3Sigma Markets – Mid Week Macro Report April 14th 2021

The seasonally strong month of April continues to perform well for stocks with new all time highs again reached in the US and Europe – the Nasdaq leading an incredible charge here, as the US rates market stabilises and highly anticipated IPO of Coinbase this afternoon hits the market. This has obviously feed into the crypto space. It’s a very big day for crypto assets with the Nasdaq listing of the cryptocurrency exchange being priced at $250 a share – propelling founders Brian Armstrong and Fred Ehrsam into the multibillionaires club. Coinbase bumper float make it ”more valuable than Goldman Sachs ”Not bad for Fred Ehrsam who started his career as a GS FX trader in NY.

Despite the problems encountered with the rollout of vaccines due to blood clots associated with the AstraZeneca and the Johnson and Johnson vaccines investors and traders are brushing those fears aside for the moment. The reality of the wave of stimulus feeding into markets is keeping prices elevated and demand is growing as the global economies continue to reopen. The rise in cases of the virus in Asia is causing concern but is not yet impacting prices. Cases in the country are rapidly increasing as a new variant of Covid is responsible for over half of cases. The variant know as B.1.617 has a double mutation of its spike protein making it more infectious and delaying the body’s antibody reaction to the virus. Japan is also experiencing a rise in cases as it looking like a second wave of the virus is hitting the country. The Japanese 225 has traded lower as a result. Elsewhere Bitcoin has traded above $64,000 as it breaks to new all time highs. Earning season has also begun with investors focussing more on the forward guidance that will be given by corporations for the quarters ahead. Earnings in general are expected to beat estimates but negative future guidance has the potential to stop the risk on rally in its tracks.

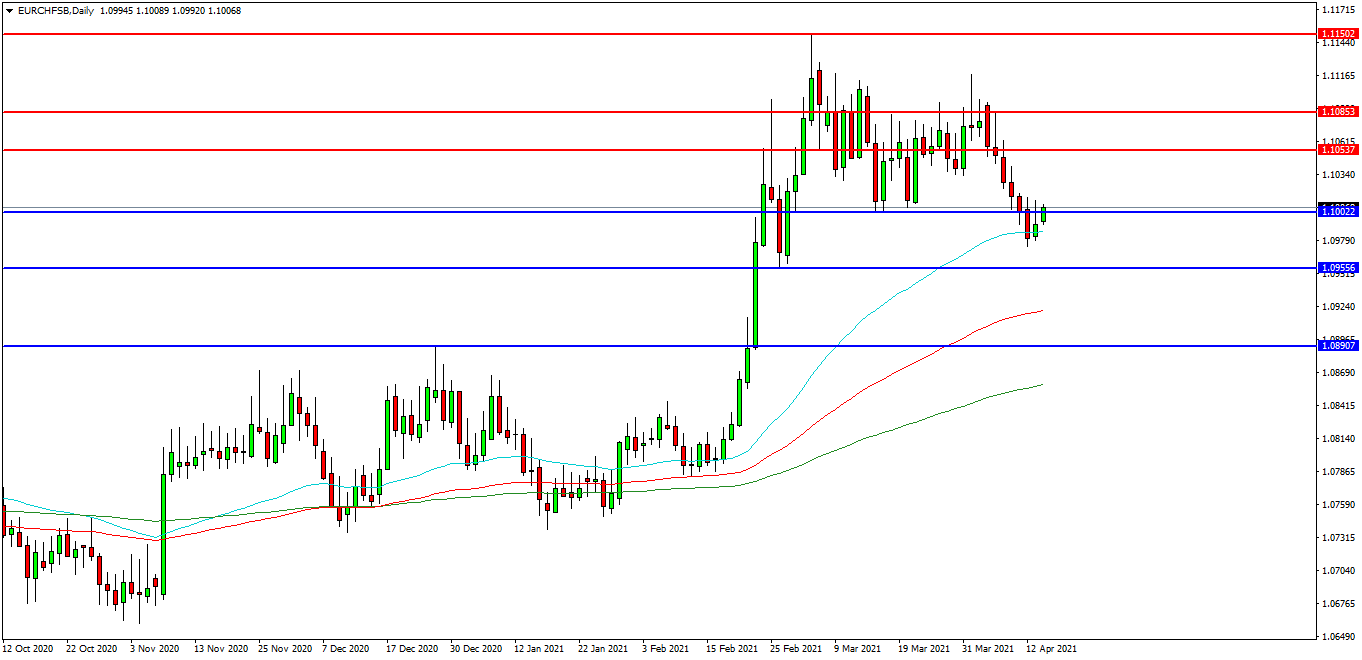

EURCHF

The EURCHF FX pair is moving back higher after making new higher low last month at 1.1000. The price has moved up to test this as resistance today. Price has fallen back from the lower high of 1.1117. Price fell under the higher low last week and tested the 50EDMA but is now using it as support around 1.0986. A confirmed breakout above 1.1030 may open the way to initial resistance at the 1.1050 area. The 1.1085 level may provide a target along the way to the 1.1100 area. Alternatively a move back down under the 1.1000 zone may find initial support at 1.0955. The 1.0900 area may be used as support followed by further supports at 1.0890 and 1.0850.

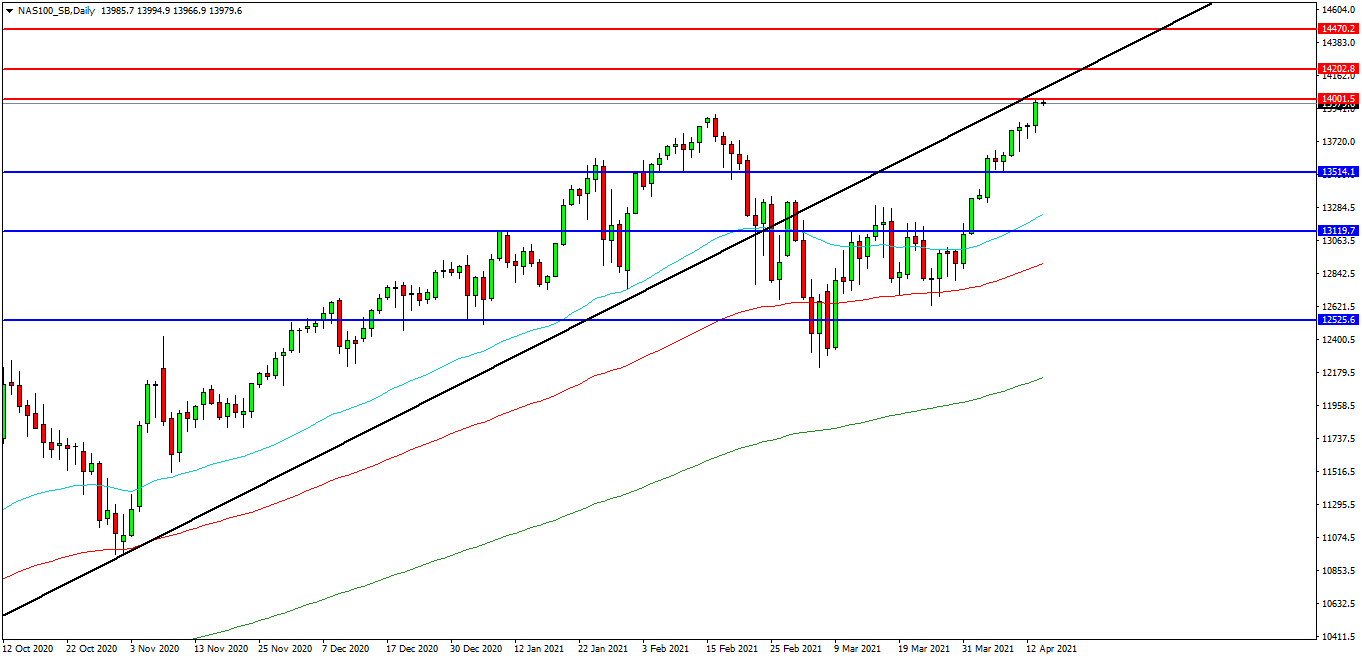

NAS 100 Index

The NAS 100 Index created a high at 14000.00 yesterday and this is now the area that traders are seeking to break. The market is testing this level as resistance and looking to break higher. Price is attempting to find resistance and at present 14080.00 on the rising trend line looks like a potential area followed by the 14200.00 level. A move higher from the current level may target resistances at the high followed by the 14275.00 area. Beyond this level, 14400.00 may offer resistance followed by the 14470.00 level. Alternatively, a move back below 13900.00 may signal a test on the support at 13780.00. Below this level the 13500.00 area may be used as support along with the 13400.00 level. A run below this support may quickly target the 13240.00 followed by 13120.00.

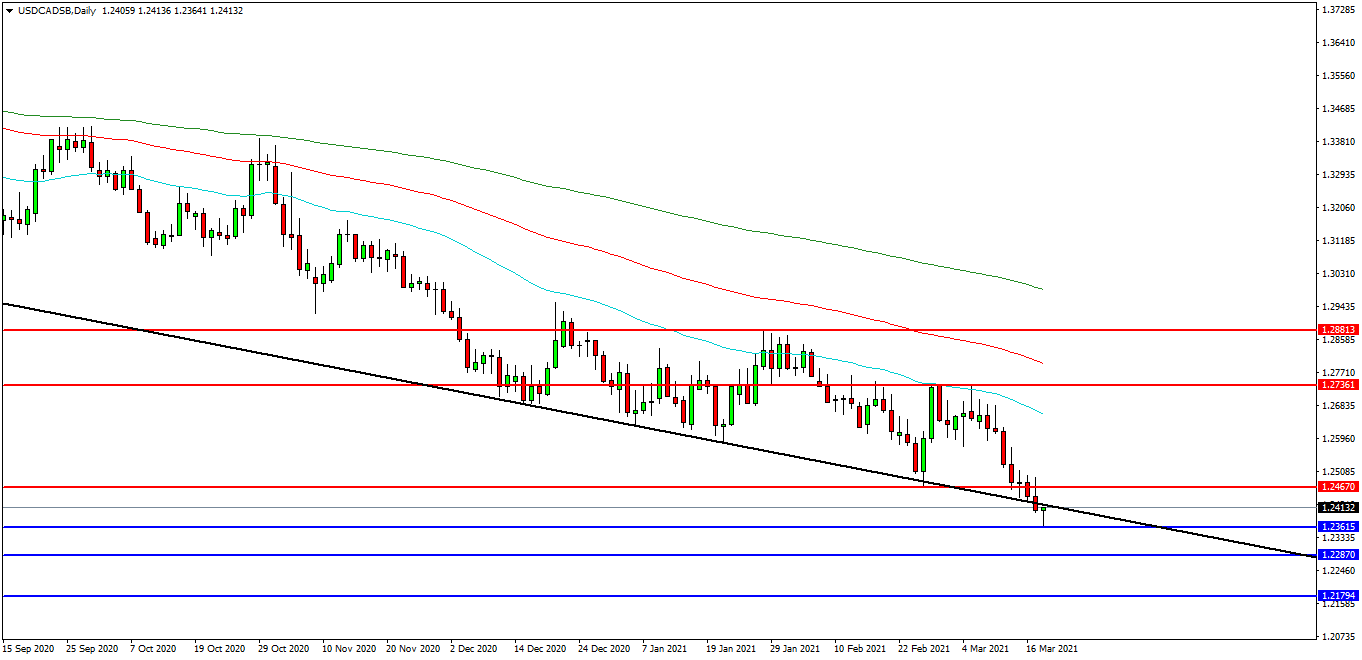

USDCAD

The USDCAD chart is showing how the pair has weakened considerably in recent weeks and is now trading at 1.2413 and is testing resistance at 1.2420 trend line. The 1.2467 level is expected to act as resistance and 1.2400 area is the initial support area. The pair may find resistance at 1.2588 or the 50 EDMA at 1.2658 followed by the 1.2736 area. A continued move higher may find more resistance around the 1.2800 level followed by the 1.2880 area. Alternatively a move back down under 1.2360 may find initial supports at 1.2300 and 1.2287. A loss of this level may extend the control of sellers and possibly open the way to a test on 1.2200. Below this level the 1.2180 area may play its part as support ultimately followed by 1.2150.