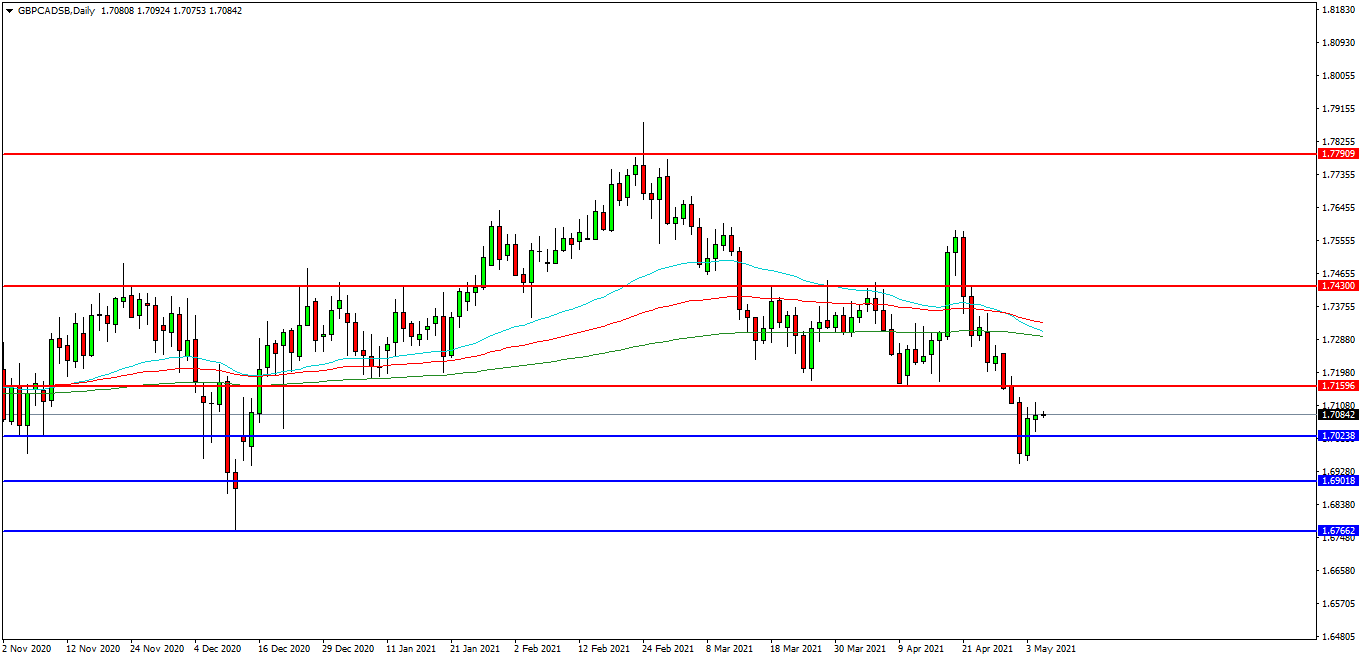

GBPCAD

The GBPCAD FX pair is moving higher after it found support to start the month at 1.6950. Price tested support at 1.7000 last week and is now trading at 1.7084. Price fell through the EDMAs around 1.7300 and sold off. A confirmed breakout above 1.7160 may open the way to initial resistance at the 1.7200 area. The 1.7250 level may provide a target along the way to the 1.7300 area. Alternatively a move back down under the 1.7000 zone may find initial support at 1.6950. The 1.6900 area may be used as support followed by further supports at 1.6825 and 1.6766.

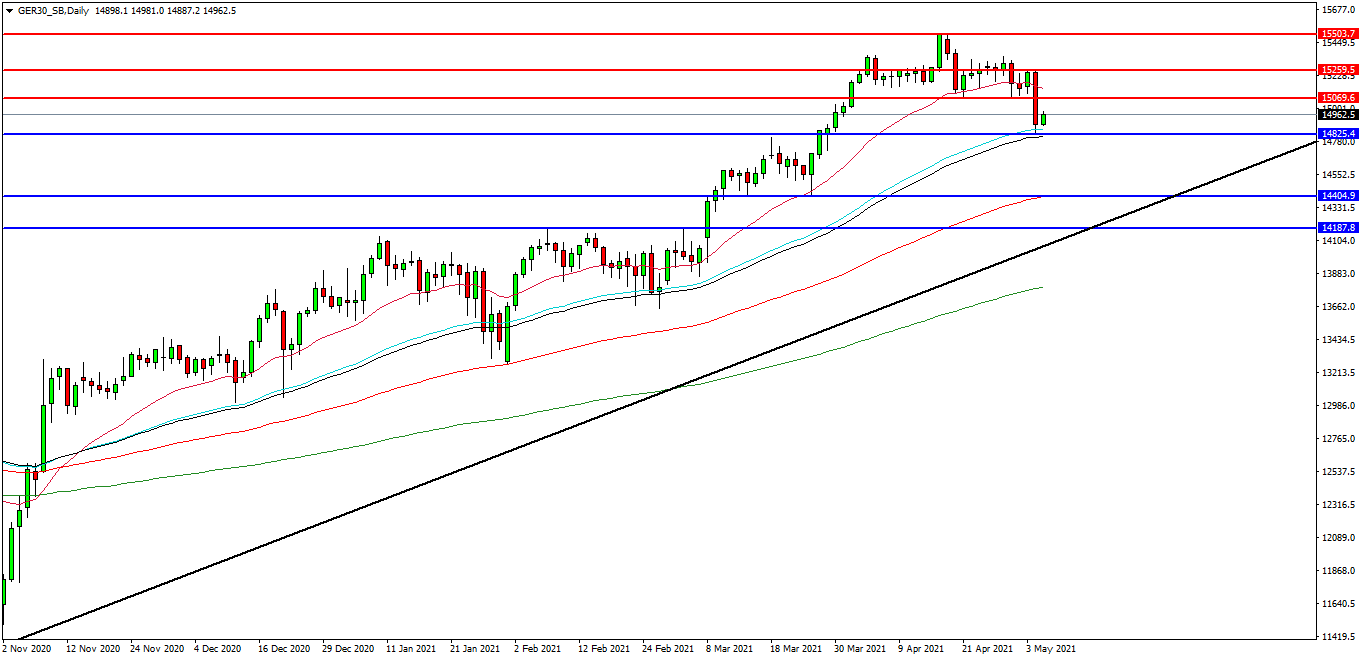

GERMAN 30 INDEX

The German 30 Index created a high at 15500.00 last month and this is now the area that traders are seeking to break. The market has failed to get back to this level and it may act as resistance. The market sold off yesterday but found support around its 50 EDMA. Price pulled back to the 15830.00 area and found support. Price is attempting to build on this support and at present 14900.00 looks like a potential area followed by the 14880.00 level. A move higher from the current level may target resistances at the 15000.00 area and 15260.00. Beyond this level, 15300.00 may offer resistance followed by the 15500.00 level. Alternatively, a move back below 14770.00 may signal a test on the support at 14500.00. Below this level the 14400.00 area may be used as support along with the 14190.00 level. A run below this support may quickly target the 14080.00 followed by 14000.00.

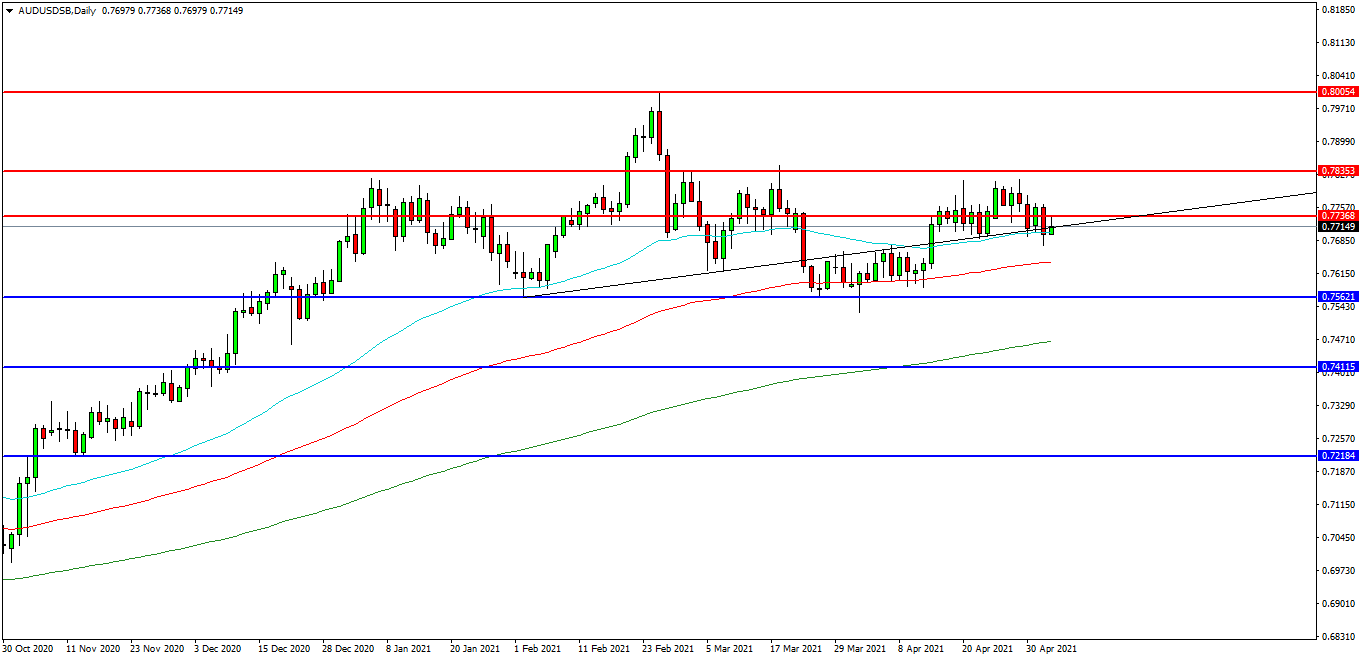

AUDUSD

The AUDUSD chart is showing how the pair has consolidated over recent weeks and is now trading at 0.7715 and testing resistance at 0.7816. The 0.7835 level is expected to act as resistance and 0.7650 area is the initial support area. The pair may find resistance at the 0.7850 area on a break higher. A continued move higher may find more resistance around the 0.7900 level followed by the 0.8000 area. Alternatively a move back down under 0.7625 may find supports at 0.7600 and 0.7560. A loss of this level may extend the control of sellers and possibly open the way to a test on 0.7500. Below this level the 0.7470 area may play its part as support ultimately followed by 0.7400.