The last week of trading has seen market volatility remain elevated as 10-Year US Treasury yields trade above 1.5%. This has caused a reassessment of the narrative and money managers are repositioning portfolios to adapt to the new environment – the reflation trade for 2021. The moves in commodities, FX and stocks have also taken centre stage and traders are finding opportunities across all assets including crypto-currencies. The emerging theme here is high yields, potential lower stocks (if yields rally significantly) and a stronger Dollar. Last Friday’s US Non-Farm Payrolls data release saw an increase to 379K against the expected 197K from the previous months 49K which was revised up to 166K. The Unemployment Rate fell to 6.2% from 6.3%. Markets took a risk on view of the data and in the mean time the US 30 Index (Dow Jones) and the German 30 Index ( Dax) have pushed to new all-time highs – we have a tradable high in the US 30 Index at 32,150 – double top. Commodities have continued their recent trends, however Oil is slightly off its highs as wqe type – one to watch. The passing of the US Stimulus package through the Senate over the weekend also helped boost confidence and give sentiment a bullish tilt. The landmark package is expected to be voted through the House of Representatives later today. It will then proceed to the President’s office for signature into law. The revised Bill includes $1400 cheques for households, a weekly top-up of $300 in federal unemployment benefits and an expansion of tax credits for children. There is also $350B in aid for state and local governments. Treasury Secretary Yellen said yesterday that “if we do our job, I am confident that Americans will make it to the other side of this pandemic — and be met there by some measure of prosperity,” she said. “[It] will finally allow us to do what most of us came to government for — not simply to fight fires and resolve crises, but to build a better country.” There is now talk that President Biden is planning to put together a $7T economic and infrastructure package to transform the US. We get US inflation figures this afternoon and the US 10 year bond auction – both will be watched closely and how yields are effected. We also have the Bank of Canada rate decision today – where the consensus is calling for no change in policy.

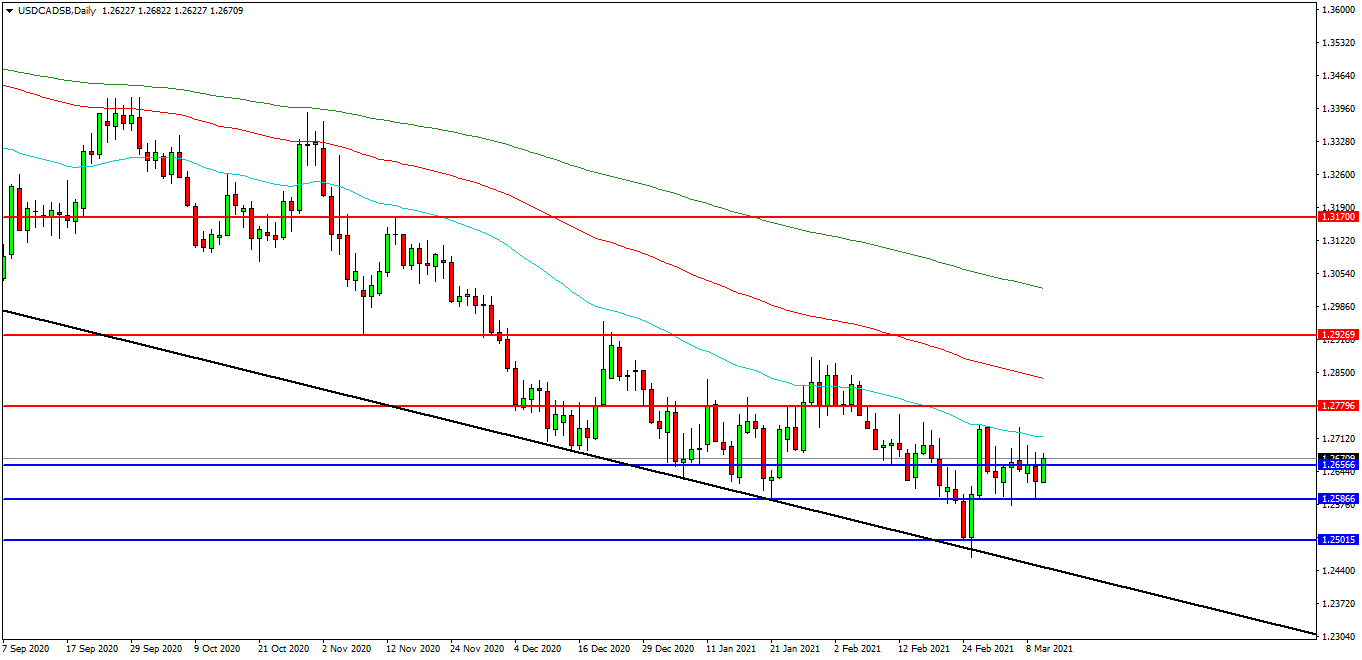

USDCAD

The USDCAD FX pair is consolidating after a false breakdown on the trend line last month. The price has moved up to test 1.2740 and the 50 EDMA as resistance. Price has fallen back and found support at 1.2586 and is now trading at 1.2670. A confirmed breakout above this area may open the way to initial resistance at 1.2780 followed by the 1.2850 area. The 1.2927 level may provide a target along the way back to the high at the 1.3000 area. Alternatively a move back down under the 1.2650 zone may find initial support at 1.2600. The 1.2600 round number area has been used as support in recent days and may be of importance. The 1.2586 area is of great importance as a higher low. Further supports may be seen at 1.2500 and 1.2460.

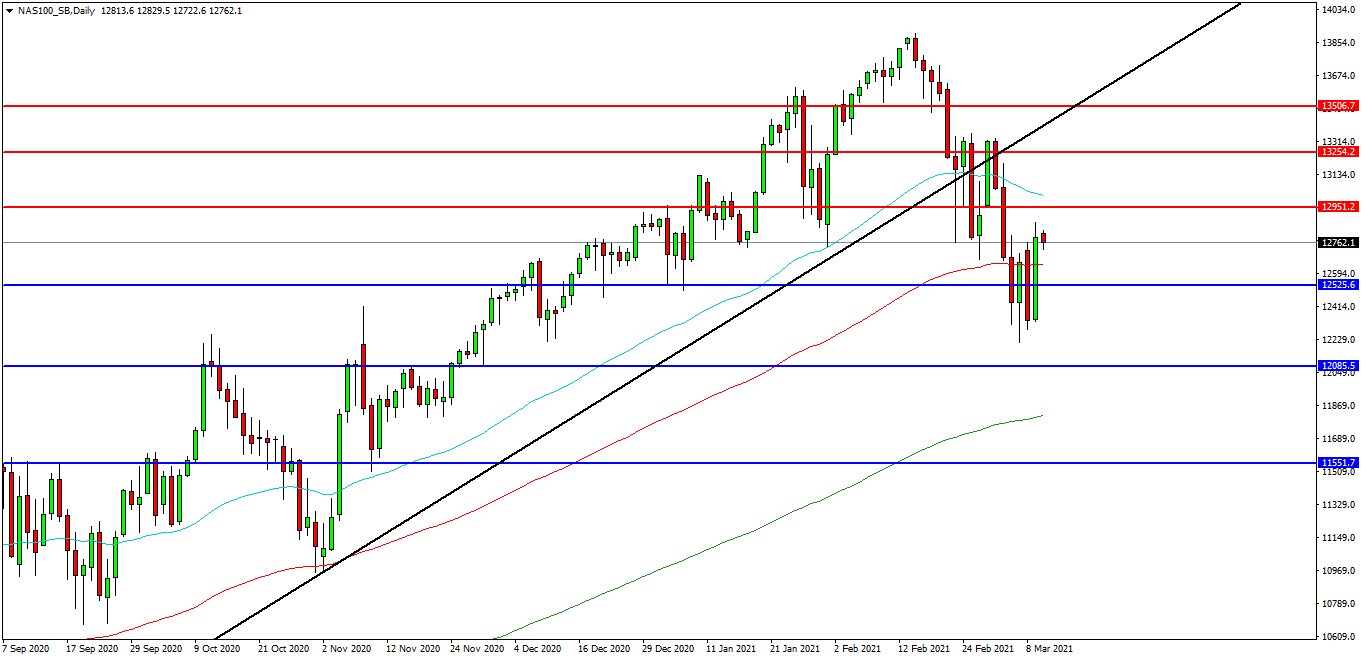

NAS 100 Index

The NAS 100 Index has found support at 12215.00 after breaking the trend line last month. The market is testing the 12760.00 level as resistance. Price is attempting to find resistance and at present 12870.00 looks like a potential area followed by the 12950.00 level. A move higher from the current level may target resistances at the 13000.00 area where the 50 EDMA is positioned. Beyond this level, 13250.00 may offer resistance followed by trend line at 13400.00 and 13500.00 level. Alternatively, a move back below 100 EDMA at 12650.00 may signal a test on the support at 12525.00. Below this level the 12220.00 area may be used as support along with the 12085.00 level. A run below this support may quickly target the 12000.00 followed by 11815.00 as the 200EDMA.

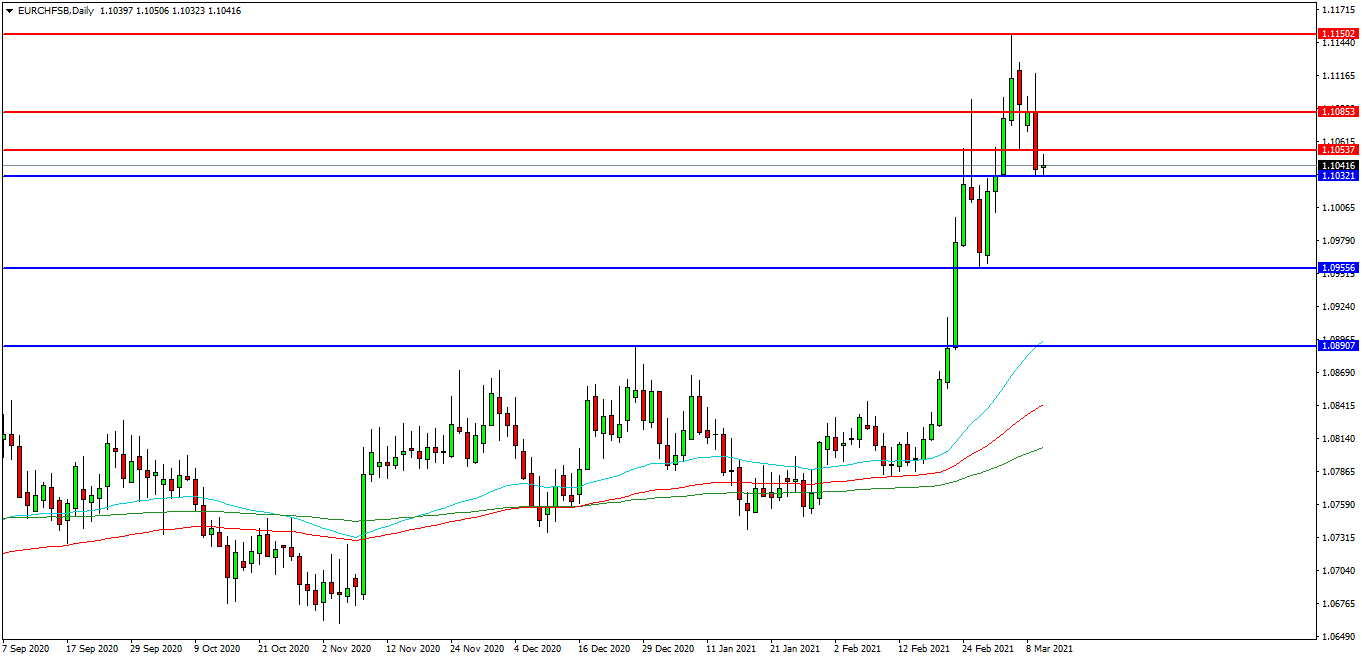

EURCHF

The EURCHF chart is showing how the pair is consolidating above the 1.1000 level and forming a low yesterday’s at 1.1032 area. The pair found support ahead of 1.1000 level. The pair has initial resistance at 1.1054 followed by the 1.1085 area. A continued move higher may find more resistance around the 1.1090 level or the 1.1100 round number followed by the high at 1.1150. Alternatively a move back down under 1.1000 may find initial supports at 1.0955 and 1.0900. A loss of this level might hand control to sellers and possibly open the way to a test on 1.0890 and the 50EDMA. Below this level the 1.0850 area may play its part as support ultimately followed by 1.0820 and the 200 EDMA.