The FED Chair Jerome Powell testified in front of the Senate Banking Committee yesterday and is expected to resume his testimony today. He said yesterday that the recovery has slowed in the US economy and that the country had not been making substantial further progress towards its goals over the past three months. He said that he expects inflation to temporarily move up on base effects. He also said that the US could be getting through the pandemic much more quickly than feared but that the job is not done yet. He said that over time the growth of the balance sheet will slow but asset purchases will continue until substantial further prioress is seen. When asked about inflation he said that if there is unwanted inflation in the future the FED have the tools to deal with it. He also said that he doesn’t see how a burst in fiscal support or spending would lead to high inflation adding that “inflation dynamics do not change on a dime”. He also said that it does not seem likely that increase in spending would lead to large or persistent inflation. He made the comment that the FED has no intention of repeating the inflation mistake of the 1970’s and that he didn’t think any uptick in inflation that’s coming in the months ahead will be large or persistent. After a dramatic selloff markets yesterday his comment gave traders and investors confidence and assets retraced most of their losses. However Asian equities have continued to selloff today and are down heavily. There has been a large selloff in Bitcoin since the high achieved over the weekend and markets are nervous in general this week.

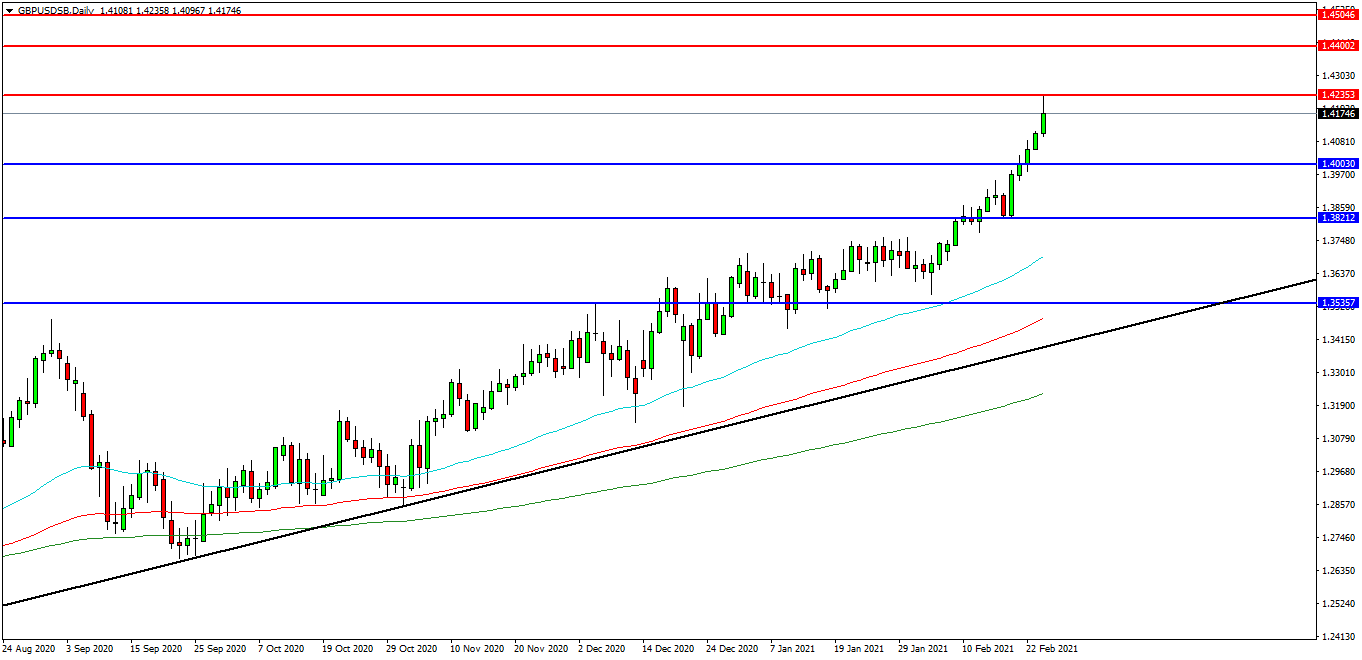

GBPUSD

The GBPUSD FX pair is making extraordinary advances after breaking the 1.4000 level. The price has shot up to test 1.4235 and has encountered a modicum of resistance. A confirmed breakout above this area may open the way to initial resistance at 1.4300 followed by the 1.4350 area. The 1.4400 level may provide a target along the way to the more ambitious 1.4500 area. Alternatively a move back down under the 1.4150/1.4100 zone may find initial support at 1.4040. The 1.4000 round number level has been used as support in recent days and may be of importance in the event of a retracement. The 1.3940 area is of great importance as a former higher high. Further supports may be seen at 1.3900 and 1.3820.

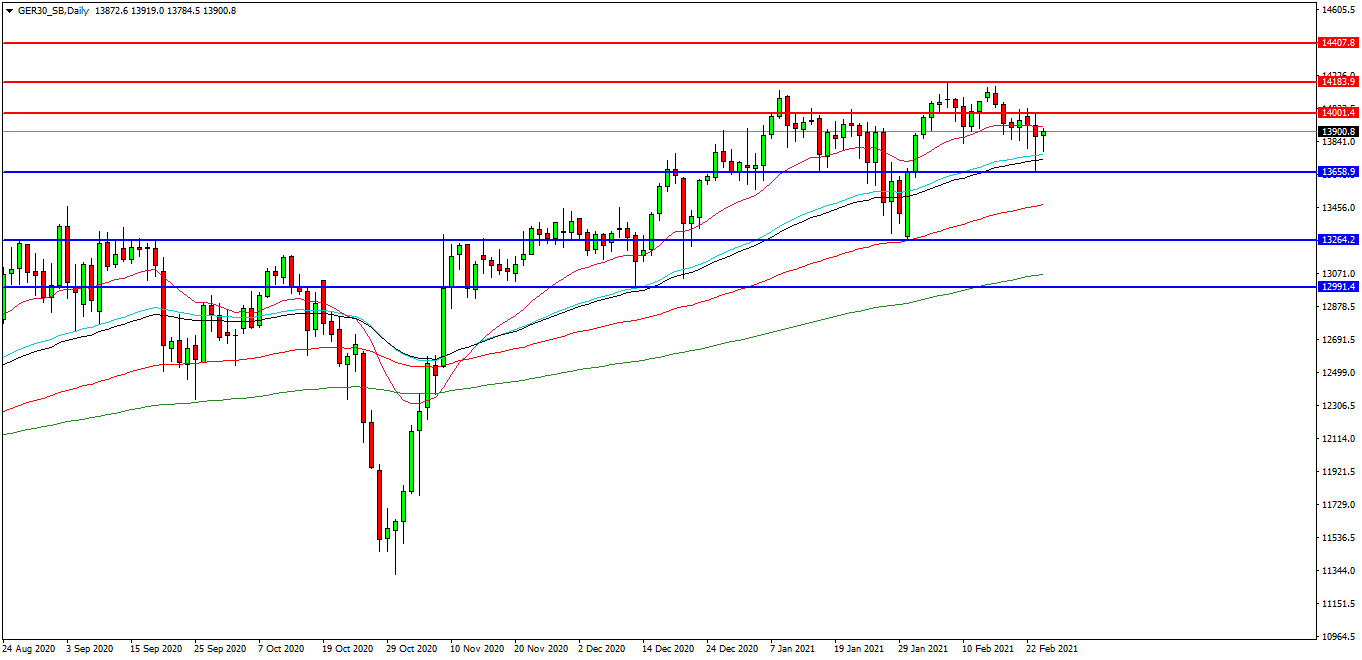

German 30 Index

The German 30 Index is consolidating its rally higher after breaking resistance around 14000.00. The market is testing the 13900.00 level as resistance after yesterday’s selloff. Price is attempting to find resistance and at present 14000.00 looks like a potential area followed by the high at 14185.00. A move higher from the current level may target resistances at the 31800.00 area. Beyond this level, 32000.00 may offer resistance followed by 14250.00 and 14400.00. Alternatively, a move back below 13650.00 may signal a test on the support at 13450.00. Below this level the 13260.00 area may be used as support along with the rising 200 DEMA. A run below this support may quickly target the 13000.00 followed by 12800.00.

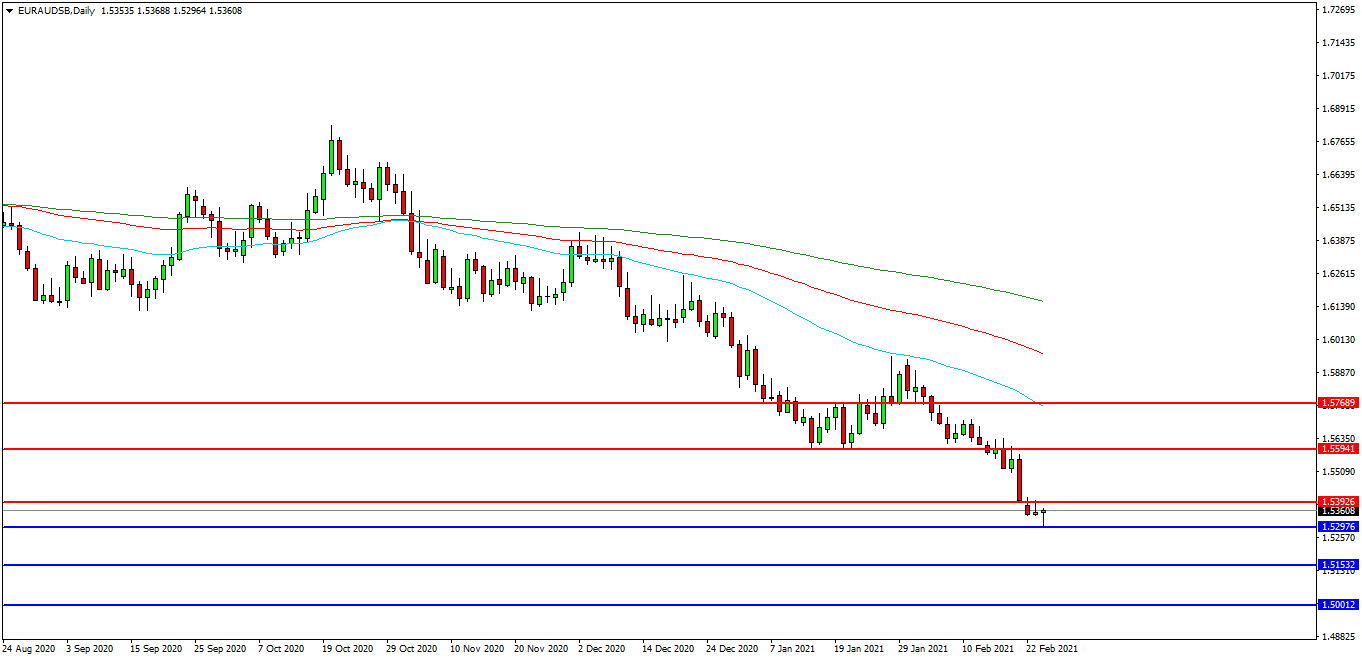

EURAUD

The EURAUD chart is showing how the pair is consolidating with a downward bias towards the 1.5300 and forming a low overnight at 1.5296 area. The pair found support ahead of 1.5300 yesterday after a fall from 1.5500 on Friday. The pair has initial resistance at 1.5393 followed by the 1.5500 area. A continued move higher may find more resistance around the 1.5590 level or the 1.5600 round number followed by the 1.5770 level and the lower high at 1.5946. Alternatively a move back down under 1.5300 may find initial supports at 1.5280 and 1.5250. A loss of this level might hand control to sellers and possibly open the way to a test on 1.5200. Below this level the 1.5150 area may play its part as support ultimately followed by 1.5000.