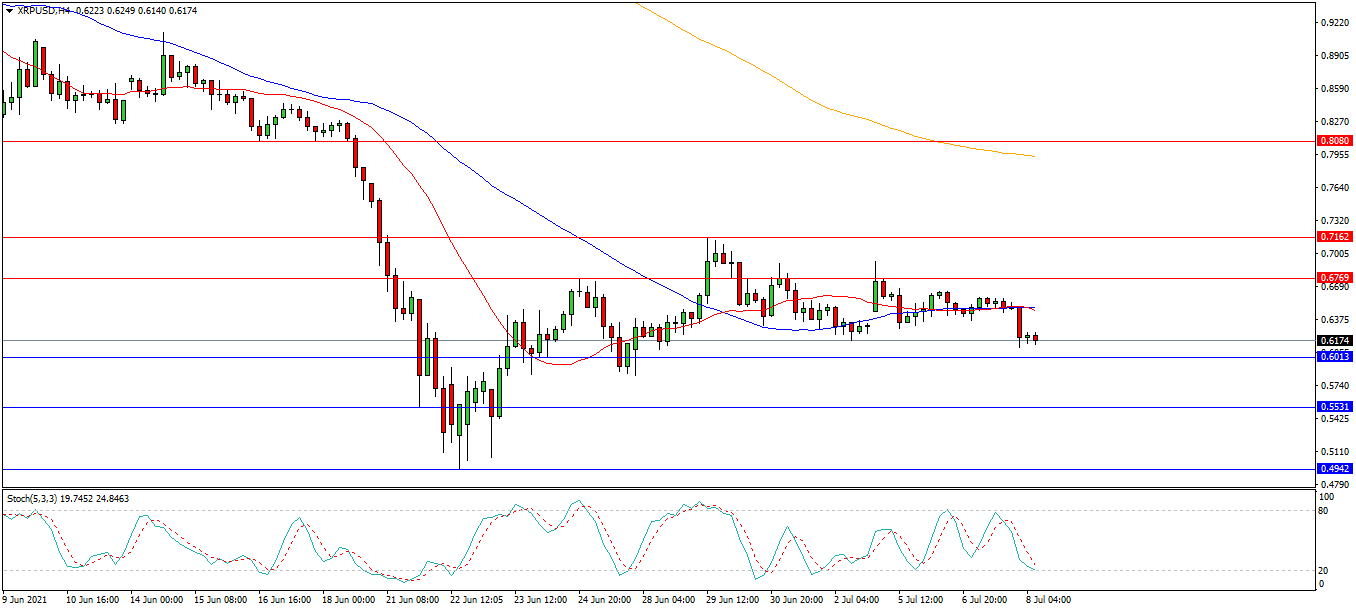

Bitcoin

The price action in Bitcoin is consolidating with a downward bias making new lower highs as indicated by the sideways moving averages. The 42,000 area was retested as resistance last month and price is currently trading at 33,200. The key trading levels of resistance for the pair at 35,130 is being used as resistance. The upside appears to be capped around 36,615 in the short term. The low set during May at 28,850 has been retested as a key support level and the 28,785 level has formed into support alongside it. A loss of this area may open the way to 25,000. Alternatively, if buyers can regain 35,000, the path to 38,000 opens up and may lead on to a test on 40,000 as a potential resistance area.

Potential Trade Set Up:

The potential trade setup for this market requires a break below 32,500 with targets at 29,800 and 28,800. Alternatively a move above the 35,300 invalidates this trade as buyers attempt a break higher.

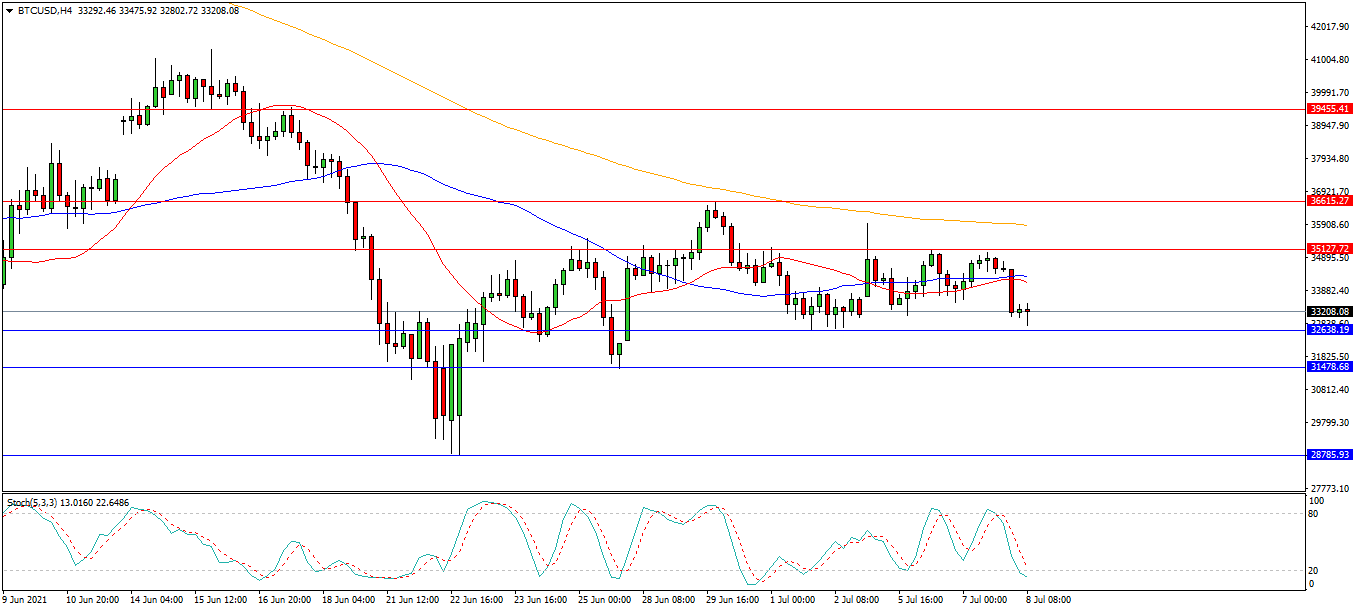

Ethereum

Ethereum found support around the 1690.00 area last month and staged a recovery to test 2400.00 but is currently trading around 2220.00. This market is consolidating but attempting to break higher by forming higher lows and higher highs off its late June low. The upside is currently capped by 2400.00. A break above the key 2400.00 area may target the 2530.00 area followed by the 2640.00 area. A break above this zone may open the way to 3000.00. Downside is initially supported by 2195.00 and the rising 50 period moving average. Alternatively if sellers re-emerge may be seen around the 2150.00 level. A loss of these levels opens the way to a test on the 1920.00 area followed by the higher low at 1790.00.

Potential Trade Set Up:

A potential trade may emerge if the pair can create a bullish rally above 2405.00 and a break above the trend line, with targets at 2640.00, 2700.00 and 2850.00. However a loss of the 2130.00 area would invalidate this idea.

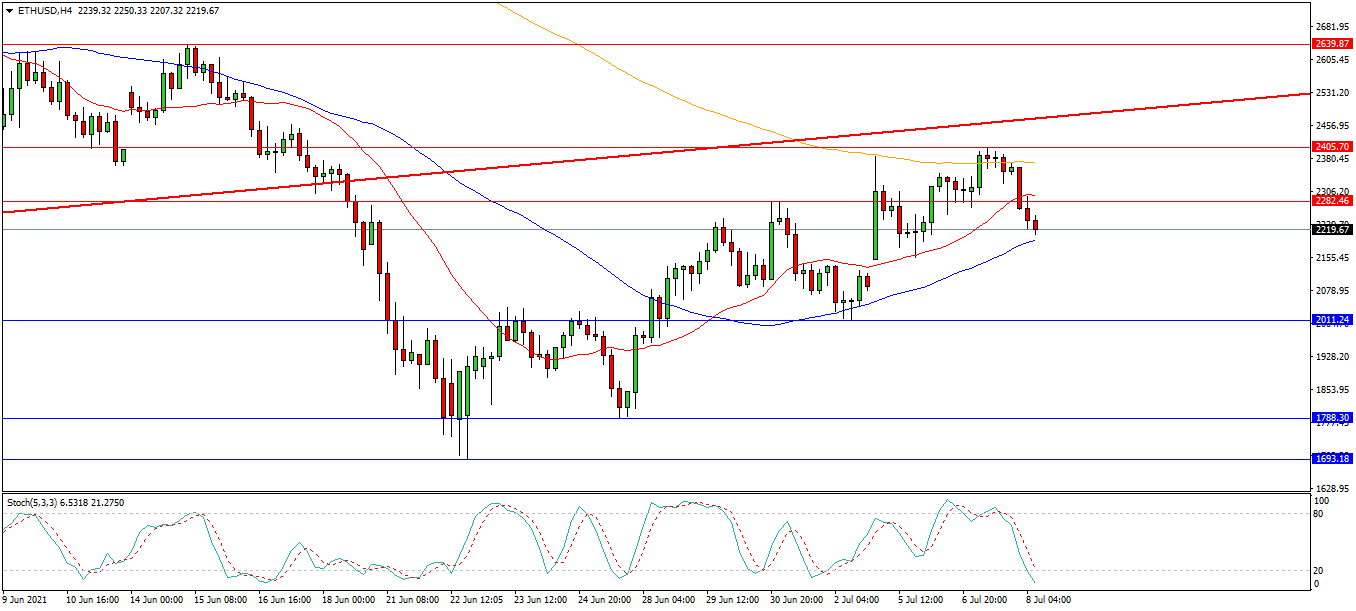

Ripple

The chart is showing that Ripple is consolidating at 0.6525, creating lower highs and higher lows. Price is currently trading at 0.6174 and may look to test the key support level at 0.6000. A break down from there may result in at test on initial support at 0.5835 followed by the low at 0.4940. Alternatively a confirmed break above the initial resistance at the 50 and 100 period moving averages at 0.6490 may signal a test on 0.6770 and higher. A breakout of this level potentially opens the way to the lower high at the 0.7160 area.

Potential Trade Set Up:

A potential trade may emerge with a move up through 0.6500 looking for a test on potential the resistance targets around 0.7100 and 0.800. A drop under 0.5500 negates this idea.