Markets are taking part in a mild Santa Clause rally this holiday week. Markets rallied after the UK and EU agreed a deal to avoid a hard Brexit. Again there was good news as the vaccines began to be rolled out across Europe this week. And there was also a glimmer of hope in the US as President Trump signed the stimulus deal agreed by Republicans and Democrats. Then the President tweeted that the cheques to households should be increased from $600 to $2000. Democrats jumped at the opportunity, immediately supporting the idea and drafting legislation to put to the House. The bill was quickly passed and with the support of 44 House Republicans. But Senate Republicans and Senate Majority Leader, Republican Mitch McConnell blocked and attempt to by Minority Leader Chuck Schumer to force a vote on the cheques in the relief bill. The Democrats in the Senate are joined by enough Republicans to potentially pass the bill but until a vote is held it remains in limbo – US stock markets sold off their highs on this yesterday – but the selling pressure was mild. The markets are also drawn to news concerning Covid-19 with strong increases in cases across the world. The rollout of vaccines in beginning to gather pace and added this is the breaking news that the UK regulator has approved the AstraZeneca vaccine today – sterling has seen a decent rally. These headlines have prompted markets to remain on a positive footing or at least consolidate in their current ranges.

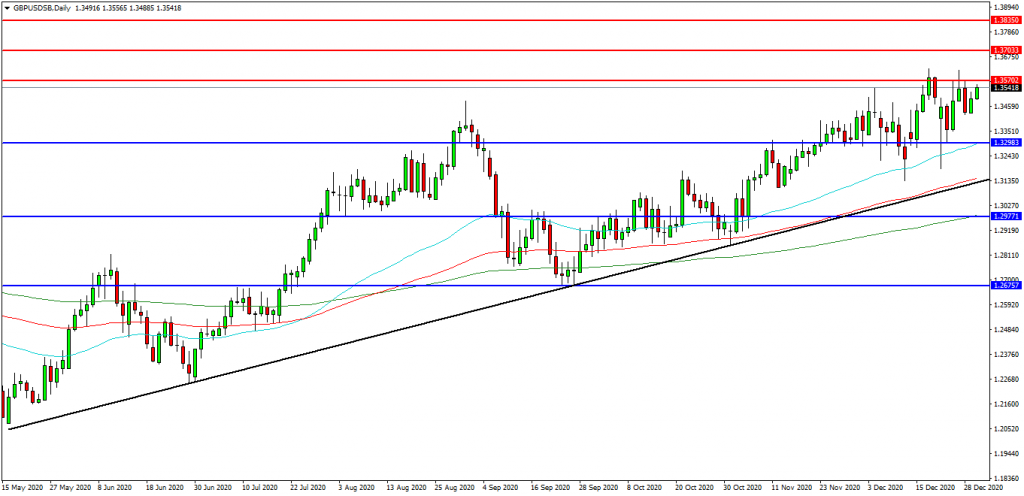

GBPUSD

The GBPUSD FX pair is currently breaking higher after moving past the important September high at 1.3480. A confirmed breakout above this area has opened the way to initial resistance at 1.3570 followed by the 1.3600 – 25 zone – 17th of Dec highs. The 1.3700 level may provide a target along the way to the more ambitious 1.3835 area. Alternatively a move back under 1.3400 may find initial support at 1.3300 and the 50 EDMA. The 100 EDMA is tracking the rising support trend line, currently at 1.3135. A failure at this level might hand control to sellers and possibly open the way to 1.2977 as the 200 EDMA and 1.2800 as the June high, followed by 1.2580 level. This is not our favoured outcome and we remain Dollar bears into 2021 The Brexit deal has had a major impact on the movement of this pair and will continue to do so over the coming days and weeks.

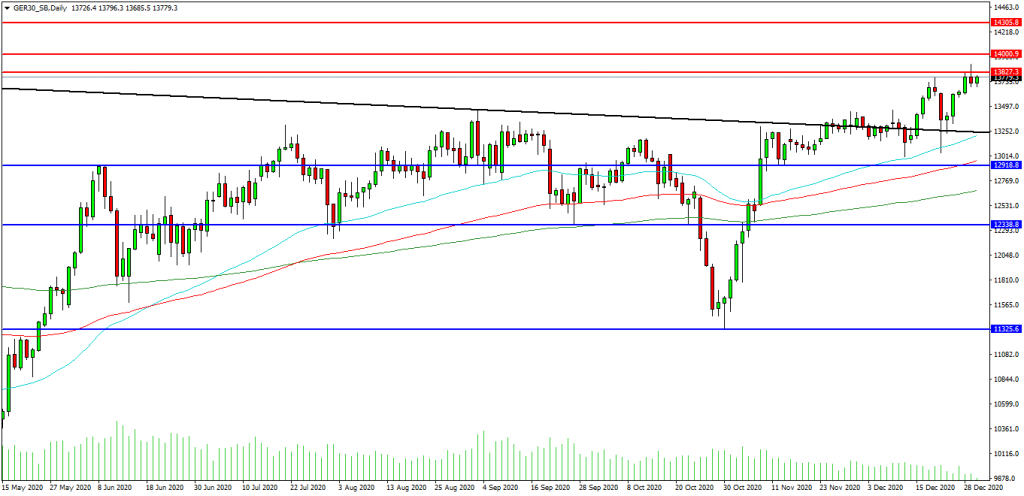

German Dax 30

The German 30 Index is attempting to continue its breakout above the falling trend line which was capping the price action at 13250.00. Price has found resistance around the 13900.00/13825.00 area including the previous all-time high. But a break above yesterday’s high of 13900.00 would appear bullish and target further resistances at the 14000.00 area. Beyond this round number level 14300.00 may offer resistance. Alternatively, a move back below the trend line at 13500.00 may signal a test on the support of the trend line and the rising 50 EDMA at 13250.0. Yesterday’s candle may entice sellers to enter the market and test 13000.00 as support, followed by 12918.00. A run below this support may quickly target 12500.00 or the September low at 12338.00.

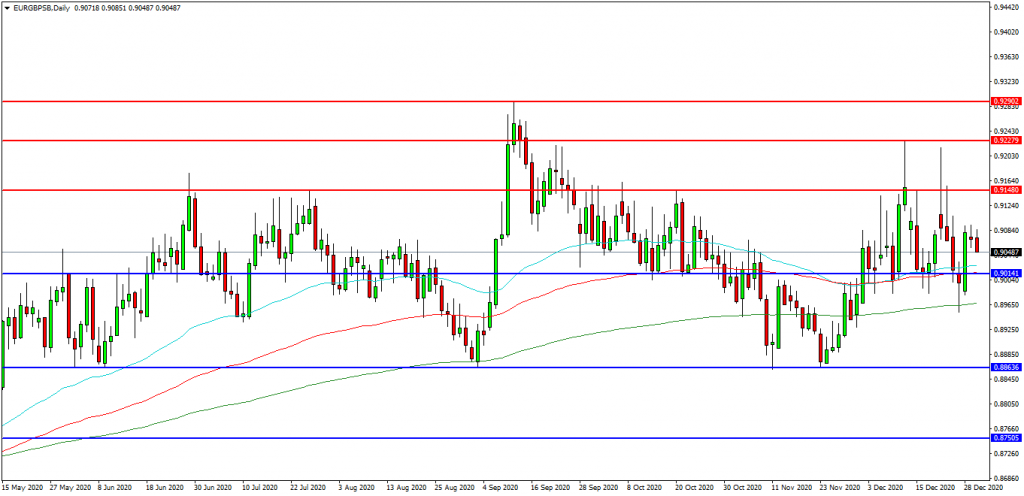

EURGBP

The EURGBP chart is showing how the pair is consolidating around the 0.9000 area. The pair found resistance at 0.9290 in September and has tested support at 0.8863. The pair remains in this range with initial resistance at 0.9092 followed by the 0.9150 area. A continued move higher may find more resistance around the 0.9228 area and 0.9290. Alternatively a move back down under 0.9014 may find initial support at 0.9000. A loss of this level might hand control to sellers and possibly open the way to 0.8965, followed by the 0.8900 level. Below these levels the 0.8860 area may once again play its part as support.