Sterling Against the Euro and Dollar

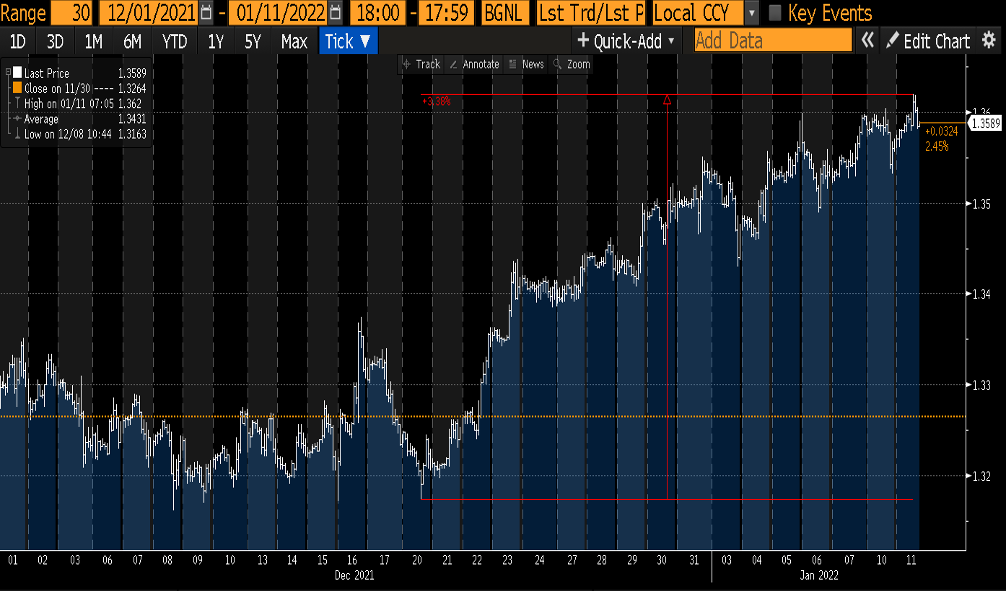

The New Year has brought a further bout of Sterling strength in the currency markets. This strength initially manifested itself in GBP/USD over the festive period as can been seen from the short term chart below – Dec 20th onwards and subsequently filtered through into GBP/EUR – higher Sterling

GBP/EUR has a seasonal tendency to trend in the first couple of months of the year and in this case we are seeing a further extension to the higher trend that emerged at the beginning of last year. There are of course many reasons to be bearish Sterling as a whole, however as it stands, we are potentially seeing a trend higher in Sterling emerge. This trend is not confirmed as of yet and we will be watching a number of indicators over the coming weeks closely – which we will highlight – that should confirm or not the higher GBP/EUR trade.

The first of these sign posts is the big technical level in GBP/EUR at 1.20 – this equates to 0.8333 in EUR/GBP terms. This is a huge psychological level in the currency pair and as can be seen from the longer term chart below, a level we have not been above in over 20 months.

We have made a number of attempts to clear this level since the beginning of the year – each day since the 4th Jan we have hit resistance near 1.20 – see short term GBP/EUR chart below. It is very likely that the reason behind these failed attempts at the 1.20 level has been Sterling supply from the corporate world. Traditionally the corporate sector will hedge their FX exposure in and around important levels like 1.20. Given we have not been at this level in over 20 months, it makes sense that Treasurers are using this opportunity to off load their pounds at good levels and mitigate their FX exposure.

So this is our first major sign post that will help indicate whether we are in a larger up-trend in GBP/EUR or whether we will fall back into the range. A weekly close above 1.20 is needed – watch this space.