3Sigma Markets – Mid Week Macro Report June 16th 2021

The markets will be focussed on the main event this week as the FOMC meets to decide on the direction of monetary policy this evening – decision released at 7.00pm BST, with Fed Chair Powell’s press conference at 7.30 pm BST. The market is expecting a relatively dovish FOMC and this may manifest itself as the FOMC continuing to reassure the market that inflation is transitory. However inflation is continuing to increase despite the FOMCs views that it will dissipate once the supply bottle necks are reduced. In fact these bottlenecks are expected to worsen over the summer and into next year and consumer and corporate demand outstrips supply. The unintended consequence of shutting down the economy to deal with Covid has led to rising inflation and an addiction to monetary and fiscal stimulus. With fiscal stimulus set to continue and even increase, the market is focussed on any hint that monetary policy will be tapered, which may lead to a decline in risk taking sentiment and a unwind of positions. The challenge of the FOMC is how to taper policy without crashing the markets, in particularly the stock markets. The FOMC is focussed on employment and is less concerned with inflation but arguably inflation should be its primary concern. The inflation narrative is slowly coming back into focus for the committee and the dot plot releases today may show that the FOMC will shift towards tightening next year. With the economy recovering and the vaccination programme accelerating it could be the perfect time to broach the issue of tapering monetary policy. The market’s reaction to this will be a key driver of sentiment over the summer. As mentioned above the market is putting a low probability on the subject of tapering and reducing stimulus, as can been seen by the fresh highs made in both the Nasdaq and the S+P 500 this week and the fact that US 10 Year Yields are now below 1.50%. It appears from now that the Fed’s message that inflation will be transitory is finally getting through to the majority of market participants – all eyes this evening’s risk event.

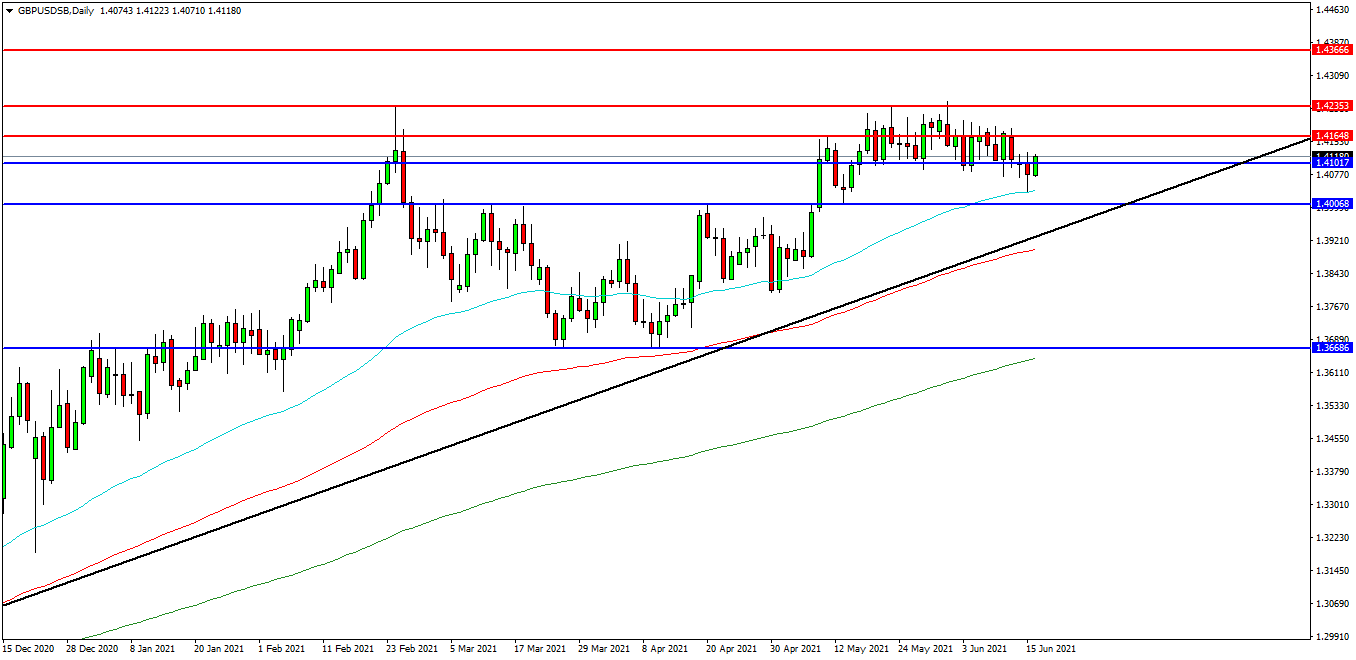

GBPUSD

The GBPUSD FX pair bounced from its 50 EDMA at 1.4038 yesterday as the market consolidates. Price tested resistance at the 1.4235 level last week. The pair is now trading at 1.4118. Price is using the 1.4200 area as resistance. A confirmed breakout above 1.4235 may open the way to initial resistance at the 1.4255 area. The 1.4300 area may provide a target along the way to the 1.4366 area. Alternatively a move back down under the 1.4100 zone may find initial support at 1.4035. The 1.4000 area may be used as support followed by further supports at 1.3920 and 1.3870.

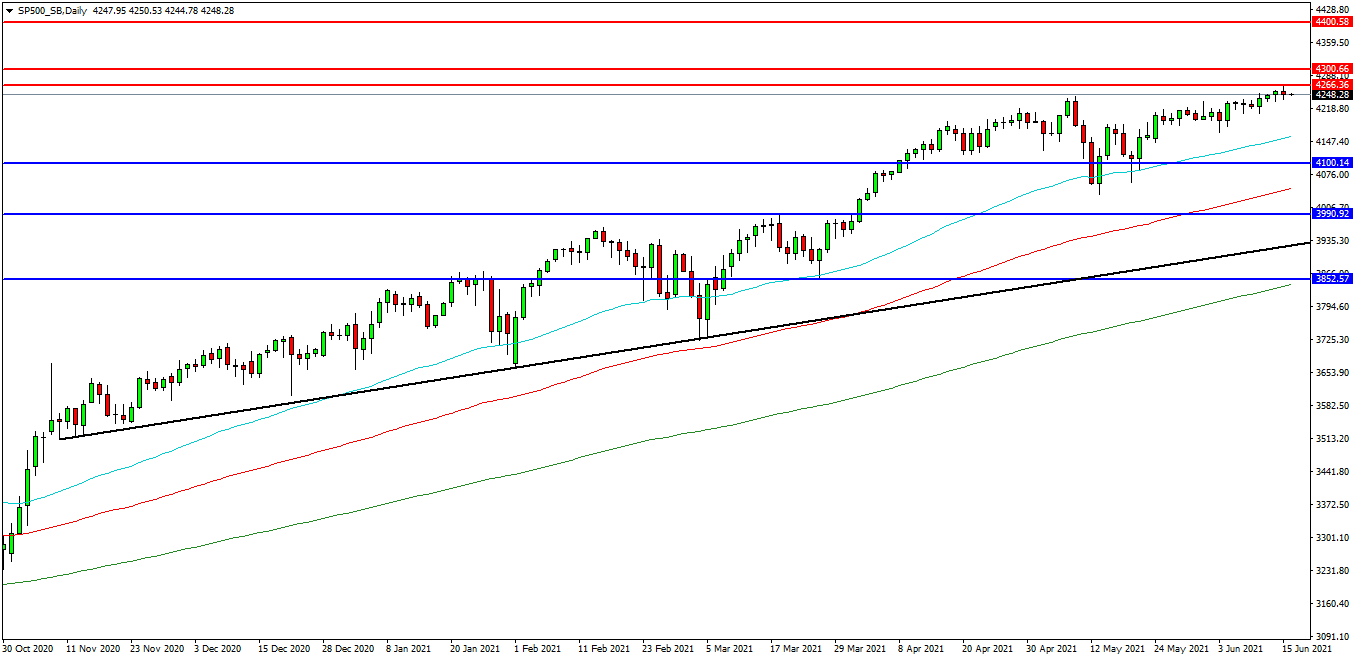

SP 500 INDEX

The SP 500 Index created a new high at 4267.00 yesterday and is now testing the 4250.00 area as support. If the market fails and breaks below this level, it may result in another move down to test 4220.00 or even 4180.00 followed by the 50EDMA around 4157.00. The market sold off from resistance yesterday but found support on the 4247.00 overnight. Price is attempting to build on support and at present 4240.00 looks like a potential area followed by the 4230.00 level as support. A move higher from the current level may target resistances at the 4260.00 area and 4267.00. Beyond this level, 4280.00 may offer resistance followed by the 4300.00 level. Alternatively, a move back below 4220.00 may signal a test on the support at 4200.00. Below this level the 4150.00 area may be used as support along with the 4130.00 level. A run below this support may quickly target the 4100.00 followed by 4046.00.

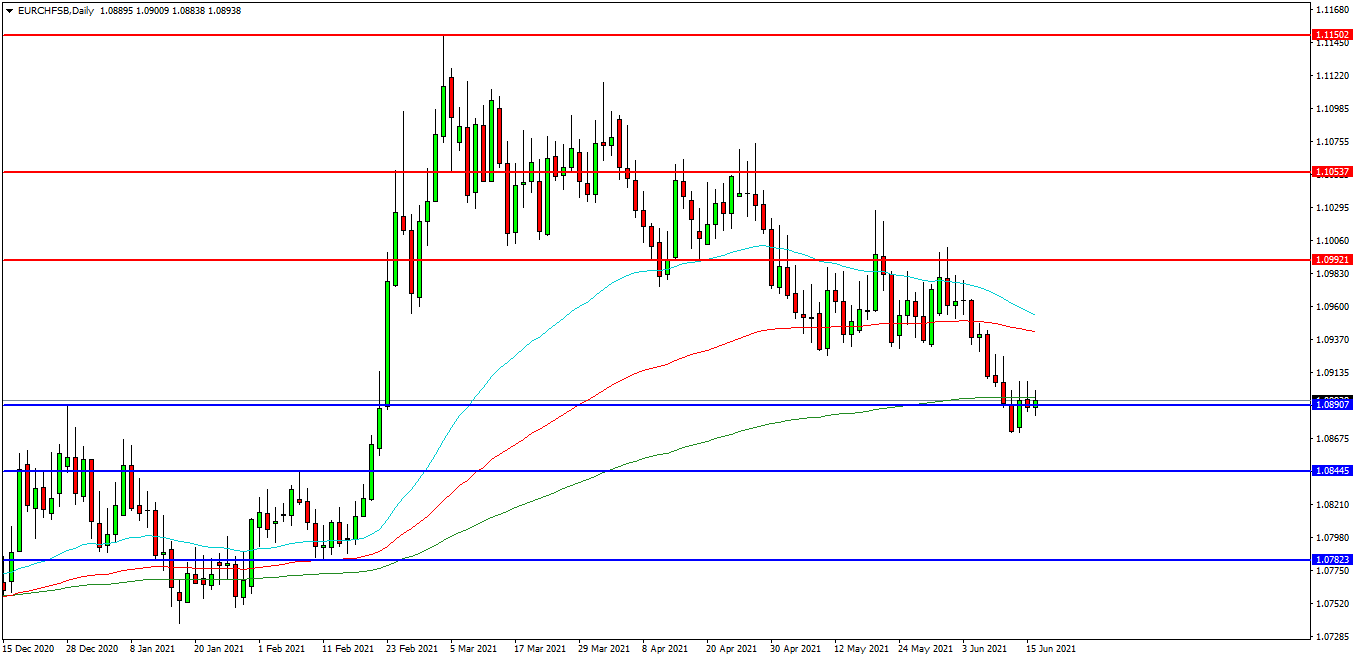

EURCHF

The EURCHF chart is showing how the pair has declined over recent days and is now trading at 1.0890. The 1.0940 level is expected to act as resistance and the 1.0860 area is the initial support area. The pair may find resistance at the 1.0960 area and the 1.0990 level on a break higher. A continued move higher may find more resistance around the 1.1000 level followed by the 1.1020 area. Alternatively a move back down under the 200 EDMA at 1.0890 may find supports between 1.0850 and 1.0845. A loss of this level may extend the control of sellers and possibly open the way to a test on 1.0800. Below this level the 1.0782 area may play its part as support and the 1.0740 area.