3Sigma Markets – Mid Week Macro Report June 9th 2021

The G7 meeting over the weekend reached an agreement to implement a 15% minimum corporate tax rate. The proposal will now be brought up at the next G20 meeting. However the UK is one of a number of countries that are calling for an exemption for financial services. UK Chancellor Sunak is seeking an exemption for the City of London to remain at the current rate. Elsewhere in the UK Bank of England Chief Economist Andy Haldane said that the BOE may need to start turning off the stimulus tap. He added that the UK economy is going “gangbusters” at the moment. He said that the country needs to keep up the momentum in getting people back to work and keep spending demand in the economy strong. He said that in maintaining this strength some pay rises may be needed and they are already seeing pressure on prices. He said that the bank could start tightening the tap on QE and could ultimately start turning QE around as it would be bad to become too dependent on monetary medicine. Markets are trading in relatively small ranges in Equities, commodities, FX and Bonds. Bitcoin fell yesterday but is trading back higher overnight. In the US, Infrastructure talks have stalled as President Biden departs for his trip to Europe. Inflation is expected to rise across the globe and traders will be watching the Bank of Canada later to see if there is any mention of increasing prices in their statement later today. We then of course have the ECB tomorrow, who should play a different tune from that of the Bank of Canada and more recently, as highlighted above, the Bank of England, as Lagarde steers the ECB with her usual dovish mantra. Tomorrow’s presser from the ECB will coincide with one of the most highly anticipated inflation releases from the US at 1.30 pm BST. Following on from last month’s mega number the markets are await another large release to kick start most asset classes that have fallen into tight ranges of late. Tomorrow inflation figure out of the US will be very significant and should dictate, along with the Fed on 16th June how markets trade over the summer and into the all-important Jackson Hole meeting in Aug.

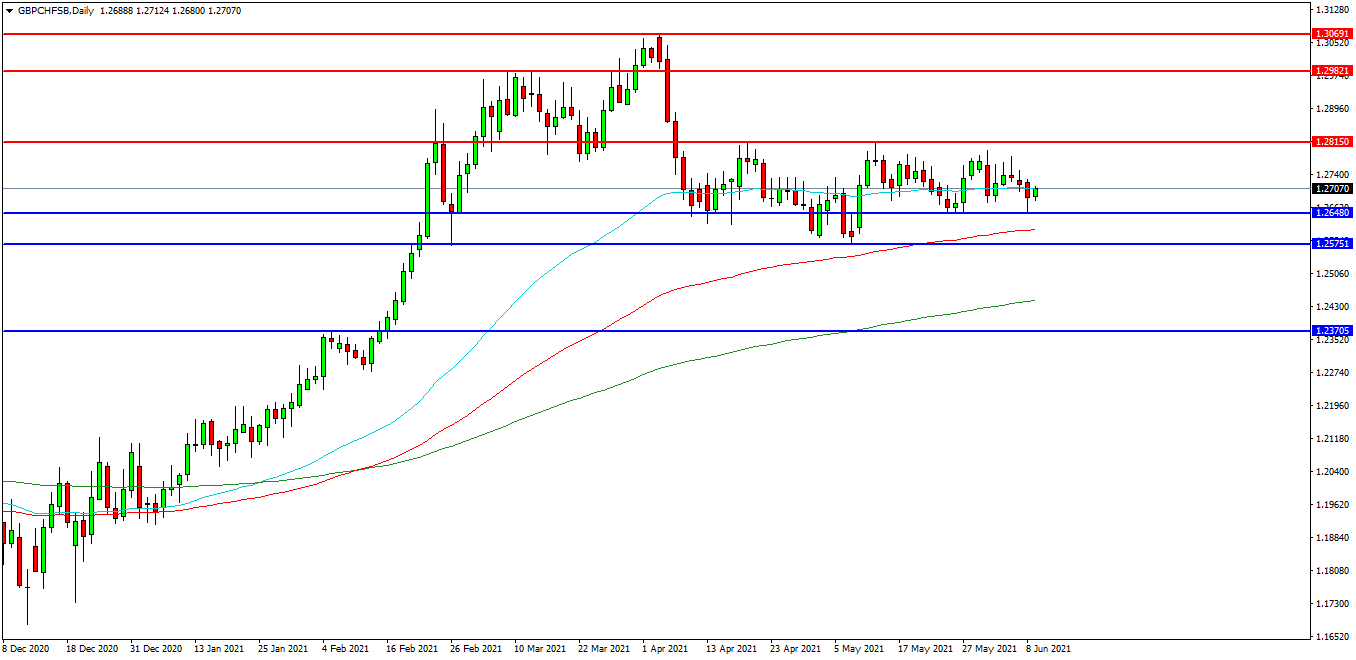

GBPCHF

The GBPCHF FX pair is trading at its 50 EDMA at 1.2707 once again as the market consolidates since the April high. Price tested support at the 1.2648 level last week. The pair is now trading at 1.2707. Price is using the 1.2800 area as resistance. A confirmed breakout above 1.2700 may open the way to initial resistance at the 1.2745 area. The 1.2900 previous support area may provide a target along the way to the 1.2980 area. Alternatively a move back down under the 1.2600 zone may find initial support at 1.2575. The 1.2500 area may be used as support followed by further supports at 1.2430 and 1.2370.

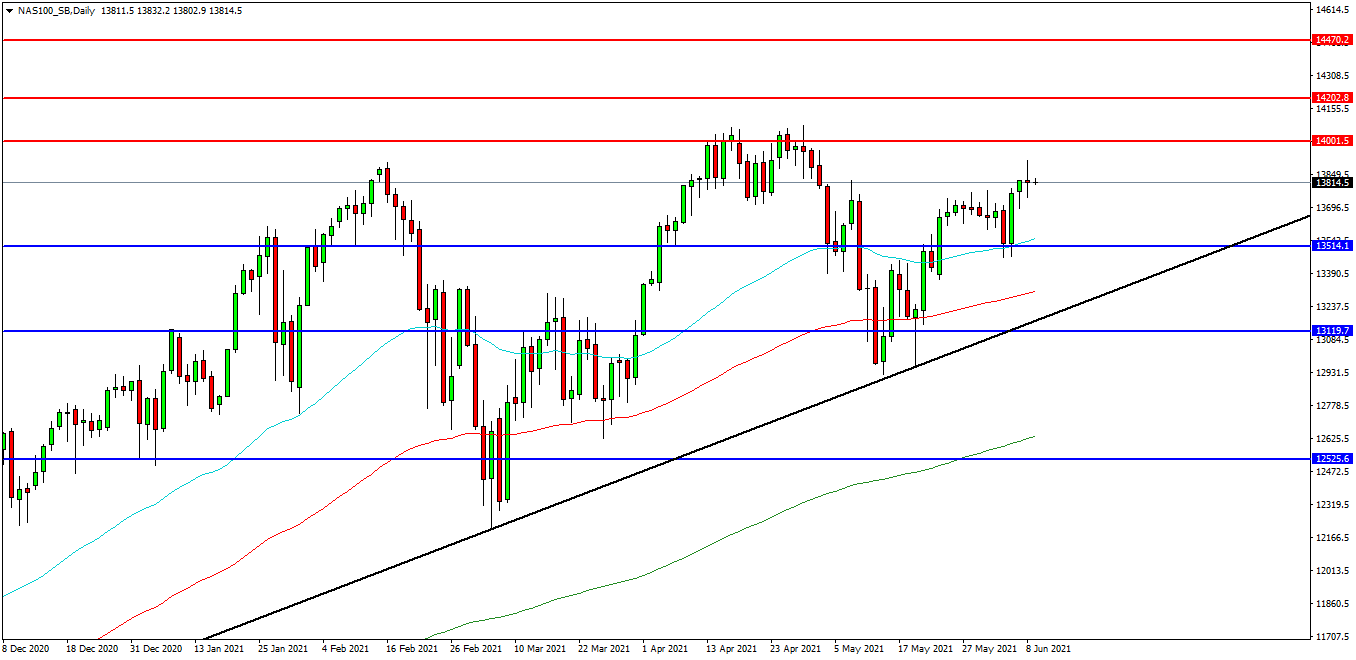

NAS 100 INDEX

The NAS 100 Index created a lower high at 13915.00 yesterday and is now testing the 13814.00 area as support. If the market fails and breaks below this level, it may result in another move down to test 13650.00 followed by the 50EDMA around 13550.00. The market sold off from resistance yesterday but found support on the 13800.00 overnight. Price is attempting to build on support and at present 13700.00 looks like a potential area followed by the 13600.00 level as support. A move higher from the current level may target resistances at the 13900.00 area and 14000.00. Beyond this level, 14080.00 may offer resistance followed by the 14200.00 level. Alternatively, a move back below 13500.00 may signal a test on the support at 13300.00. Below this level the 13120.00 area may be used as support along with the 13080.00 level. A run below this support may quickly target the 13000.00 followed by 12920.00.

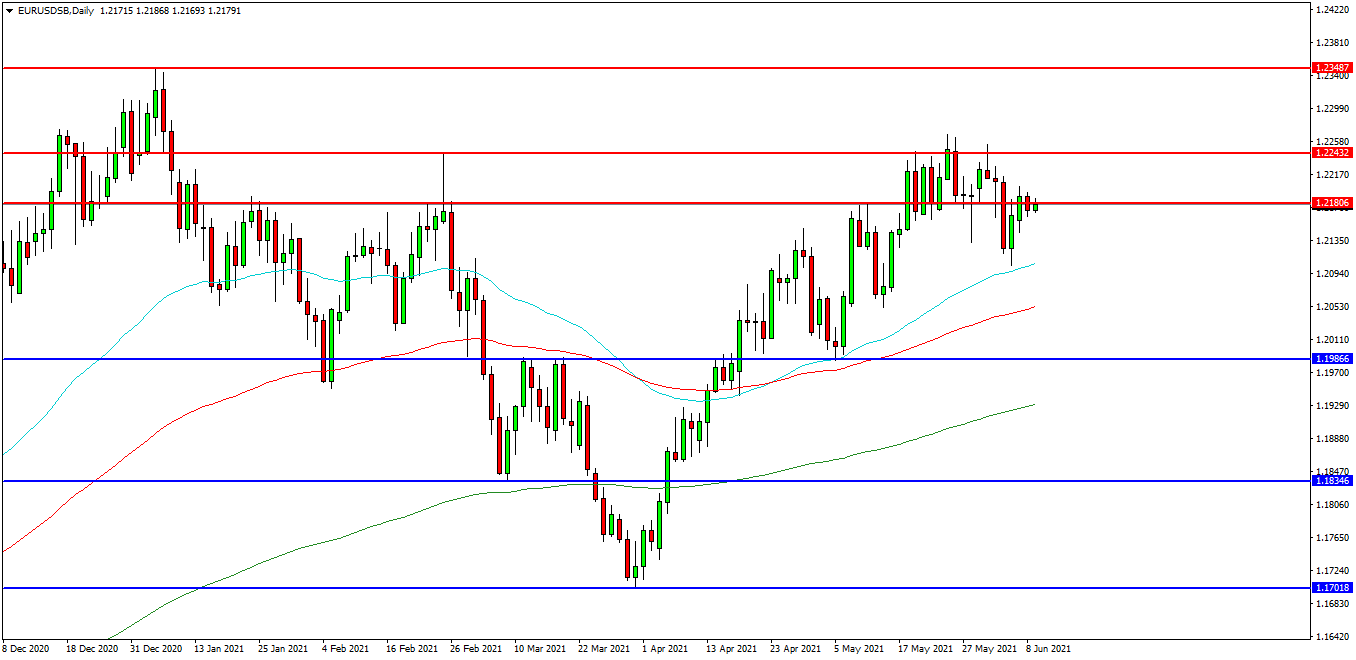

EURUSD

The EURUSD chart is showing how the pair has consolidated over recent days and is now trading at 1.2180. The 1.2220 level is expected to act as resistance and the 1.2100 area is the initial support area. The pair may find resistance at the 1.2200 area and the 1.2243 level on a break higher. A continued move higher may find more resistance around the 1.2260 level followed by the 1.2280 area. Alternatively a move back down under the 50 EDMA at 1.2100 may find supports between 1.2050 and 1.2030. A loss of this level may extend the control of sellers and possibly open the way to a test on 1.2000. Below this level the 1.9860 area may play its part as support and the 200EDMA at 1.1930.