3Sigma Markets – Mid Week Macro Report March 24th 2021

The markets moved into risk off mode this week after setting new highs last week and having to deal with various negative factors affecting sentiment over the last 24 hours. The markets are slipping back a little after the positivity generated by the approval of the US stimulus package and the push up to new all time highs in US stock markets. There has been a subversive risk off move in Chinese equities over the last number of weeks as the Chinese economy lags, the authorities are slowing the amounts of stimulus and the market turns lower, particularly in the Chinese tech sector. Chinese markets are approaching correction territory and this is having a wider global impact on sentiment. Yesterday the Bank of Canada said that they will discontinue the market function programmes used to counter the covid-19 crisis. The commercial paper purchase program (CPPP), the provincial bond purchase program (PBPP) and corporate bond purchase program (CBPP) will discontinue on April 2, May 7 and May 26 respectively. The BOC does not plan to sell any of the securities it acquired during the programmes. On a global level Covid-19 cases are rising once again as the vaccination rollout continues on. Supply issues are impacting the vaccination rollout in various countries and with various manufactures but progress is still being made. However this has led to a general feeling that the worse is over, where in reality new strains are more widespread and covid fatigue is leading to a drop in adherence to best practices. This has led to the start of a new wave taking hold. Supply chain issues have been further impacted by the crash of one of the world’s largest container vessels in the Suez Canal yesterday. The MV Ever Given was hit by a gust of wind while it was experiencing a power issue and the bow of the ship ran aground into the canal bank. This has led to the canal being closed to traffic further slowing the global supply chain.

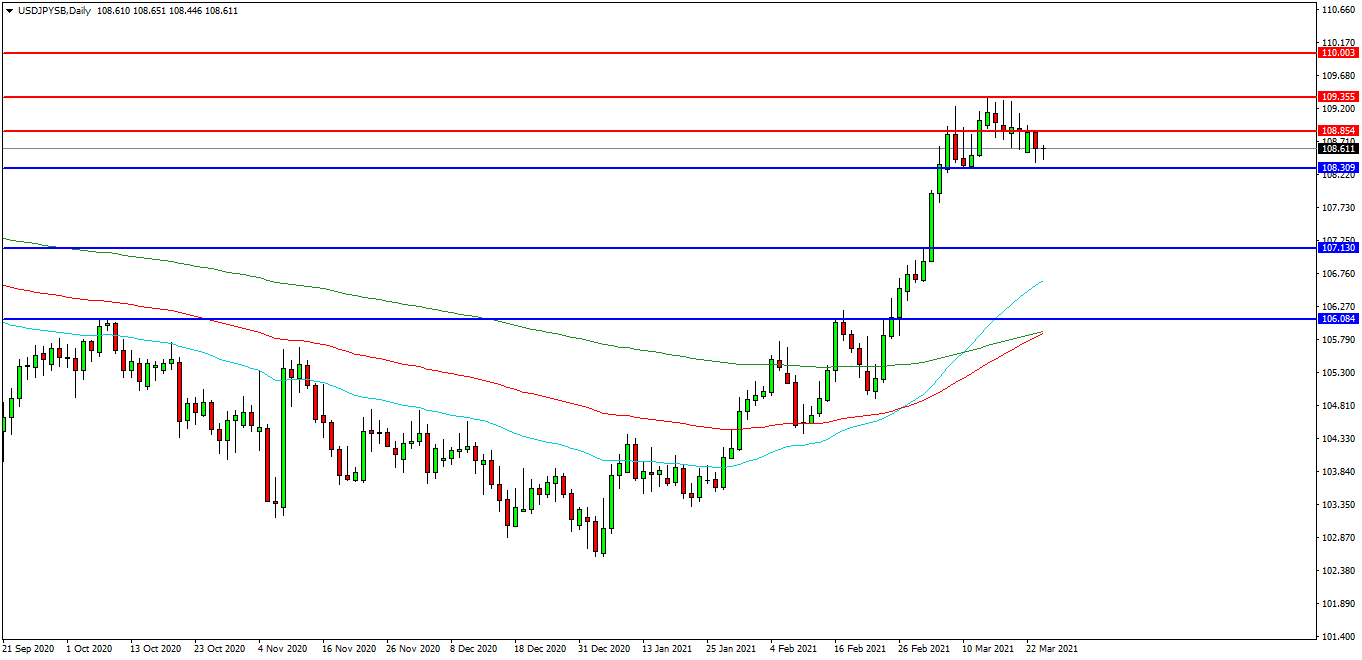

USDJPY

The USDJPY FX pair is making new highs after breaking higher last month. The price has moved up to test 109.355 as resistance. Price has fallen back and found support at 108.400 and is now trading at 108.600. A confirmed breakout above this area may open the way to initial resistance at 108.855 followed by the 109.355 area. The 109.600 level may provide a target along the way to the 110.000 area. Alternatively a move back down under the 108.000 zone may find initial support at 107.750. The 107.400 area may be used as support and breakout level may be of importance around 107.130. The 106.000 area is of great importance as it contains the 100 and the 200 EDMAs. Further supports may be seen at 105.700 and 105.500.

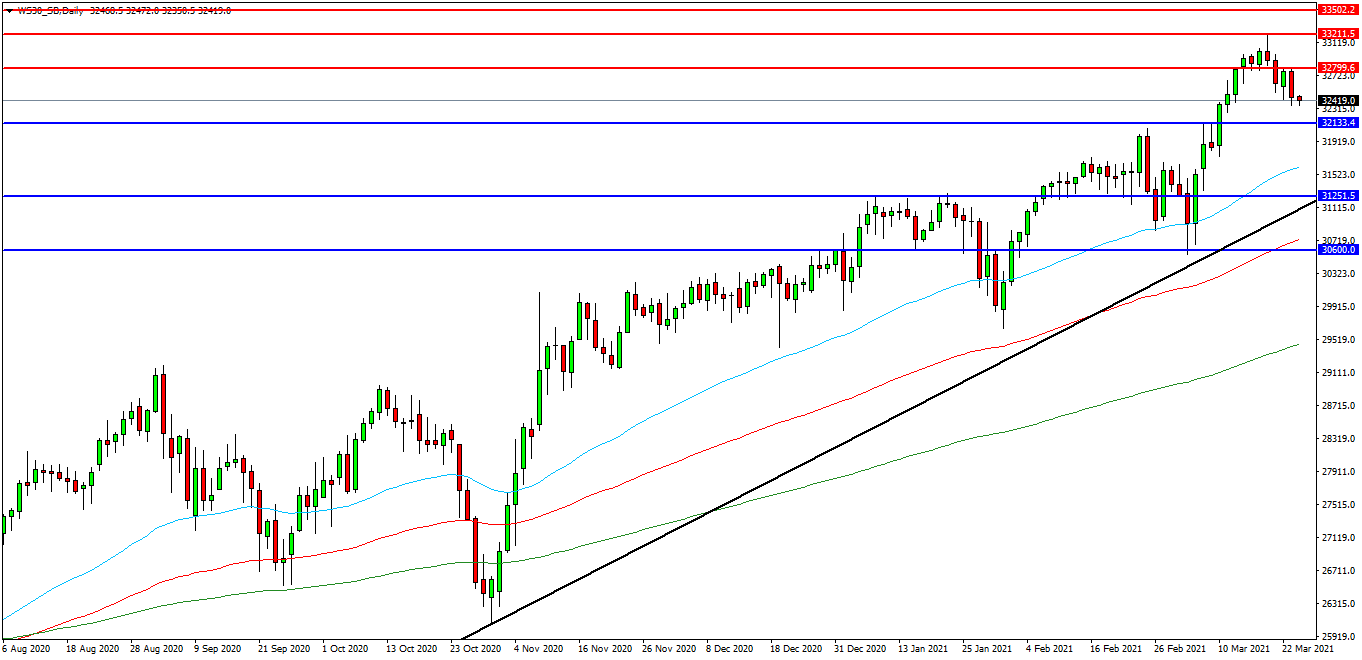

WS 30 Index

The WS 30 Index created a high at 33228.00 last week. The market is testing the 32400.00 level as support. Price is attempting to find resistance and at present 32800.00 looks like a potential area followed by the 33000.00 level. A move higher from the current level may target resistances at the 33200.00 area. Beyond this level, 33300.00 may offer resistance followed by the 33500.00 level. Alternatively, a move back below 32130.00 may signal a test on the support at 32000.00. Below this level the 31600.00 area may be used as support along with the 31500.00 level. A run below this support may quickly target the 31250.00 followed by 30750.00 as the 100EDMA.

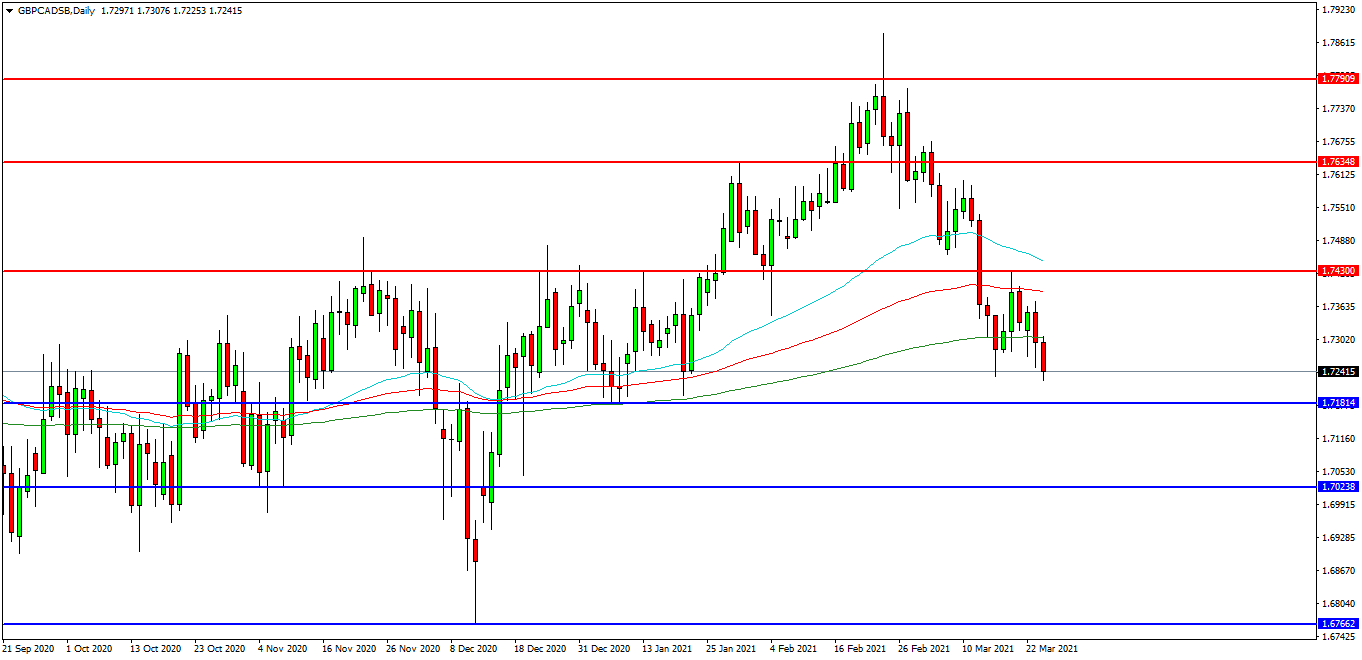

GBPCAD

The GBPCAD chart is showing how the pair has weakened considerably in recent weeks and is now trading at 1.7241 after having found support at 1.7225. The 1.7300 level is acting as resistance and 1.7200 area is the initial support area. The pair may find resistance at 1.7390 followed by the 1.7430 area. A continued move higher may find more resistance around the 1.7450 level which is where the 50 EDMA is at present. Alternatively a move back down under 1.7200 may find initial supports at 1.7181 and 1.7024. A loss of this level may extend the control of sellers and possibly open the way to a test on 1.7000. Below this level the 1.6920 area may play its part as support ultimately followed by 1.6800.