The release of US Non-Farm Payrolls data on Friday drew the attention of the market that was looking for a gauge on the performance of the US economy. The economic data is showing that the recovery is extremely fragile and the prospect of inflation is skewing the economic outlook for many analysts. The headline NFP report showed that there were 49K jobs created against the expected 85K, but an improvement on the previous -140K. However the previous number was also revised lower to -227K leaving a huge gap in the work force. The unemployment rate fell to 6.3% from 6.7% as more and more workers drop out of the labour force. Part of this drop is due to the large cohort of workers that are reaching retirement age and part is due to the unemployed not being able or wanting to find work. The Average Hourly Earnings fell to 0.2% against a forecast of 0.3% and a prior 0.8% which was revised up to 1.0%, showing that in the previous month, it was lower paid workers who bore the brunt of layoffs. Tomorrow liquidity is expected to contract with the arrival of the Chinese Lunar New Year Holiday which will run for a week – the year of the Ox. At present equity markets are reaching out to new all time highs and the risk on rally is continuing. But there are trends developing in the Bond, FX and commodity markets that may draw attention away from assets. Bonds in particular are in play at present and the moves in the USD are having a far reaching impact. Today it is all about the inflation figures released out of the US. US CPI is expected to show a slight drop in the index to 0.3% from a prior month at 0.4%. A stronger print here however would certainly grab the markets attention and we believe could have an out-sized impact –commodity prices certainly pointing to a higher print sooner rather than later. US 10 Year Yields through 1.20% – the Dollar should rally and with Stock Markets on their highs – we could see a significant move lower here – as we say all about that inflation figure at 1.30 pm

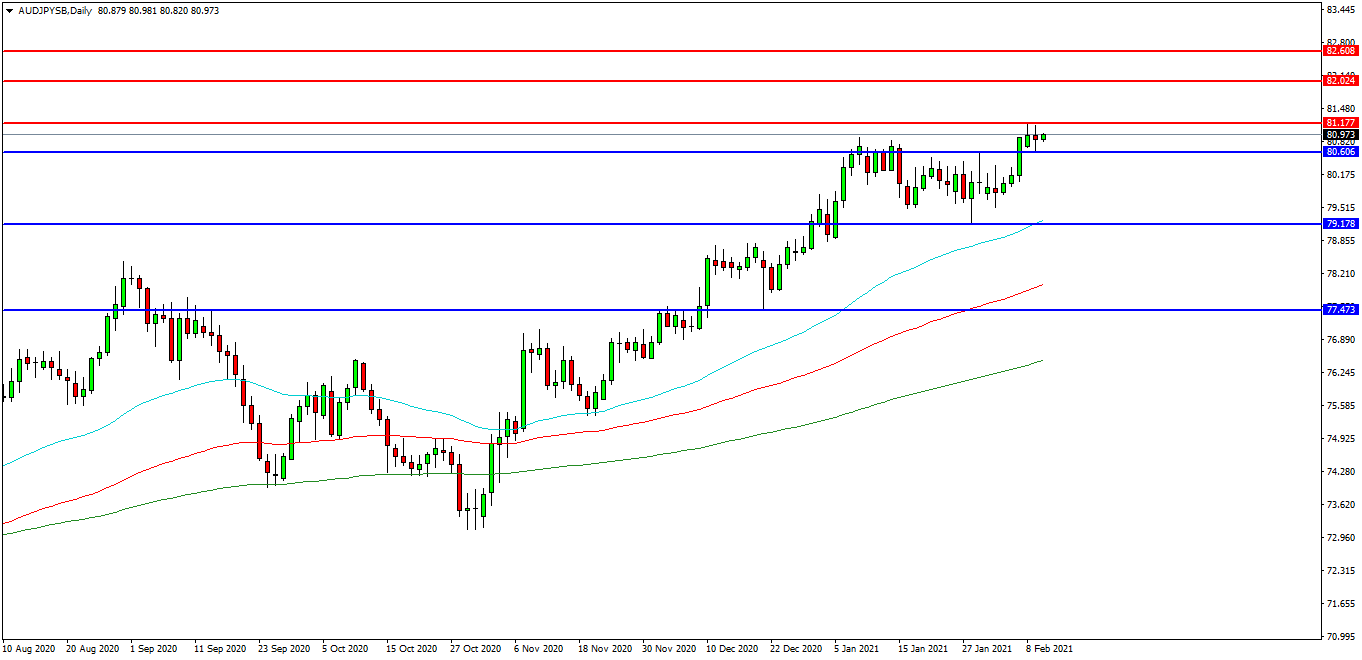

AUDJPY

The AUDJPY FX pair is moving higher after breaking past the important 80.000 level last month. The pair is testing the 81.000 level at present and bouncing off the resistance at 81.177. A confirmed breakout above this area may open the way to initial resistance at 81.500 followed by the 82.000 area. The 82.600 level may provide a target along the way to the more ambitious 83.000 area. Alternatively a move back down under the 80.500/80.000 zone may find initial support at 79.200 and the rising 50 EDMA. The 79.180 level has been used as support in recent days. The 79.200 area is of great importance as the higher low and further supports may be seen at low of 77.475 and 76.500.

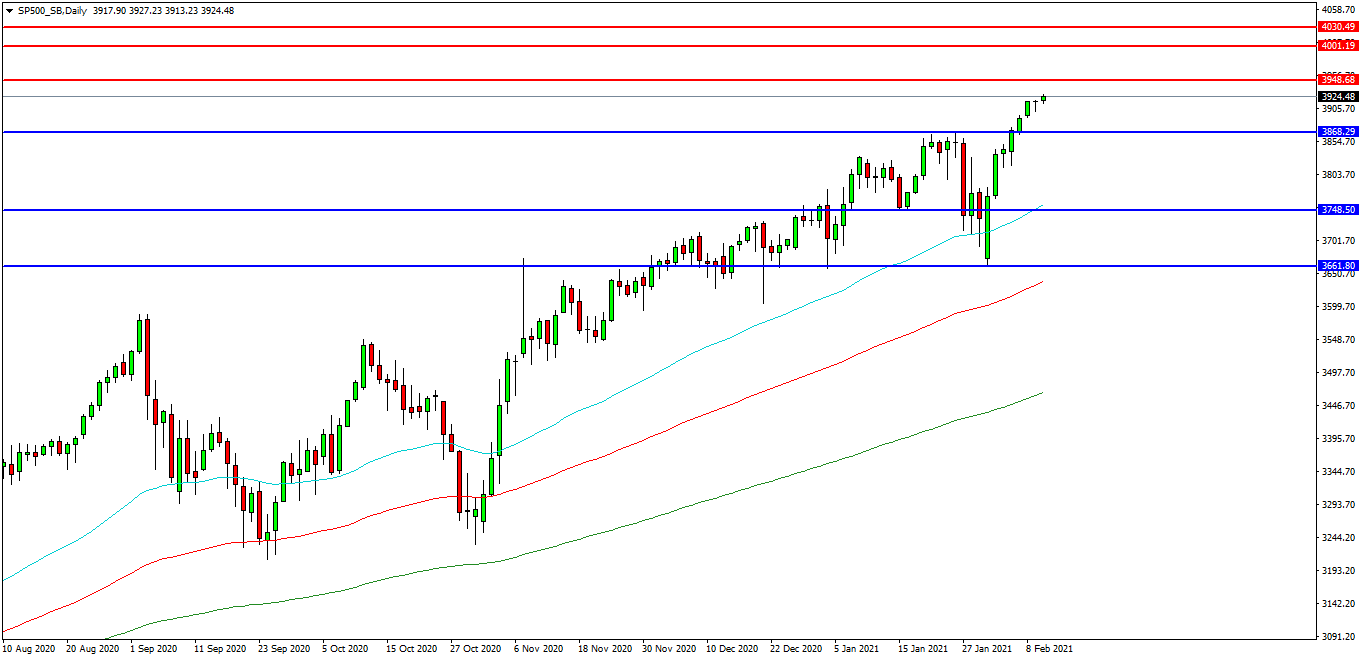

US 500 Index

The US 500 Index is continuing its rally higher albeit with less vigour than last week. The market is testing the 3925.00 level and setting daily new all time highs. Price is attempting to find resistance and a present 3940.00 looks like a potential area followed by 3950.00. A move higher from the current level may target resistances at the 4000.00 area. Beyond this level, 4030.00 will offer resistance followed by 4050.00 and 4080.00. Alternatively, a move back below 3900.00 may signal a test on the support at 3868.00. Below this level the 3750.00 area may be used as support along with the rising 50 DEMA. A run below this support may quickly target the 3661.00 followed by 3600.00 – these could all come into play on a higher CPI print out of the US today.

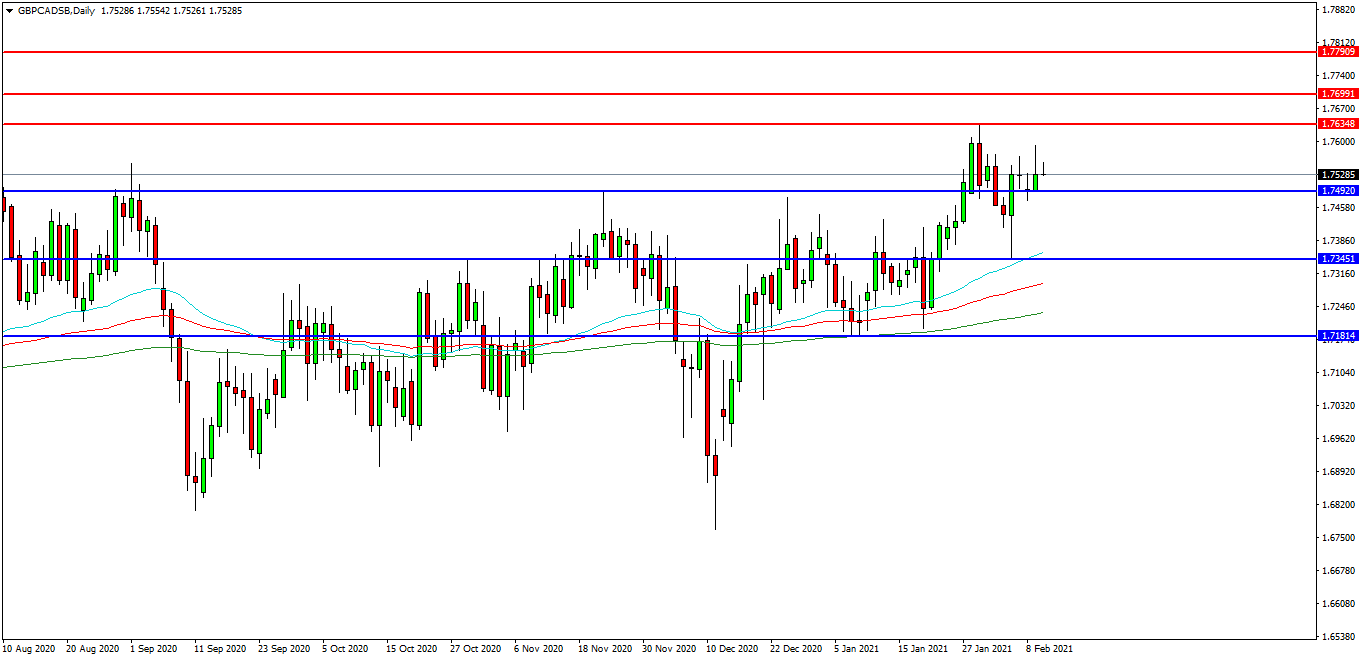

GBPCAD

The GBPCAD chart is showing how the pair is consolidating with a upward bias towards the 1.7700 area after breaking the resistance at 1.7500. The pair found support at 1.7490 yesterday after a fall to 1.7473 on Monday. The pair has initial resistance at 1.7589 followed by the 1.7600 area. A continued move higher may find more resistance around the1.7635 level or the 1.7700 round number followed by the 1.7790 level and the high at 1.7800. Alternatively a move back down under 1.7400 may find initial support at 1.7360 as the 50DEMA and 1.7345. A loss of this level might hand control to sellers and possibly open the way to a retest on 1.7200, as the breakout area. Below this level the 1.7000 area may play its part as support.