3Sigma Markets – Mid Week Macro Report June 2nd 2021

The move higher in equity markets yesterday began in the Asian time frame and extended into Europe but US traders met the positivity with caution and left the markets essentially unchanged or negative by the time of the US close. The opening exchanges to begin the month of June are bringing questions to bear in the market and this is creating indecision. Risks abound as various indicators are flagging overbought conditions and the timing of the risk on move since last year’s lows may be showing signs of exhaustion. On the other hand there is a possibility that a push higher in risk sentiment can extend the rally in markets to much higher levels. There are also risks on the horizon from the Covid-19 virus. Many countries are reopening their economies while others are dealing with fresh outbreaks and re-entering lockdown. The vaccine rollout has been uneven across the globe and this coupled with the different responses of individual governments and societies has led to new variants emerging. The WHO has revealed new names for the variants of concern to avoid location stigma. The UK variant has been renamed Alpha, the South African variant has been named Beta, the Brazilian variant Gamma and the Indian variant Delta. It is this Indian variant, Delta, which is of most concern as it is spreading rapidly in the UK. GBP fell from its 3 year high as the country opens up despite growing cases numbers of the delta variant. There is a growing fear that the next phase of the UK reopening on June 21 may have to be suspended as while a high number of the UK population has received one vaccine shot, many have yet to receive their second and are susceptible to the virus until then. As such markets are hanging by a thread despite the underlying risk on sentiment. This sentiment can easily and rapidly switch to full on risk off mode quickly if fear emerges.

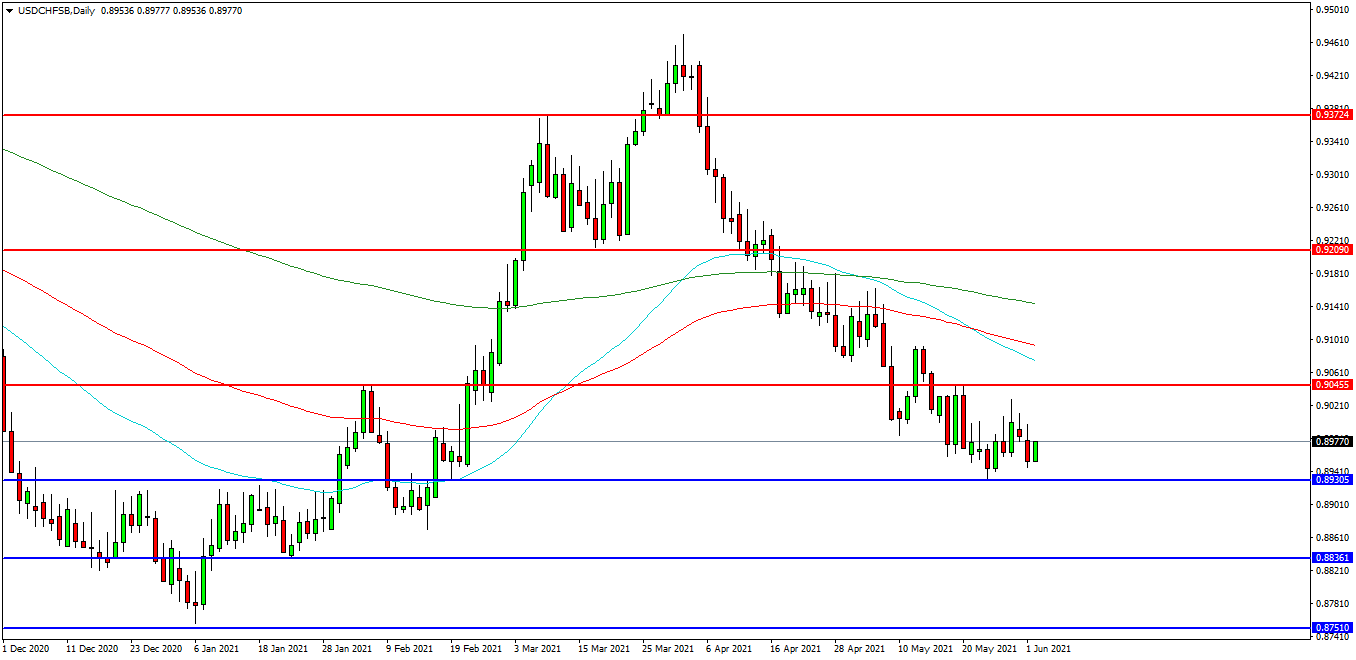

USDCHF

The USDCHF FX pair fell below its 50 EDMA at 0.9100 once again as sellers have taken charge since the April high. Price tested support at the 0.8930 level last week. The pair is now trading at 0.8977. Price is using the 0.8950 area as support. A confirmed breakout above 0.9000 may open the way to initial resistance at the 0.9045 area. The 0.9100 previous support area may provide a target along the way to the 0.9200 area. Alternatively a move back down under the 0.8900 zone may find initial support at 0.8836. The 0.8800 area may be used as support followed by further supports at 0.8750 and 0.8713.

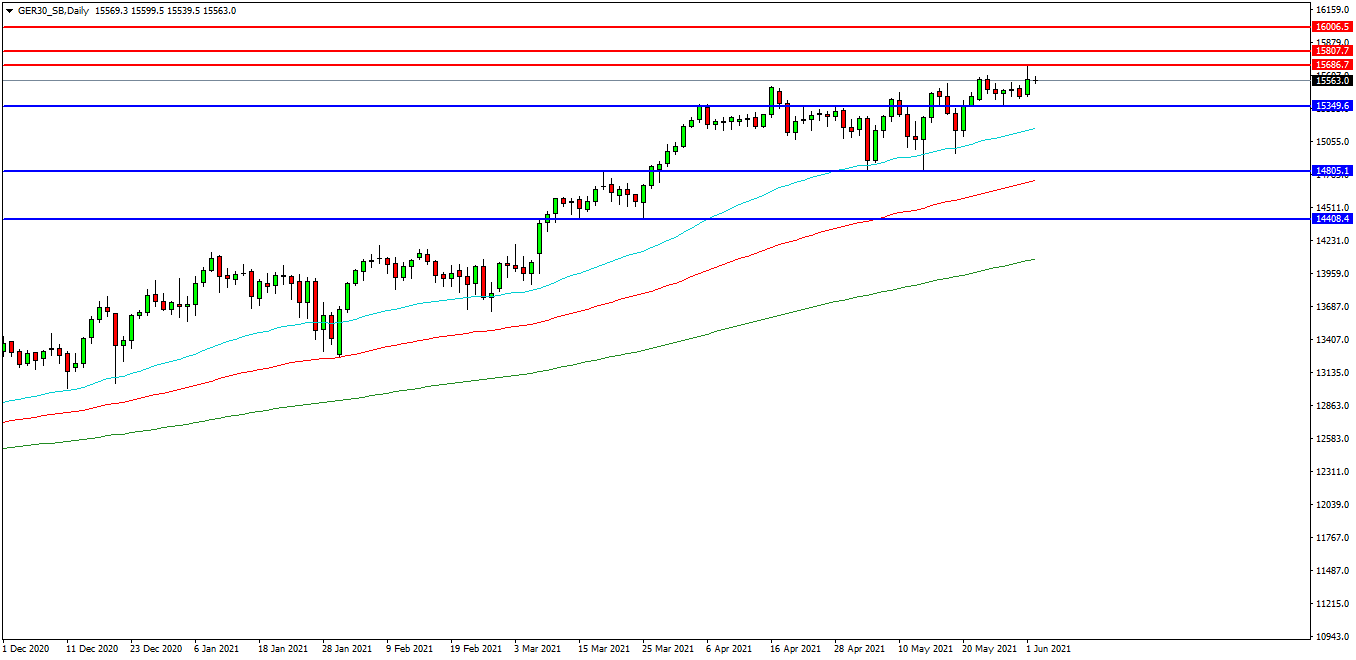

GERMAN 30 INDEX

The German 30 Index created a high at 15686.00 yesterday and is now testing the 15550.00 area as support. If the market fails and breaks below this level, it may result in another move down to test 15350.00 followed by the 50EDMA around 15163.00. The market sold off from resistance yesterday but found support on the 15540.00 overnight. Price is attempting to build on support and at present 15000.00 looks like a potential area followed by the 14800.00 level as support. A move higher from the current level may target resistances at the 15700.00 area and 15800.00. Beyond this level, 15850.00 may offer resistance followed by the 16000.00 level. Alternatively, a move back below 14800.00 may signal a test on the support at 14400.00. Below this level the 14300.00 area may be used as support along with 50EDMA and at 14080.00 level. A run below this support may quickly target the 14000.00 followed by 13700.00.

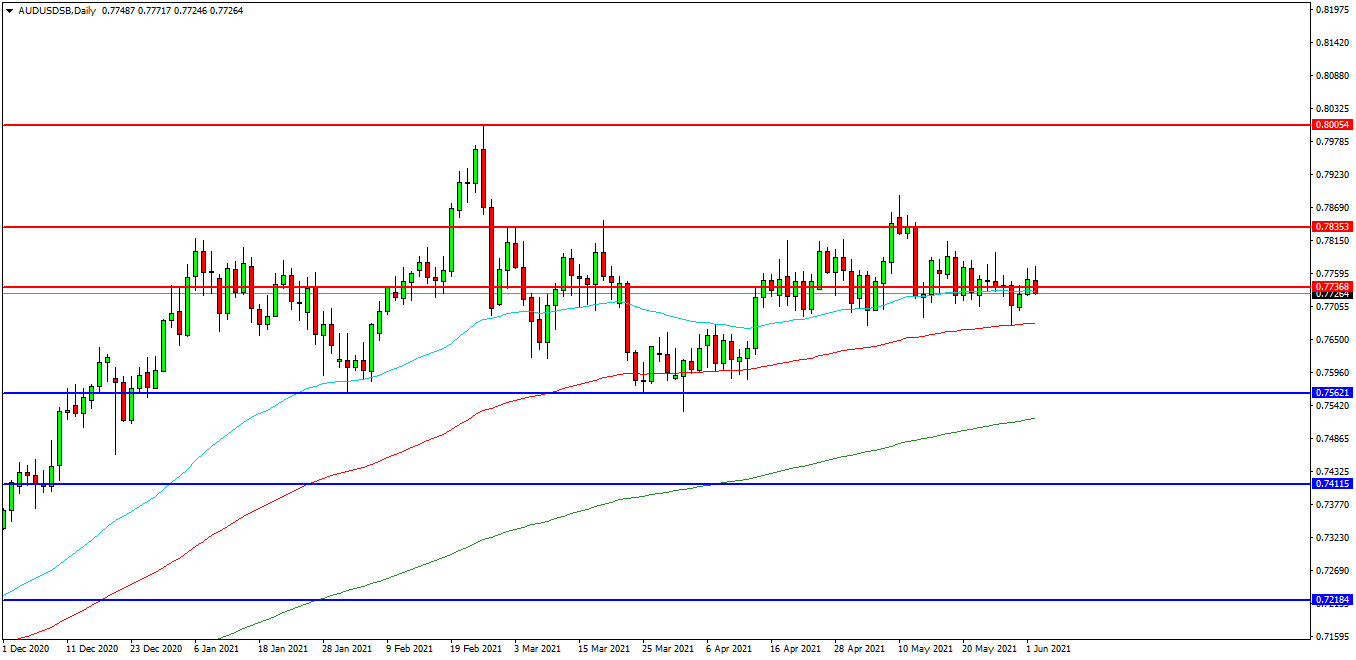

AUDUSD

The AUDUSD chart is showing how the pair has consolidated around its 50 EDMA over recent weeks and is now trading at 0.7726 and testing the 50 EDMA. The 0.7780 level is expected to act as resistance and 0.7700 area is the initial support area. The pair may find resistance at the 0.7800 area and the 0.7835 level on a break higher. A continued move higher may find more resistance around the 0.7930 level followed by the 0.7980 area and 0.8000. Alternatively a move back down under the 100 EDMA at 0.7677 may find supports between 0.7650 and 0.7600. A loss of this level may extend the control of sellers and possibly open the way to a test on 0.7562. Below this level the 0.7520 area may play its part as support as the 200EDMA ultimately followed by 0.7500.