3Sigma Markets – Mid Week Macro Report April 7th 2021

The seasonally strong month of April has begun in fine form for stocks with new all time highs reached in the US and Europe. Hopes of a sustained vaccine rollout and ample stimulus have pushed the market firmly into risk on mode. The reopening of the economy in the US is proceeding at pace and this was confirmed by the strong Non-Farm Payrolls number on Good Friday. Worries about inflation are being brushed aside by the markets at present but there is a growing concern that prices in the US are rising due to the large amounts of cash printed to stimulate the economy. The effect of this is being felt in an increase in the cost of food and consumer demand has driven under supply in houses in many areas to the point where the housing market is running hot. Auto sales in the US are also experiencing consumer demand while supply is curtailed from production shutdowns and the semiconductor chip shortage. The FOMC meeting minutes will be released later today and this should give traders and investors a greater insight into the FEDs thinking on the economy and stimulus. It is expected that the FED will cite the increase in inflation and prices as transitory. With the stronger job number also playing into the equation the FED is expected to say that they are making progress on their path to revive the economy but they will stop short of saying that they will make any sort of adjustments yet. We feel the dovish stance will remain, with the mantra of lower for longer once again rolled out to the markets, particularly given how US yields have stabilised over the past number of weeks.

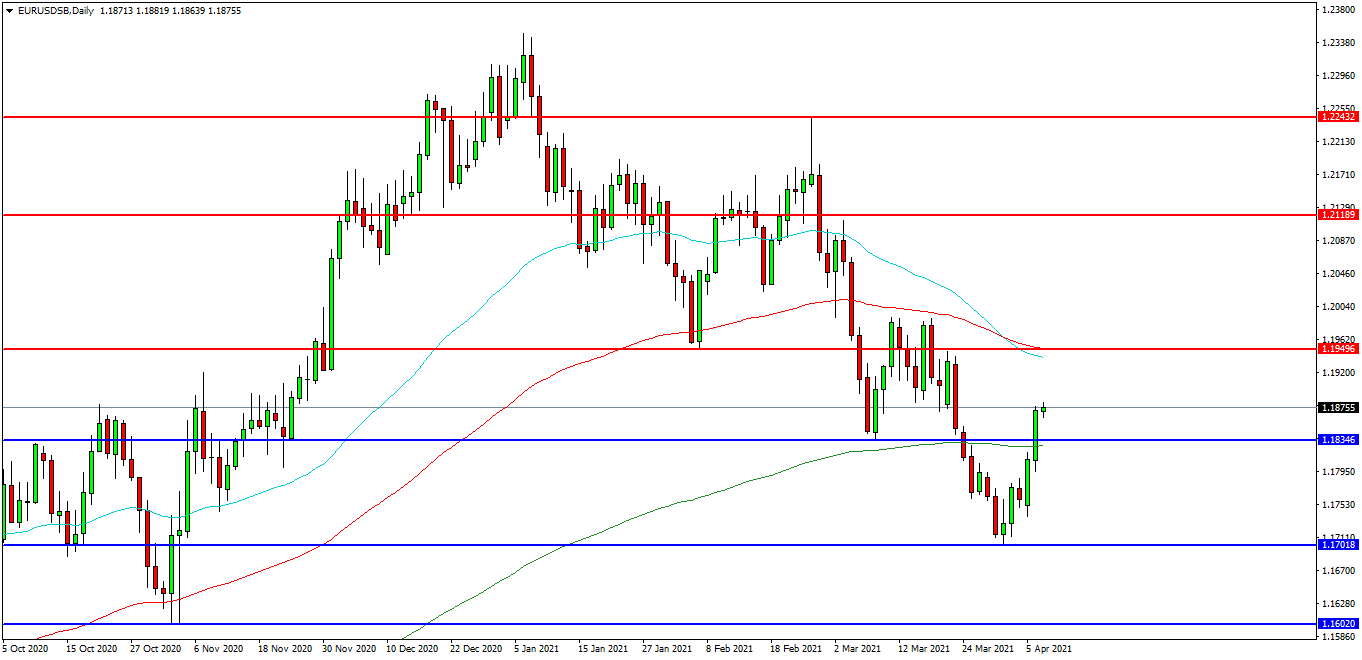

EURUSD

The EURUSD FX pair is moving back higher after making new higher low last month at 1.1700. The price has moved up to test 1.1875 as resistance today. Price has fallen back from the January high of 1.2350. Price fell under the trend line last week and is trading the 200EDMA last week but is now using it as support around 1.1827. A confirmed breakout above 1.1900 may open the way to initial resistance at the 1.1950 area where the 50 and 100 EDMA’s are located. The 1.2000 level may provide a target along the way to the 1.2100 area. Alternatively a move back down under the 1.1800 zone may find initial support at 1.1750. The 1.1700 area may be used as support followed by further supports at 1.1600 and 1.1570.

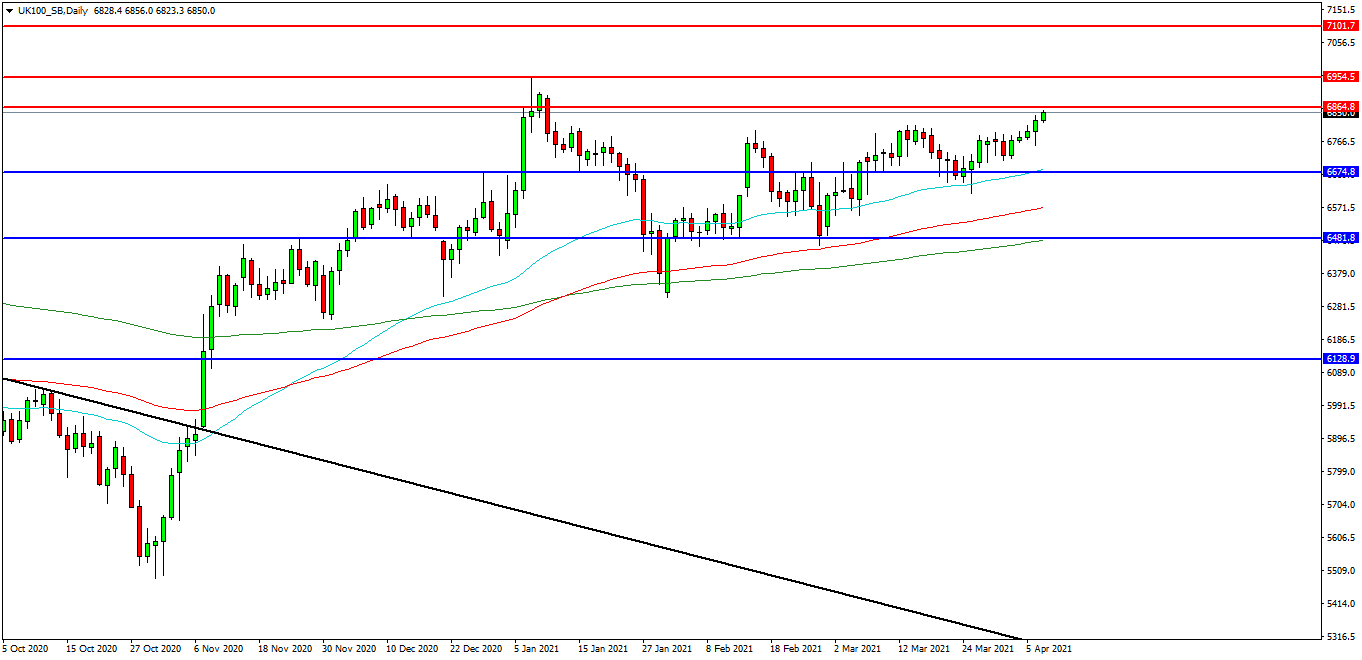

UK 100 Index

The UK 100 Index created a high at 6954.00 in January and this is now the area that traders are seeking to retest. The market is testing the 6850.00 level as resistance and looking to break higher. Price is attempting to find resistance and at present 6865.00 looks like a potential area followed by the 6900.00 level. A move higher from the current level may target resistances at the high followed by the 7000.00 area. Beyond this level, 7050.00 may offer resistance followed by the 7100.00 level. Alternatively, a move back below 6675.00 may signal a test on the support at 6570.00. Below this level the 6480.00 area may be used as support along with the 6400.00 level. A run below this support may quickly target the 6300.00 followed by 6128.00.

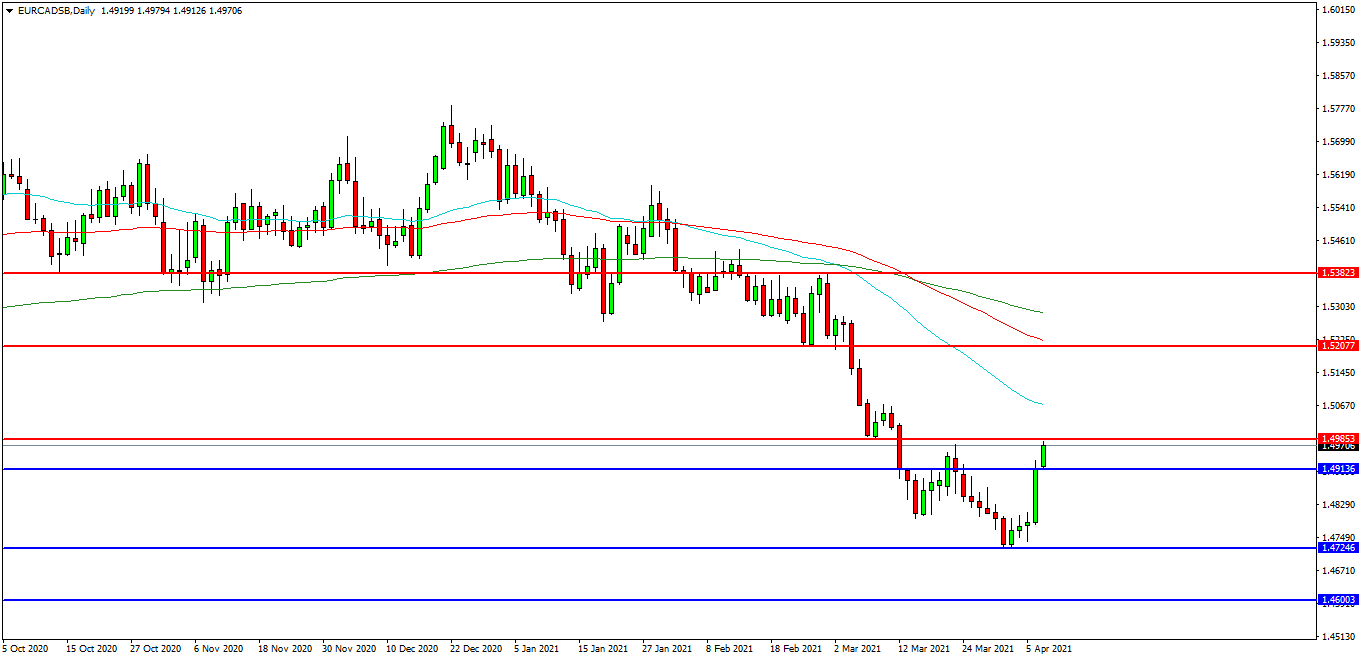

EURCAD

The EURCAD chart is showing how the pair has weakened considerably in recent weeks and is now trading at 1.4970 and is testing resistance at 1.5000. The 1.5060 level is expected to act as resistance and 1.4913 area is the initial support area. The pair may find resistance at 50 EDMA at 1.5070 followed by the 1.5200 area. A continued move higher may find more resistance around the 1.5300 level followed by the 1.5380 area. Alternatively a move back down under 1.4900 may find initial supports at 1.4820 and 1.4725. A loss of this level may extend the control of sellers and possibly open the way to a test on 1.4680. Below this level the 1.4600 area may play its part as support ultimately followed by 1.4550.