The markets are shifting their focus to inflation as the rise in commodity prices in recent days has created ripples. The blast of cold air across the US has exposed the weaknesses in US production and delivery of energy products. Oil production has been shut down in Texas and this has led to supply disruption at the pumps. The gas supply has been diverted to households so that the heating can remain on, but at the expense of power plants which has resulted in days of blackouts in some parts of the US. The drift higher in energy prices has been occurring since Oil prices went negative in H1 2020, with the chart showing the price forming a bull flag along the way. The leg higher that began in October has put pressure on the economy and increased the prospect of higher inflation. The market is somewhat nervous of increases in inflation and this is seen as a drag on the economy and markets. The FED’s policy of keeping rates lower for longer will come under severe pressure as inflation rises and they may have to deviate from this plan and increase rates ahead of the expected 2023 time frame. However, the Fed is likely to see the rise in energy prices as “transient” and attempt to ignore this dynamic. The issue is that the fundamentals in the Oil market in particular point to higher prices as supply is restricted. For one, OPEC is determined to reduce supply in a time where the re-opening of economies following Covid-19 lockdowns will create a higher level of demand. The supply is also being restricted as infrastructure is canceled, e.g.; the keystone pipeline. This amounts to the potential for higher inflation and the FED being forced to act ahead of time and increase rates. The result of this could have negative implications for the economy and asset prices. This 2021 reflation trade has become evident in US yield curve and we have seen 10 Year US Yields hit a 1 year high over night in Asia at 1.33%. The increase in US yields has far reaching consequences for the broader financial markets – most notably the Stock Markets.

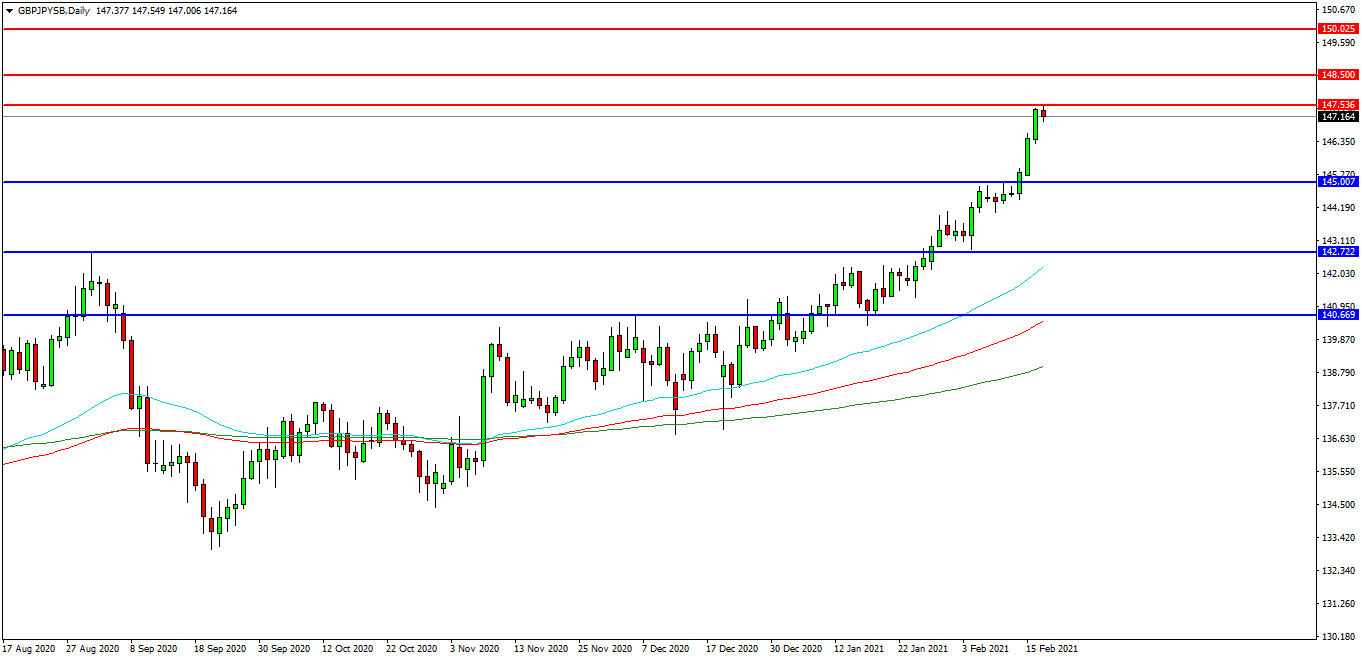

GBPJPY

The GBPJPY FX pair is making extraordinary advances after breaking the 145.000 level on Friday. The price has shot up to test 147.500 and has encountered a modicum of resistance. A confirmed breakout above this area may open the way to initial resistance at 148.000 followed by the 148.500 area. The 149.600 level may provide a target along the way to the more ambitious 150.000 area. Alternatively, a move back down under the 145.500/145.000 zone may find initial support at 144.200. The 144.000 level has been used as support in recent days and may be of importance in the event of a retracement. The 142.720 area is of great importance as the higher low and the September high. Further supports may be seen at 142.250 and 140.700.

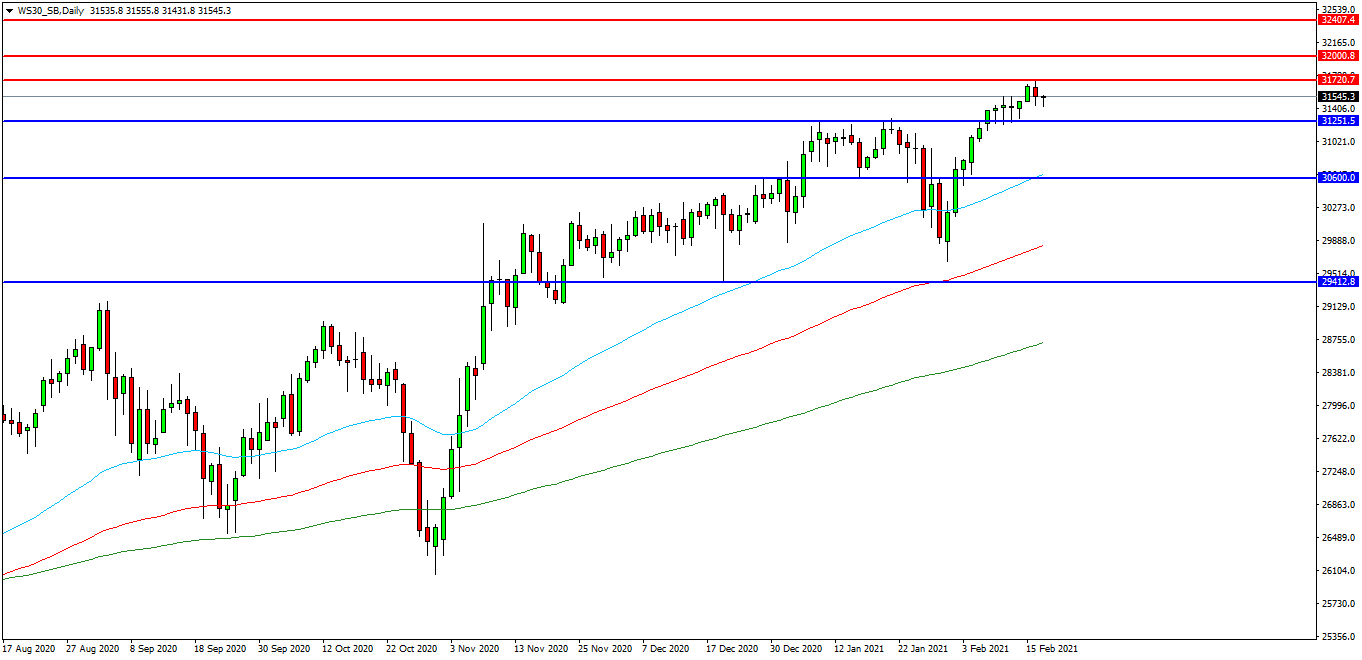

WS 30 Index

The WS 30 Index is continuing its rally higher after breaking resistance around 31250.00. The market is testing the 31720.00 level as resistance and setting daily new all time highs. Price is attempting to find resistance and a present 31550.00 looks like a potential area followed by 32000.00. A move higher from the current level may target resistances at the 31800.00 area. Beyond this level, 32000.00 may offer resistance followed by 32150.00 and 32400.00. Alternatively, a move back below 31250.00 may signal a test on the support at 31000.00. Below this level the 30600.00 area may be used as support along with the rising 50 DEMA. A run below this support may quickly target the 30000.00 followed by 29800.00.

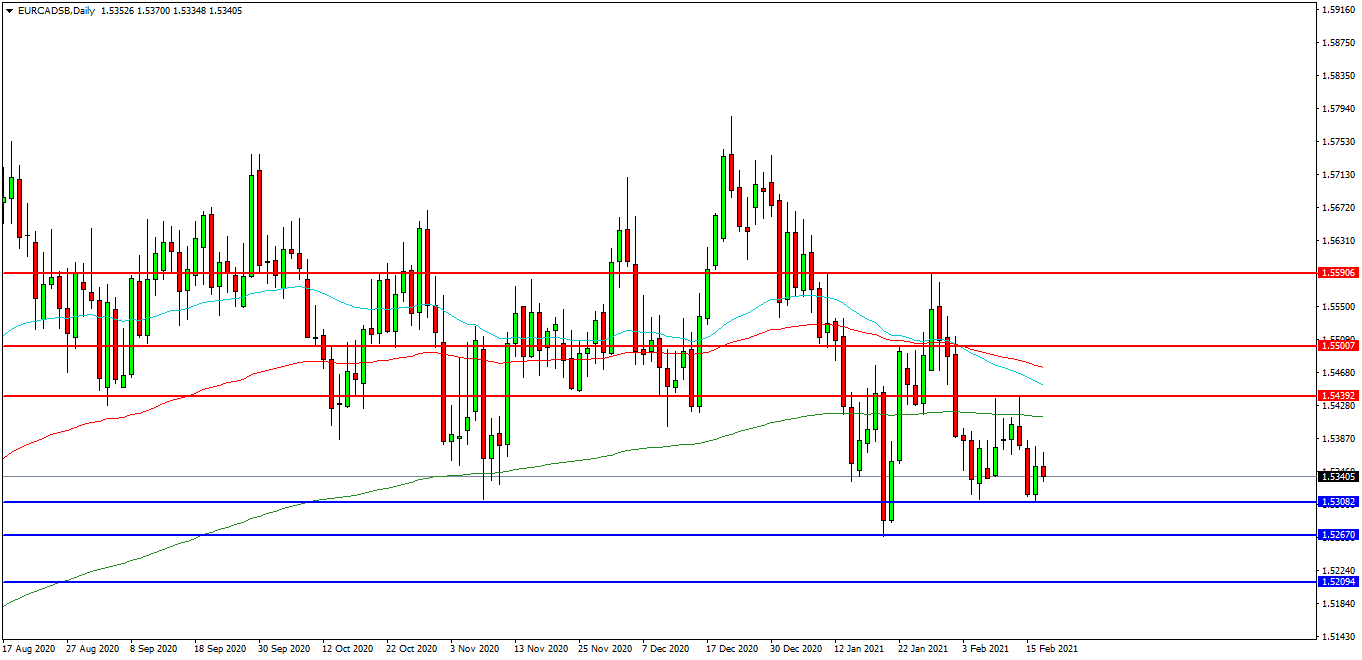

EURCAD

The EURCAD chart is showing how the pair is consolidating with a downward bias towards the 1.5300 area after breaking the support of the 200 EDMA at 1.5400 area. The pair found support at 1.5300 yesterday after a fall from 1.5384 on Monday. The pair has initial resistance at 1.5377 followed by the 1.5400 area. A continued move higher may find more resistance around the 1.5440 level or the 1.5500 round number followed by the 1.5540 level and the lower high at 1.5590. Alternatively, a move back down under 1.5300 may find initial support at 1.5267 and 1.5250. A loss of this level might hand control to sellers and possibly open the way to a retest on 1.5200. Below this level the 1.5174 area may play its part as support.